Amundi's Equities Strategies

The aim of Amundi Equities is to deliver world-class risk-adjusted returns for our clients. At the core of the approach is the conviction that alpha can be extracted through a disciplined, repeatable and fundamental investment process.

Leveraging on our strong internal capabilities, Amundi Equities manages and offers a range of unique and innovative products.

An established and recognised expertise

Equities' Offering

5 Reasons to partner with Amundi for Active Equity Strategies

Through 7 locations, our 76-strong investment team¹ is characterized by a strong average industry experience and a wide diversity of backgrounds.

Disciplined and repeatable investment process for alpha generation with a strong focus on fundamental bottom-up research, supported by one of the largest industry buy-side research teams. This combined with dedicated portfolio construction analysts embedded in the team, enables a platform for attractive risk adjusted returns for clients.

Amundi Equities offers a comprehensive range of high-conviction active equity strategies, covering all main geographical areas, sectors and capitalization levels.

A diligent and innovative approach to ESG integration that goes beyond conventional methods. ESG integration is fully part of our fundamental analysis, uncovering risks as well as opportunities for each investment case.

Long track record in equity protection and overlay strategies for investors seeking downside protection and reduction in volatility for their equity allocations.

Through 7 locations, our 76-strong investment team¹ is characterized by a strong average industry experience and a wide diversity of backgrounds.

Disciplined and repeatable investment process for alpha generation with a strong focus on fundamental bottom-up research, supported by one of the largest industry buy-side research teams. This combined with dedicated portfolio construction analysts embedded in the team, enables a platform for attractive risk adjusted returns for clients.

Amundi Equities offers a comprehensive range of high-conviction active equity strategies, covering all main geographical areas, sectors and capitalization levels.

A diligent and innovative approach to ESG integration that goes beyond conventional methods. ESG integration is fully part of our fundamental analysis, uncovering risks as well as opportunities for each investment case.

Long track record in equity protection and overlay strategies for investors seeking downside protection and reduction in volatility for their equity allocations.

The Equities range in a glimpse

Core Equities

Core Expertise includes all the alpha products – high conviction strategies seeking to outperform their respective benchmark. Through bottom up, fundamental stock selection, these strategies have proven track records of delivering strong risk-adjusted returns over the medium term.

Emerging Market Equities

Amundi applies an integrated and research led approach to investing in EM. We aim to create alpha and avoid permanent capital impairment in a highly imperfect market via a holistic approach. To do so, we have embedded risk management and portfolio construction capability with bespoke tools designed around the investment process.

|

Emerging Markets StrategiesAmundi's applies an integrated and research led approach to investing in EM, looking across equity and fixed income. Read more |

US Equities

Based in Boston, the US equity platform offers a wide range of actively managed US equity strategies to meet the needs of institutional investors. The US Investment platform dates back to 1928 and was the first in the US to incorporate responsible investment criteria into its portfolios. Today, the Equity team fully integrates ESG analysis into its fundamental research process, leveraging Amundi's global ESG and equity resources.

A dedicated team of highly experienced equity managers and analysts work closely together to share information and generate new investment opportunities across industries and sectors by focusing their research on companies that are favourably positioned from a competitive, financial and ESG perspective, with a clear objective: to generate strong risk-adjusted returns over time.

Investors can thus benefit from a wide range of strategies active in key areas of the US markets.

Innovation in Equities

Responsible Investing

The Road to Responsible Alpha

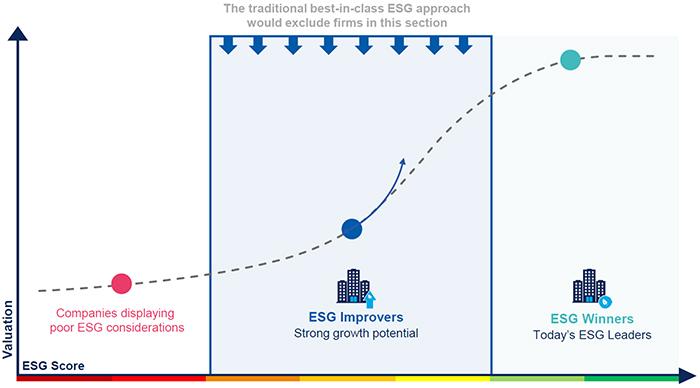

ESG Improvers, our innovative approach, consists of detecting and investing in companies with ESG momentum, who benefit from a solid fundamental investment case and an improving ESG profile.

We seek out two types of companies: “ESG Improvers”, companies portraying a solid investment case and an improving ESG trend, as well as “ESG Winners”, offering quality foundations, attractive valuations and strong ESG ratings. Through this approach, Amundi enables early investors to capture the ESG premium, investing before the trend converts to improve ESG ratings.

Seeking income today for a sustainable tomorrow

The European/Global Equity Sustainable Income strategy offers a unique combination of income and ESG. As the world is changing, investors are becoming increasingly aware of the need to invest into sustainable business models in order to protect not only the future of the world we live in, but also their financial future. Companies have adapted to this new environment and the European and Global Equity Sustainable Income strategy is poised to take advantage of these dynamics.

