The American central bank cuts its key interest rate by 25 bp

This is the first cut after a nine-month break

► Monetary policy updates: The Federal Reserve cut interest rates by 25 bp to 4-4.25% due to a slowing US labor market and rising unemployment, while the ECB paused rate cuts, keeping rates at 2% as Eurozone inflation stabilized near target. Other central banks like the BoE and SNB remain cautious amid inflation concerns.

► Economic and Market Trends: Political instability in France increased fiscal uncertainty, pushing French borrowing costs above Italy’s for the first time since 2005. Despite trade tensions, Eurozone private sector activity showed steady growth in manufacturing and services, though German yield curves reflect cautious investor sentiment.

► Inflation and Labour Market: Eurozone inflation stabilized with rising food prices offset by falling energy costs, while US inflation remains elevated due to tariff effects. The US labor market slowdown influenced the Fed’s rate cut, but persistent inflation pressures suggest a cautious outlook for future monetary policy.

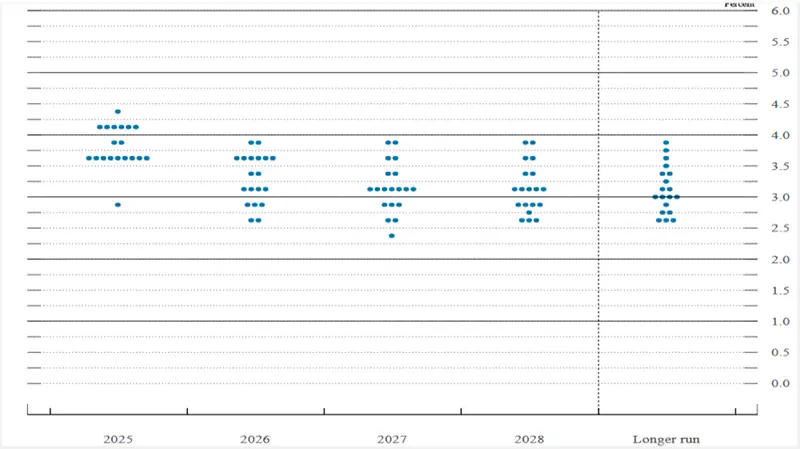

FOMC members' projection of interest rates

Source: Federal Reserve

The latest Fed dot plot shows that most members expect interest rates to remain stable or decrease slightly in the near term, signaling a more accommodative stance. Some members indicate the possibility of further rate cuts if the economy slows more than expected or inflation continues to decline toward the target. Over the medium term, the majority anticipate rates to settle at lower levels than the recent peak, though uncertainties remain around inflation and labor market developments.

Number of the month | ||

25 This is the interest rate cut (in bp) |

ECB: Pauses Rate Cuts as Lagarde Signals Cautious Outlook

Over the past three months, the ECB has implemented two interest rate hikes, each by 25 bp, as part of its ongoing efforts to combat persistent inflation across the Eurozone. These increases have pushed the main refinancing rate to its highest level in more than ten years, signaling the ECB’s commitment to tightening monetary policy. Christine Lagarde, the ECB President, has emphasized that although inflation is showing signs of gradually easing, it still remains above the ECB’s 2% target, which means that further rate hikes remain a possibility.

However, she stressed that future increases will likely be more measured and cautious. Lagarde highlighted the ECB’s data-dependent approach, explaining that upcoming policy decisions will carefully weigh the need to control inflation against the risks posed to economic growth. She also pointed out that ongoing uncertainties—such as volatile energy prices and geopolitical tensions—continue to influence the bank’s outlook and policy stance. Importantly, Lagarde reassured markets that the ECB is fully committed to restoring price stability while striving to avoid triggering a recession.

We remain committed to raising rates further, if necessary, but we will proceed with cautionis over.

(14 September 2025)

ECB |

|

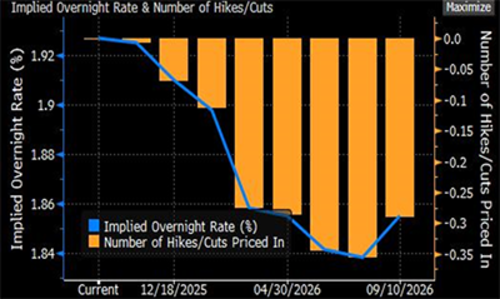

| Forecasts on interest rate trends in the eurozone suggest a 35% probability that the European Central Bank will decide on a further, and apparently final, cut between now and the beginning of the second half of 2026. In this regard, the data available from time to time to the members of the Frankfurt-based institution will be decisive, with particular reference to inflation and employment. For the time being, the deposit facility rate remains at 2%. |

Source: Bloomberg as of 02/10/2025 |

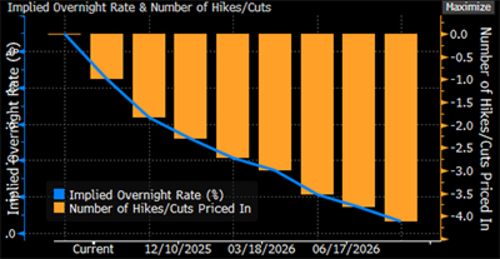

FED | |

Source: Bloomberg as of 02/10/2025 | On the US side, the situation appears to be completely different from that observed in the eurozone. Here, in fact, the cycle of interest rate cuts, which resumed at the last meeting in September after a nine-month hiatus, looks set to continue for some time to come. In fact, the markets are forecasting up to three more rate cuts by September 2026. According to these forecasts, the Fed Funds rate could fall by 75 basis points to a level close to 3.2%. |

French Governement turmoil

France has faced renewed political turbulence and financial strain. Prime Minister François Bayrou’s government collapsed in September 2025 after losing a confidence vote on a strict austerity budget, designed to cut the deficit by tens of billions of euros. President Emmanuel Macron responded by appointing Sébastien Lecornu as the new prime minister, but he inherits a fragmented parliament and widespread social unrest. Protests and strikes, including the grassroots movement “Bloquons tout” have intensified opposition to spending cuts.

The political crisis has spilled into markets. French government bond yields have risen and the spread over German Bunds has widened, reflecting higher perceived risk. Fitch downgraded France’s sovereign rating, citing both its heavy debt burden—about 113% of GDP—and the government’s limited ability to implement reforms. Equity markets have also come under pressure, with investors wary of prolonged instability.

Find out about our treasury offer