- Home

- Liquidity solutions – balancing flows and achieving stability

Liquidity solutions – balancing flows and achieving stability

May 2023 | 2 min read

Liquidity solutions – balancing flows and achieving stability

As geopolitical turmoil and the fear of contagion in the banking sector have weighted on global financial markets, investors have shifted their attention towards safer assets, driving substantial inflows towards liquidity solutions1.

Asset managers and investors traditionally monitor fund flows, i.e. the amount of money going in or out of a specific fund, with great attention. Market participants can interpret extremes on both ends as negative signs, and the optimal scenario is a balance between inflows and outflows.

Furthermore, flow data provide a unique snapshot of the state of a specific fund, and could be used as an indicator for trends in the asset management space. Investors may consider these numbers to guide their decisions, as they provide insights on the asset classes that are more or less popular at a particular moment in time.

For liquidity solutions, it is paramount to have the ability to manage smoothly large inflows and outflows. As the funds are particularly sensitive to interest rate fluctuations and monetary policy decisions, they could be more exposed in case of sudden market movements which may generate more deposits and withdrawals of funds. The stability and diversity of the client base, as well as the size of the fund, play an important role, especially in periods of markets distress.

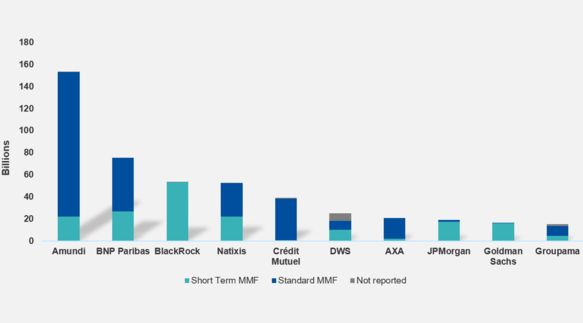

Amundi, thanks to its long experience of more than 30 years in providing liquidity solutions, has the capacity to face large flows in different market conditions, ensuring the continuity of business. Furthermore, as it can be seen in the below graph, Amundi ranks first2 among the top 10 European funds, underscoring the popularity of its offering and how it is recognized by investors as a stable solution to address their liquidity needs.

Top 10 European funds - Open-ended cash funds denominated

in euros (outstanding amounts in EUR billion)

Source: Broadridge, end of January 2023. MMF: money market funds. For illustrative purpose only.

To learn more about our product range, please visit our Best Ideas:

Sources:

1 Reuters, Global Money market funds draw massive inflows in week to March 15, 17 March 2023

2 No1 in Money Market Management in Europe in euros. FundFile - End June 2022 - Open-ended Funds domiciled in Europe and in euros only.

Important information

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 17 May 2023. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 17 May 2023

Doc ID: 2902798

Learn more about our Convictions

Powered by Amundi Institute