While 2022 brought a series of economic shocks for emerging markets, the outlook for the asset class is now more positive, with some emerging economies well positioned to grow in 2023.

Amid China’s earlier than expected reopening and a downturn in US economic conditions, emerging markets (EM) are well positioned to continue outpacing their developed peers for growth in 2023. Discover our experts’ views on investment opportunities across EM regions and asset classes.

While 2022 brought a series of economic shocks for emerging markets, the outlook for the asset class is now more positive, with some emerging economies well positioned to grow in 2023.

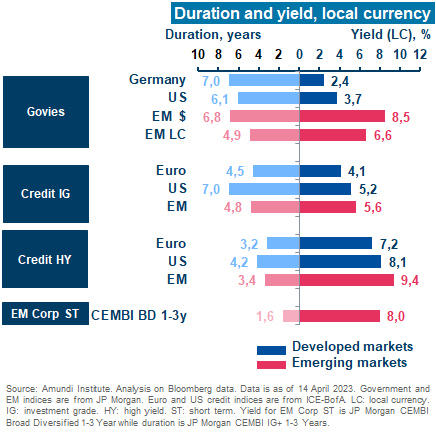

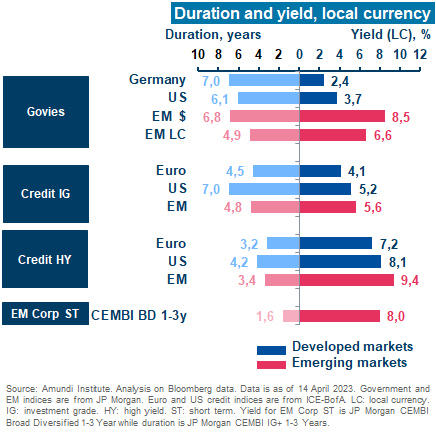

After the great repricing of 2022, yields in EM bonds are back to appealing levels from an absolute and relative standpoints. We believe, EM bonds offer an interesting entry point in terms of carry and spreads with opportunities in Hard Currency, local rates and FX.

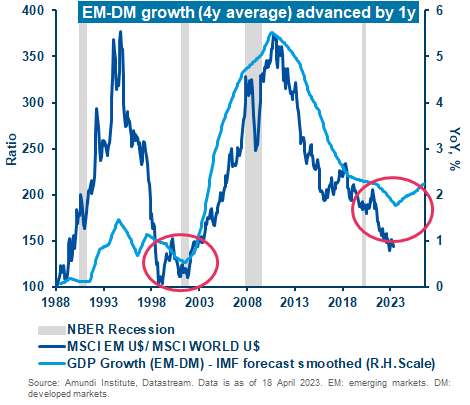

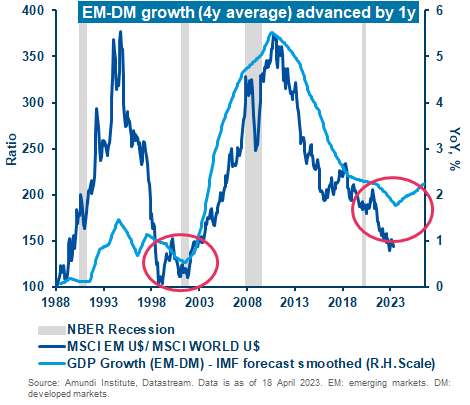

The recovery of the Chinese economy with the EM-DM economic growth differential and uncrowded EM equity positioning compared to the historical average are supportive factors for the asset class. However, investors should note that the EM space presents a fragmented universe, implying a strong need to be selective so that country-specific factors can be taken into account.

