- Home

- India – a wide range of opportunities for investors

India – a wide range of opportunities for investors

May 2023 | 2 min read

India – a wide range of opportunities for investors

Key Takeaways

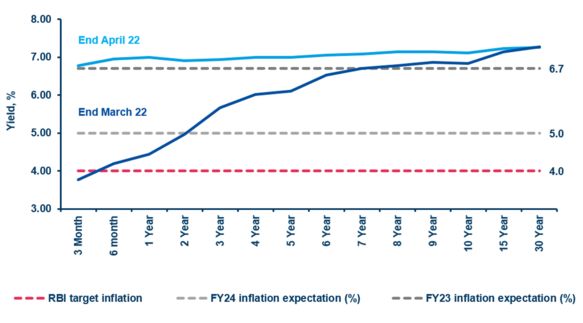

• We acknowledge that Indian yields could be deemed attractive on both relative and absolute terms

• Green bond issuance ranks second among emerging economies, behind China, and may offer compelling yields

• Indian equities have significantly outperformed global counterparts over the past two years

• In our opinion 2023 could be a year of adjustments for India, with plenty of opportunities for investors

India could provide a wide range of opportunities for investors, thanks to the size of its domestic market and solid macroeconomic fundamentals.

Looking at fixed income, the combination of more favourable growth-inflation prospect, and the effects of the monetary policy decisions suggest that the Reserve Bank of India (RBI) may pause its rate hikes. The outlook is also positive in terms of fiscal consolidation, as the country is increasing its tax collection rate, and this could help its position in facing external shocks. In our opinion, this situation could provide a rather optimistic outlook for Indian fixed income over the medium-term, as attractive yields should be available both on relative and absolute basis.

Green bond financing could be another appealing opportunity for investors, and with $7.45 bn issued to date, India is ranking second among emerging economies, behind China. In January 2023 the RBI sold $965.7mn in sovereign green bonds with appealing yields, and it is expected to auction other $2 bn. The money raised might be used to fund eco-friendly initiatives, as India has pledged to reduce the emission intensity of its GDP by 45%, compared to 2005 levels by 2030.

We believe that Indian equities have significantly outperformed global counterparts over the past two years; nevertheless, the valuation premium has started to normalise following the recent underperformance. However, considering the long-term growth story, several factors continue to support investment activity and the profit cycle. In our opinion, a decade of low corporate capital expenditure (capex) activity in India, the emergence of new industries, and “China plus one”1 should support the idea that India will see a positive trend in terms of spending over the medium-term. At the same time, there has been a shift in market dynamics, and cyclical industries, value stock and mid and small caps are performing well in the post-Covid recovery.

Despite global headwinds, our view is that 2023 will be a year of adjustments for India; growth may slow down but balance out, and this could lead the way to a more sustainable recovery, probably driven by a revival in manufacturing and investments, generating several opportunities for investors.

Indian bonds yields

Source: Amundi Institute on Bloomberg data as of 30 April 2023.

Read more from the Amundi Institute on India

Source:

1 A Sherpa is the personal representative of a head of state or head of government who prepares an international summit

Important information

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 26 May 2023. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 26 May 2023

Doc ID: 2905842

Learn more about our Convictions

Powered by Amundi Institute