Summary

Highlights

- 2025 was an exceptional year for markets, with international equities and gold leading.

- 2026 is likely to be a year of resilient growth, but risks in the form of high valuations and high government debt remain.

Investors should avoid expensive segments and maintain a diversified* approach in equity markets.

In this edition

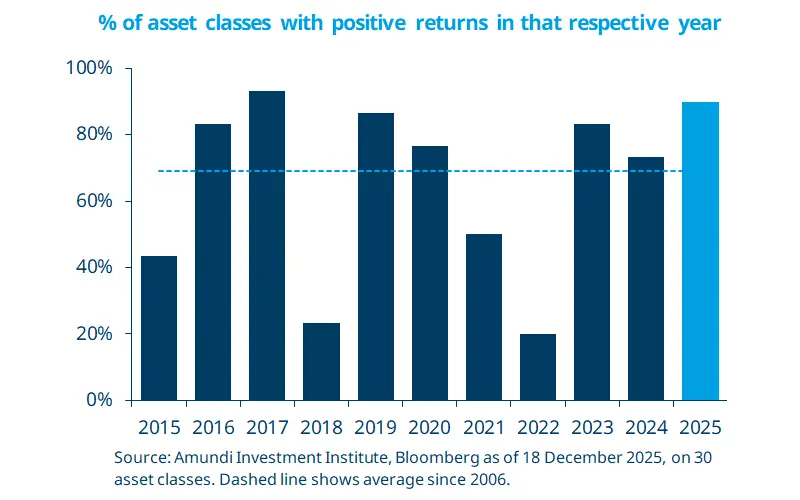

2025 was an outstanding year for market performance, with 90% of the 30 main asset classes we track posting positive returns — exceeding historical averages for the third consecutive year.

Gold, Chinese equities, and broader emerging markets led with returns above 30%, while oil prices fell nearly 20%. US stocks underperformed international equities, with the S&P 500 up 17.9% versus +32.7% for the global equity index excluding the US. The equity rally occurred despite the unconventional policies of the US administration, particularly on the tariff front, which impacted the safehaven appeal of the US dollar. Geopolitical tensions and central-bank buying also supported gold.

Looking ahead, 2026 is likely to be a year of resilient growth, though risks from a slowing US labour market, geopolitical issues, AI-driven market euphoria, and fiscal deficits remain.

Key dates

5 Jan US ISM manufacturing PMI, Indonesia inflation rate |

7 Jan Euro Area Inflation Flash estimate, US ISM Services PMI, US Job openings |

9 Jan China Inflation, US Non Farm Payrolls, US Unemployment Rate |

Read more