These strategies seek to achieve an attractive level of income and a superior risk adjusted return with a sustainable framework relative to the benchmark. It is fully aligned with Amundi’s strong ESG ambition, leveraging on our Equity Income expertise and extensive ESG capabilities.

The Road to Responsible Alpha

ESG Improvers, our innovative approach, consists of detecting and investing in companies with ESG momentum, who benefit from a solid fundamental investment case and an improving ESG profile.

We seek out two types of companies: “ESG Improvers”, companies portraying a solid investment case and an improving ESG trend, as well as “ESG Winners”, offering quality foundations, attractive valuations and strong ESG ratings. Through this approach, Amundi enables early investors to capture the ESG premium, investing before the trend converts to improve ESG ratings.

Seeking income today for a sustainable tomorrow

The European/Global Equity Sustainable Income strategy offers a unique combination of income and ESG. As the world is changing, investors are becoming increasingly aware of the need to invest into sustainable business models in order to protect not only the future of the world we live in, but also their financial future. Companies have adapted to this new environment and the European and Global Equity Sustainable Income strategy is poised to take advantage of these dynamics.

These strategies seek to achieve an attractive level of income and a superior risk adjusted return with a sustainable framework relative to the benchmark. It is fully aligned with Amundi’s strong ESG ambition, leveraging on our Equity Income expertise and extensive ESG capabilities.

Protected Equity Solutions

Our protected equity strategy

Protection solutions aim to reduce drawdowns, portfolio volatility and can address other issues (e.g. regulatory constraints such as Solvency II). They also reduce the risk of unfortunate market timing. Structuring reactive solutions which are cost efficient and sustainable over the long run requires expertise. Amundi’s Convexity Solutions team aims to offer asymmetric risk return profiles across its offering. The team has +20 years of experience in managing derivatives and equity volatility strategies, on which it builds when structuring protection solutions. These are bespoke, to best meet the needs of each client. They focus on the most liquid listed equity index options, which are naturally convex and can be structured for equity strategies managed by Amundi or devised for third party managed equity portfolios.

ESG Equities Solutions

As part of the DNA of Amundi Equities, our wide ESG offering is articulated around four pillars in order to meet your clients’ needs.

Global Ecology Strategy

-

This strategy has a 30-years track-record and has a long manager tenure (the portfolio manager has remained unchanged since 2003).

-

It represents a unique opportunity to gain exposure to growing and sustainable secular trends that are aligned to the 17 UNs Sustainable Development Goals.

-

This strategy offers a real ESG exposure, through a truly diversified and comprehensive set of ESG objectives.

Identifying tomorrow’s winners – a unique dynamic approach to ESG

ESG Improvers franchise

-

While most would look at ESG integration from a statistic perspective, we launched a process that integrates ESG criteria in a dynamic manner.

-

ESG winners are quality companies with attractive valuations and strong ESG ratings, while ESG improvers are corporates portraying a solid fundamental investment case and an improving ESG trend, but not yet an ESG leader. A combination of the two, in our view, will allow investors to benefit from the improvement in ESG ratings before a trend materialises and the premium is established. Hence, it will be important to include both ESG winners and ESG improvers in portfolios.

ESG combined with Income

Equity Sustainable Income Franchise

We see ESG as a source of alpha opportunity. On the positive side, we believe that sustainable business models (the strong ESG stewards) are well positioned to benefit from the structural shift towards ESG friendly investments. ESG conscious companies tend to enjoy less volatility in their profitability and companies with more stable profits have the potential to deliver a more stable and sustainable dividend.

Engagement

Japan

-

The structural changes that Japanese corporates have gone through the last several years are a tailwind for the engagement investors like us. Japanese corporates have room to improve on ESG practices, which offers ample room to unlock the value through engagement on ESG angles.

-

This investment solution represents an attractive solution for investors seeking alpha while making a positive ESG impact on Japanese corporates, through their investment.

-

We seek companies, which we believe have established mechanisms necessary to deliver growth on a sustainable basis. We try to integrate ESG in a dynamic manner leveraging both global and local ESG specialist resources. We engage directly with companies to help encourage long-term value creation.

-

Our long investment horizon allows us to take full advantage of building credibility with the companies and seeking to influence the management on the corporate strategy

France

-

The engagement philosophy applied to the France Engagement strategy is to encourage major French companies to improve their ESG practices by leveraging off its position as a shareholder.

-

Our approach is based on shareholder dialogue and has a long-term investment horizon. The objective of the strategy is two-fold. First, we aim at improving the analysis of the risks and opportunities facing French companies. In addition, we try to support them in the continuous improvement of their ESG practices through company meetings and to accompany them toward both energy transition and social cohesion strengthening, which are two key themes of the Amundi’s 2021 engagement policy.

-

The investment process is based on a combination of both financial and ESG analysis, leveraging off the expertise and experience of Amundi's equity research and ESG analysts.