Investor Account Access

Investor access to Shareowner accounts and Closed End Funds accounts.

Y-Share: CBYYX | A-Share: ACBAX

K-Share: ACBKX

The Fund provides an opportunity to invest in an alternative asset class that is uncorrelated1 with financial markets. We believe a portfolio construction approach that actively allocates among catastrophe (CAT) bond sectors through a comprehensive due-diligence process, can potentially capture relative value and reduce portfolio risk.

|

|

|

|

Attractive diversification2 toolCAT bonds are outcome-oriented investments with low correlation to capital markets as their performance is linked to non-financial events (such as earthquakes and hurricanes). |

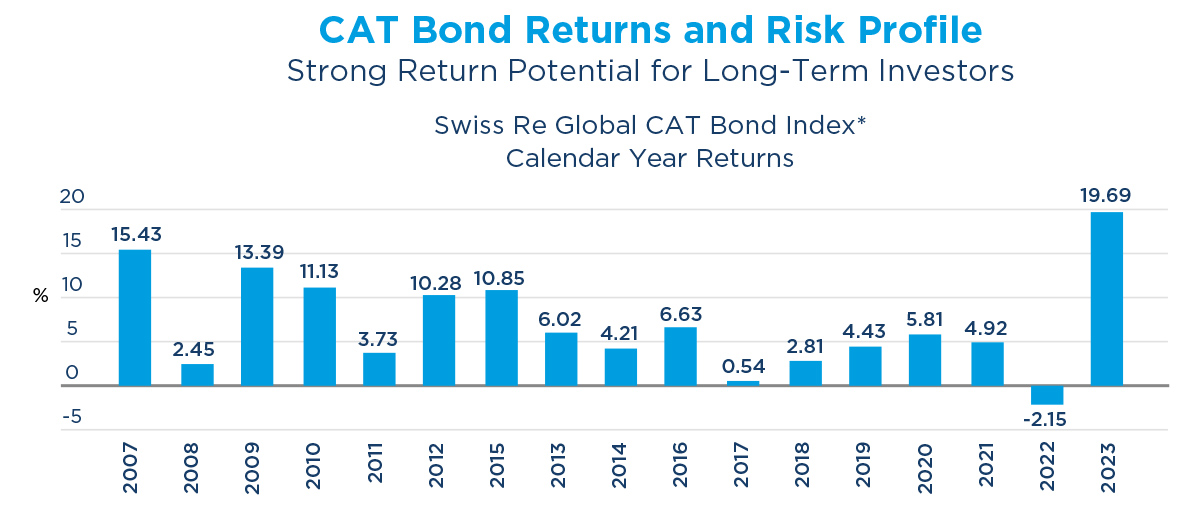

Attractive potential risk-adjusted returnsCAT bond index returns have demonstrated annual positive returns in 16 of the past 17 years.3 |

CAT Bond correlation and return characteristicsStructurally uncorrelated asset class may optimize client portfolios. |

1 Correlation – The degree to which assets or asset class prices have moved in relation to one another. Correlation ranges from -1 (always moving in opposite directions) through 0 (absolutely independent) to 1 (always together). 2 Diversification does not assure a profit or protect against loss. Source: Swiss Re Global Cat Bond Index. 3 The Swiss Re Global Cat Bond Total Return Index, which tracks the aggregate performance of all USD, EUR and JPY denominated CAT bonds, capturing all ratings, perils and triggers. The index seeks to hedge out the EUR and JPY currency risk at the inception of the bonds. However, the index does not reflect the full ILS market. Past performance is no guarantee of future results.

Data represents past performance, which does not guarantee future results. Not meant to represent performance of any Amundi US portfolio. The Swiss Re Global CAT Bond Performance Index tracks the aggregate performance of all USD, EUR and JPY denominated CAT bonds, capturing all ratings, perils and triggers. The index seeks to hedge out the EUR and JPY currency risk at the inception of the bonds. However, the index does not reflect the full ILS market. Had expenses been included, returns would have been lower. *Source: Swiss Re Global CAT Bond Performance Index as of December 31, 2023.

According to estimates by Guy Carpenter, a global risk specialist and provider of ILS sourcing and pricing information, the price of CAT bonds increased by approximately 35% at the January 1, 2023 renewal date, this is only the third time in three decades that prices have reached such a level.