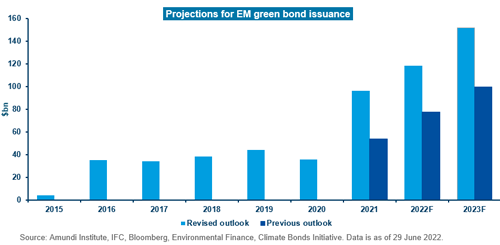

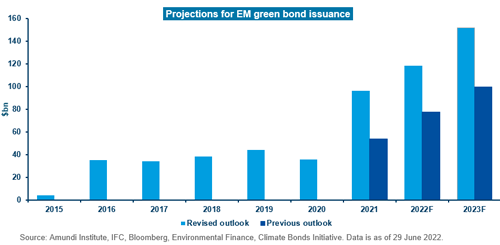

EM sustainable fixed income universe has increased significantly in terms of issuance in recent years.

China in particular has increased its sustainable issuance significantly for the last two years and the country is by far the largest issuer across EM countries. In 2022, China spent $546 billion on energy transition investment, accounting for almost half of global expenditure1.

After the great repricing of 2022, yields in EM bonds are back to appealing levels from an absolute and relative standpoints. We believe, EM bonds offer an interesting entry point in terms of carry and spreads with opportunities in Hard Currency, local rates and FX.

The recovery of the Chinese economy with the EM-DM economic growth differential and uncrowded EM equity positioning compared to the historical average are supportive factors for the asset class. However, investors should note that the EM space presents a fragmented universe, implying a strong need to be selective so that country-specific factors can be taken into account.

EM sustainable fixed income universe has increased significantly in terms of issuance in recent years.

China in particular has increased its sustainable issuance significantly for the last two years and the country is by far the largest issuer across EM countries. In 2022, China spent $546 billion on energy transition investment, accounting for almost half of global expenditure1.

After significant monetary policy tightening over the past two years in many Emerging Markets, we expect a more stable monetary policy, as the peak of inflation is likely to be behind us. Nevertheless, the global scenario is complex, risks are elevated and the fragmented nature of Emerging Markets will require a highly selective approach.

We believe now is the time for investors to reassess their exposure to Emerging Markets.

|

EM-DM growth differential to move in favour of EM in 2023 driven by China's reopening and the slowdown in Developed Markets. |

|

After a significant tightening of monetary policy by many EM CBs, we expect a more stable monetary policy, as the peak of inflation may be behind us. |

|

The appreciation of the US currency in 2022 was a major challenge for many EM countries. The weak fundamentals in the US are reverting fast and a deteriorating outlook for the US vs the rest of the world is less positive for the USD and supportive for EM currencies in H2 2023. |

|

One of the main risks to watch out for is the excessive tightening of financial conditions affecting economic growth. Investors also need to monitor idiosyncratic stories, and internal vulnerabilities which can increase EM fragmentation. |

This information is exclusively intended for “Professional” investors within the meaning of the MiFID Directive 2004/39/EC of 21 April 2004, and articles 314-4 and following of the General Regulations of the AMF. It is not intended for the general public or for non-professional individual investors within the meaning of all local regulations, or for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act.

This non-contractual information does not under any circumstances constitute an offer to buy, a solicitation to sell, or advice to invest in financial instruments of Amundi or one of its affiliates (“Amundi”).

Investing involves risks. The performance of the strategies is not guaranteed. In addition, past performance is not in any way a guarantee or a reliable indicator of current or future performance. Investors may lose all or part of the capital originally invested.

There is no guarantee that ESG considerations will enhance a fund’s investment strategy or performance.

Potential investors are encouraged to consult a professional adviser in order to determine whether such an investment is suitable for their profile and must not base their investment decisions solely on the information contained in this document.

Amundi assumes no liability, either direct or indirect, resulting from the use of any of the information contained in this document, and shall not under any circumstances be held liable for any decisions taken on the basis of this information.

This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of Amundi, for any third person or entity in any country or jurisdiction which would subject Amundi or any of its products to any registration requirements within these jurisdictions or where this might be considered unlawful. This information is provided to you based on sources that Amundi considers to be reliable, and it may be modified without prior warning.

The “Professional” investor as defined in Directive 2004/39/EC dated 21 April on markets in financial instruments (MIFID).

The full definition of “US Person” is included in the legal/general conditions of access to the website.