A leading provider of private equity investment

Risk-rated portfolio construction

All our portfolios are rigorously selective, whether they involve direct investments in unlisted companies or investments in other private equity funds (fund of funds). Our thorough knowledge of private equity investment and the Amundi Group's long investment history allows us to offer solutions tailored to your chosen risk profile.

Private equity investment experts

| Expertise based on experience |

Proven and reliable investment strategies |

Access to the best investment opportunities |

Innovative diversified solutions

01 | An experienced management team

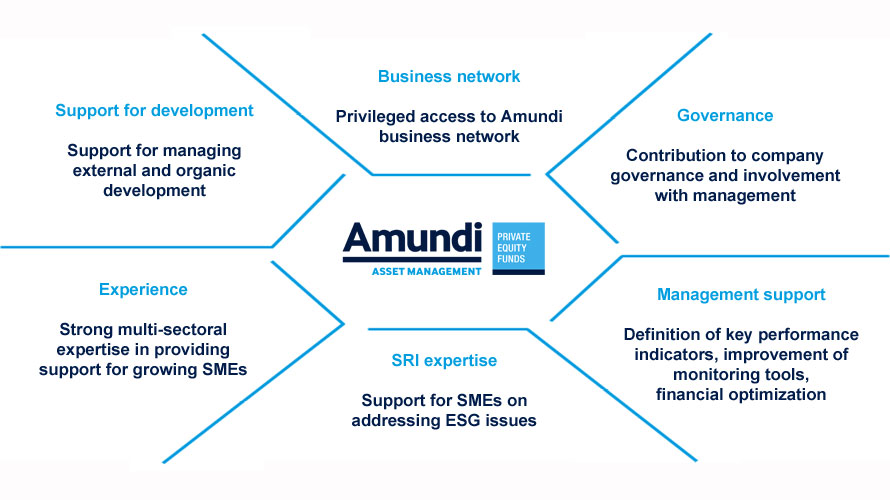

All members of our management teams are experienced and high-performing investors. They are seasoned team players with varied and complementary professional profiles and experience. They work closely with others in the business to secure access to the best investment opportunities.

02 | Focus on capital growth

Our direct investments in equity or quasi-equity funds focus on capital growth. We are active shareholders in more than 250 SMEs and we favour companies that show strong growth prospects and have proven business models.

Leaders in the market

USD 8.4

bn in multi-management1

15

dedicated people1

USD4-36M

range of investment size1

A full service provider

Given for illustrative purposes only, may change without prior notice.

1 - Source: Amundi as of December 31, 2015.

The content of this page is solely intended to provide information about Amundi Group strategies. None of these information constitute an advertisement, a recommendation, an advice, an offer or a solicitation by Amundi Thailand and/or Amundi Group companies to buy or sell financial instruments or any investment product, enter into any such transactions described herein or to provide investment advice.

This information is exclusively intended for “Professional” investors within the meaning of the MiFID Directive 2004/39/EC of 21 April 2004, and articles 314-4 and following of the General Regulations of the AMF. It is not intended for the general public or for non-professional individual investors within the meaning of all local regulations, or for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act.

This non-contractual information does not under any circumstances constitute an offer to buy, a solicitation to sell, or advice to invest in financial instruments of Amundi or one of its affiliates (“Amundi”).

Investing involves risks. The performance of the strategies is not guaranteed. In addition, past performance is not in any way a guarantee or a reliable indicator of current or future performance. Investors may lose all or part of the capital originally invested.

Potential investors are encouraged to consult a professional adviser in order to determine whether such an investment is suitable for their profile and must not base their investment decisions solely on the information contained in this document.

Amundi assumes no liability, either direct or indirect, resulting from the use of any of the information contained in this document, and shall not under any circumstances be held liable for any decisions taken on the basis of this information. This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of Amundi, for any third person or entity in any country or jurisdiction which would subject Amundi or any of its products to any registration requirements within these jurisdictions or where this might be considered unlawful.

This information is provided to you based on sources that Amundi considers to be reliable, and it may be modified without prior warning.