We believe the combination of the continued hard market, supply/demand imbalances and the recent substantial price increases, may present an attractive investment opportunity in 2023.

|

At current prices, catastrophe bonds could present an attractive entry point to the asset class. |

An open-end fund focused on catastrophe (CAT) bonds, a subset of insurance-linked securities, invests in a more liquid subset of the insurance-linked securities (ILS) market, providing an alternative for investors and intermediaries seeking access to this attractive and non-correlated asset class. The more liquid subset of the asset class in a mutual fund structure offers an opportunity for investors who prefer daily liquidity versus an interval fund structure.

Tickers

Class A: ACBAX |

BenchmarkICE BofA US 3- Month T-Bill Index Reference IndexSwiss Re Global CAT Bond Index |

Investment ObjectiveTotal return Inception Date01/26/2023 |

|

|

Pioneer CAT Bond Fund Overview |

Pioneer CAT Bond Fund Quarterly Factsheet |

|

|

|

|

|

Chin Liu |

Mei Li |

Joe Qiu |

Jing Chen |

|

||

|

Joseph Morgart |

||

*Effective April 28, 2023, Campbell Brown has resigned from Amundi US.

A Word About Risk: Pioneer Cat Bond Fund

The Fund invests primarily in catastrophe bonds (CAT) and other forms of insurance-linked securities (ILS). The Fund could lose a portion or all of the principal it has invested in catastrophe bonds, and the right to additional interest and/or dividend payments with respect to the security, upon the occurrence of one or more pre-defined trigger events. Trigger events may include natural or other perils of a specific size or magnitude that occur in a designated geographic region during a specified time period, and/or that involve losses or other metrics that exceed a specific amount. The size of the ILS market may change over time, which may limit the availability of ILS for investment. The availability of ILS in the secondary market may also be limited. Investments in high yield or lower-rated securities are subject to greater-than-average price volatility, illiquidity, and possibility of default. The market price of securities may fluctuate when interest rates change. When interest rates rise, the prices of fixed income securities held by the Fund will generally fall. Conversely, when interest rates fall, the prices of fixed income securities held by the Fund will generally rise. Investments in the Fund are subject to possible loss due to the financial failure of issuers of underlying securities and their inability to meet their debt obligations. The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment. ILS in which the Fund invests may have limited liquidity or may be illiquid and, therefore, may be impossible or difficult to purchase, sell, or unwind. Investing in foreign and/or emerging market securities involves risks relating to interest rates, currency exchange rates, and economic and political conditions. The Fund may use derivatives, such as swaps, inverse floating-rate obligations and others, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on the Fund’s performance. Derivatives may have a leveraging effect. To the extent the Fund invests a significant percentage of its assets in a single industry, such as the insurance segment, the Fund may be particularly susceptible to adverse economic, regulatory or other events affecting that industry. As a non-diversified Fund, the Fund can invest a higher percentage of its assets in the securities of any one or more issuers than a diversified fund. Being non-diversified may magnify the Fund’s losses from adverse events affecting a particular issuer. Please see a prospectus for a complete discussion of the Fund’s risks.

The views expressed regarding market and economic trends are those of Amundi Asset Management US, Inc. ("Amundi US"), and are subject to change at any time. These views should not be relied upon as investment advice, as securities recommendations, or as an indication of trading intent on behalf of any portfolio.

Individuals are encouraged to seek advice from their financial, legal, tax and other appropriate professionals before making any investment or financial decisions or purchasing any financial, securities or investment-related product or service, including any product or service described in these materials. Amundi US does not provide investment advice or investment recommendations.

Before investing, consider the product's investment objectives, risks, charges and expenses. Contact your financial professional or Amundi US for a prospectus or summary prospectus containing this information. Read it carefully. To obtain a free prospectus or summary prospectus and for information on any Pioneer fund, please download it from our literature section.

Securities offered through Amundi Distributor US, Inc.

60 State Street, Boston, MA 02109

Underwriter of Pioneer mutual funds, Member

SIPC.

Not FDIC insured | May lose value | No bank guarantee Amundi Asset Management US, Inc. Form CRS Amundi Distributor US, Inc. Form CRS

EXP-2025-03-12-ADID-3436293-1Y-T