Summary

Highlights

The impact of US tariffs on inflation is limited for now but political pressure on US institutions is growing.

In addition, risks around global trade wars, particularly between the US and China, still persist.

Hence instead of being carried away by euphoria, there is a need to focus on quality assets and diversification1.

In this edition

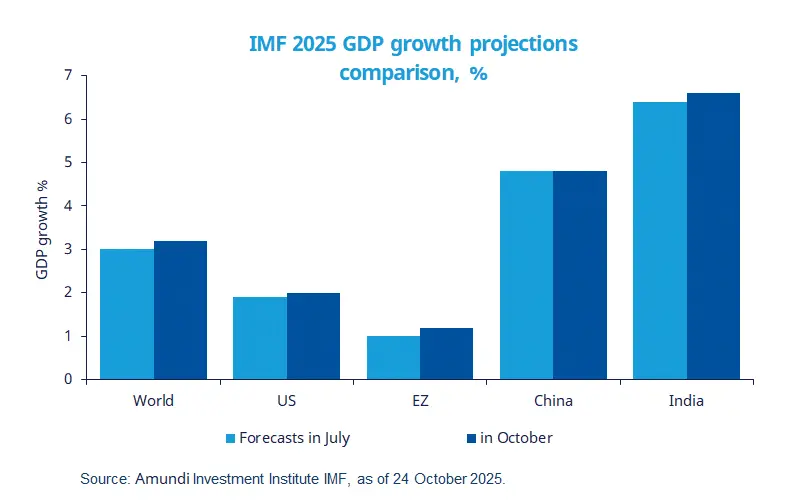

In its latest World Economic Outlook, the IMF upgraded its 2025 global growth forecast to 3.2%. Global trade and financial conditions have proven resilient, helped by trade deals between the US and some of its trading partners. We believe the global trading system is bruised but not broken: roughly 70% of trade is flowing as before. An artificial intelligence–driven (AI) productivity upswing has also supported prospects for global growth.

Looking ahead, risks related to trade wars, uncertainty over fiscal policy, and labour-supply issues could hinder growth. For next year, global growth is forecast at 3.1%, but this masks the risks. In the US, domestic consumption remains the main pillar of growth, although weakening labour markets are an important concern. In the euro area, much depends on the implementation of Germany’s fiscal stimulus. The EU’s defence push is viewed as a gradual evolution. Finally, the IMF’s growth forecasts for China were unchanged and are close to the Chinese government’s target.

Key dates

Fed interest rate decision, US retail inventories |

ECB and BoJ interest rate decision, US and EZ GDP growth rate, |

EZ inflation rate, US personal income and spending |

1 Diversification does not guarantee a profit or protect against a loss.

Read more