Summary

Highlights

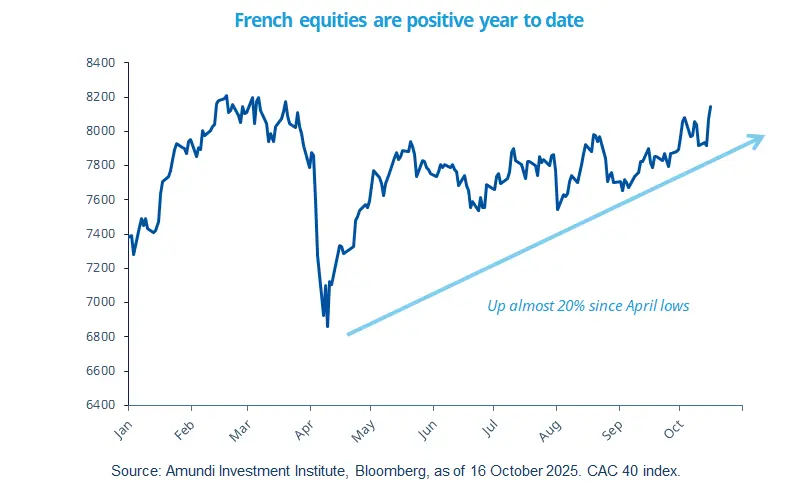

After this week’s relief rally, the CAC 40 is nearly back to its February highs, having almost fully recovered prior losses.

Government bond yields also fell this month, indicating declining political uncertainty.

Volatility could return amid risks over budget discussions and uncertainty over the government’s future.

In this edition

French Prime Minister (PM) Lecornu secured wins in two no-confidence motions in the National Assembly, triggering a rally in French stocks, and paving the way for additional discussions over a draft budget. Markets welcomed the news that the country, for the time being, has avoided snap elections and the political uncertainty has eased.

The victory came following the PM’s pledge to suspend President Macron’s landmark pension reform by freezing the planned increase in the retirement age until the 2027 presidential election. While uncertainty over the government’s future, the management of public finances and credit rating revisions persist, the new PM is likely to aim to pass the 2026 budget before year-end. On a positive note, the country’s economic growth is expected to improve modestly as it moves towards 2026, though policy uncertainty may weigh on household confidence.

Key dates

China GDP, industrial production and retail sales |

US existing home sales, France business confidence |

US inflation, global composite, manufacturing and services flash PMIs |

Read more