Summary

In a nutshell

April was marked by renewed volatility in the fixed income and equity markets. The rebound in risk assets after the April sell-off was fueled by hopes of trade deals and strong earnings results. The market is now shifting toward a narrative that the impact of Trump's policies on growth and inflation will not have a significant or lasting effect.

The SP500 and Euro Stoxx 50 stock markets returned to their pre-April 2 levels.

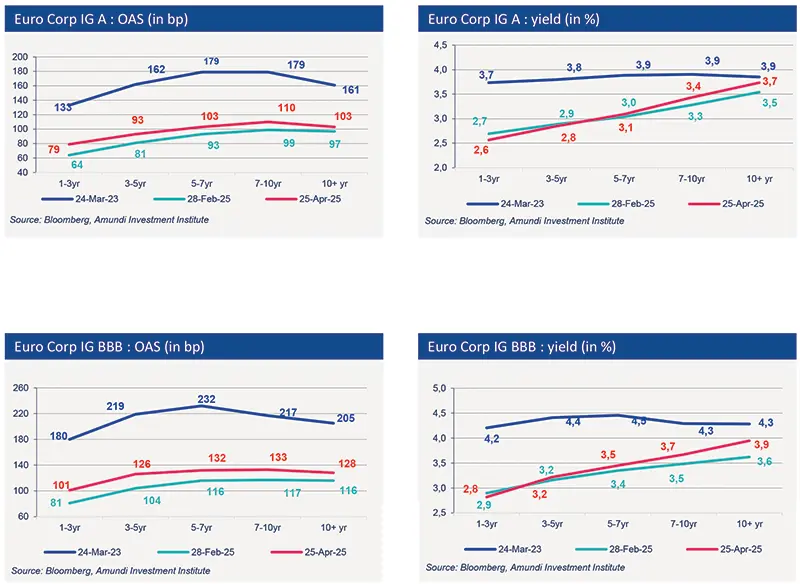

In the euro market, IG and HY euro bonds regained more than half of the ground lost following the trade war. The IG spread rebounded by more than 40 bps to 125 bps, before tightening by 20 bps. The HY spread jumped to 429 bp to return below 360 bp.

The environment remains positive for credit markets.

Low growth and declining inflation. Persistent high geopolitical, trade, and economic uncertainties are expected to weigh on eurozone GDP growth. We expect a slowdown but not a recession. Furthermore, declining inflation should allow the ECB to continue lowering rates. We expect three more rate cuts, resulting in a terminal rate of 1.5%.

Strong demand for fixed income products. Investors want to lock in their returns before the ECB lowers rates further.

Solid corporate fundamentals.

More attractive valuation. The sharp widening of spreads has restored valuations that had become very stretched in this asset class.

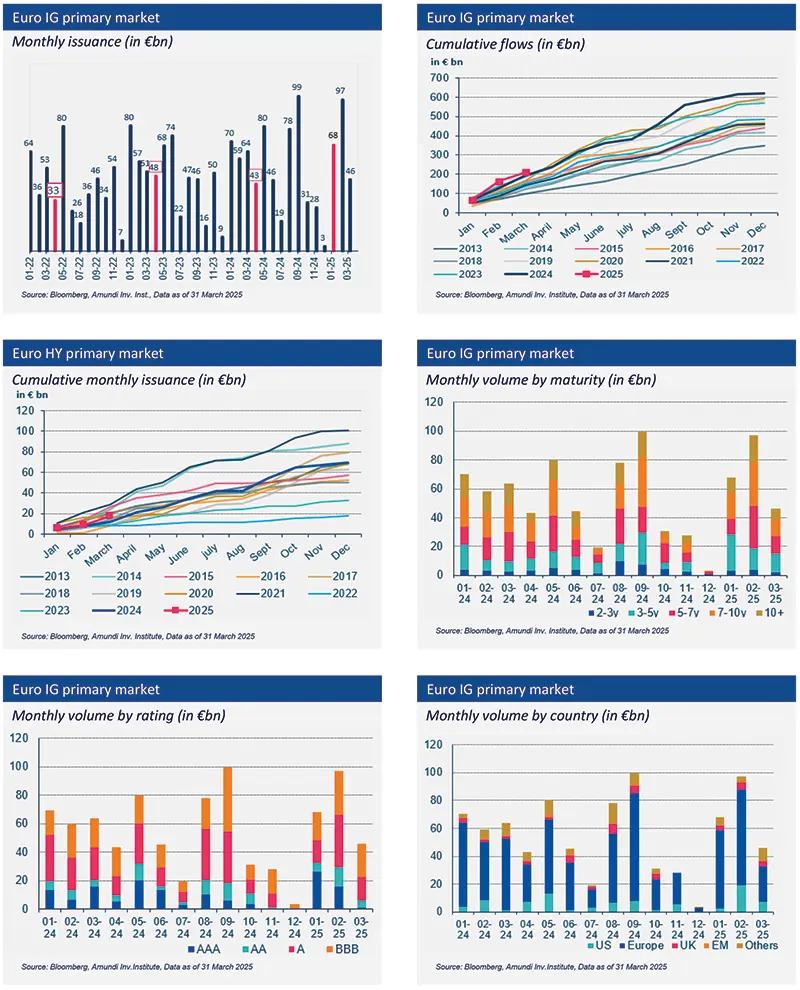

Primary market Investment Grade

Market data

Find out about our treasury offer