- Home

- Fixed income: why now is the time to be agile

Fixed income: why now is the time to be agile

May 2023 | 2 min read

Fixed income: why now is the time to be agile

2022 has witnessed the coexistence of high inflation and heightened volatility. This has forced Central Banks in developed economies to tighten their monetary policies, leading to the “great repricing” of fixed income.

This has been followed by an adjustment in bond yield curves, and a parallel shift of markets attention from inflation concerns to growth prospects. As the outlook for global economies continues to be uncertain, we believe that this complex scenario could be particularly attractive for bonds.

In our view, investors wishing to take advantage from these circumstances should look at agile strategies, able to adapt in a changing environment, while favouring high-quality corporate and sovereign bonds.

Indeed, we believe that this type of strategies could bring a number of benefits to investors:

1. A mitigation of country risk, as investing in a number of sovereign and corporate bonds could result in investors being less exposed to specific country issues. This is especially important at a moment where we are witnessing a divergence of both growth and inflation between developed and emerging markets.1 Additionally, default rates tend to increase during periods of economic slowdown, with negative effects on the value of the portfolios.

2. Connected to the first aspect, the combination of different interest rate environments could provide further advantages to investors. We believe that monetary policy tightening in developed markets is not over yet, while in emerging economies it is in a more advanced stage. As a result, investors should favour markets where inflation has peaked and hikes have been already priced in, reducing rate-driven losses.

3. Cross-sector diversification*: by selecting high-quality credit and investment grade, we expect that investors could better face market uncertainties. As more secure bonds are less volatile, their spreads tends to increase less if compared to lower quality counterparts during recessions. In addition, investing in different industries allows investors to be less exposed to sector-specific shocks, contributing to reduce the level of risk in a diversified portfolios.

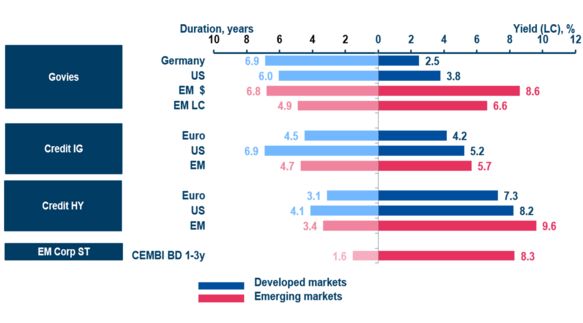

Duration and yield, local currency

Source: Amundi Institute. Analysis on Bloomberg data. Data is as of 28 April 2023. Government and EM indices are from JP Morgan. Euro and US credit indices are from ICE-BofA. LC: local currency. IG: investment grade. HY: high yield. ST: short term. Yield for EM Corp ST is JP Morgan CEMBI Broad Diversified 1-3 Year while duration is JP Morgan CEMBI IG+ 1-3 Years.

Amundi, one of the leading players in fixed income investing, has developed a top-down macro driven process that identifies appealing opportunities in the markets and offers a wide range of solutions to investors.

Discover more here:

*Diversification does not guarantee profit or protect against loss.

Sources:

1 Amundi Institute, Our key takeaways from IMF’s Spring Meeting, 10 May 2023

Amundi Institute, Themes in depth, Bonds are back: credit markets in focus during 2023, January 2023

Important information

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 25 May 2023. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 25 May 2023

Doc ID: 2919312

Learn more about our Convictions

Powered by Amundi Institute