Summary

Highlights

Productivity gains should help keep labour costs in check over the medium term.

The fallout from US tariffs has not yet fully shown up in inflation data. we are closely monitoring services inflation.

We think the Fed will cut interest rates twice this year. Political pressures on the bank may affect this view.

In this edition

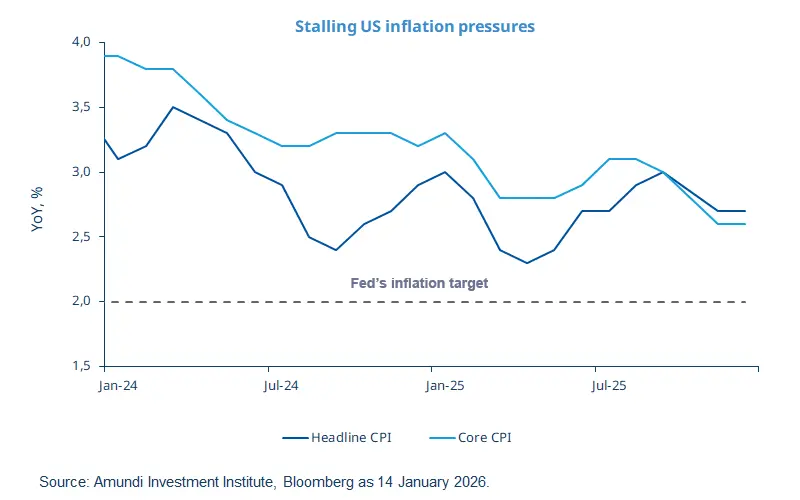

US CPI was up 2.7% YoY in December, unchanged from the previous month, meeting market expectations and significantly down from levels seen in early 2024. Core inflation — which excludes food and energy — rose 2.6%, slightly below expectations. It was weighed down by declines in used cars and trucks and by IT‑related goods.

Disruptions caused by the government shutdown and the challenges in data collection make it difficult to assess the current inflation momentum. While structural indicators confirm the ongoing disinflation trend (i.e. a slowdown in the inflation pace), we think shelter and services inflation is key to understanding the overall picture (Rental prices rebounded to levels close to those seen earlier in 2025.). Secondly, a potential increase in prices due to US tariffs may keep inflation elevated. Overall, we expect slightly volatile inflation ahead, which should keep inflation above the Fed’s 2% target throughout 2026.

Key dates

Germany and EZ ZEW survey expectations, UK unemployment rate |

US personal income and spending, PCE and core PCE price indices |

S&P global manufacturing and services PMIs |

Read more