Mid-Year Outlook 2025

A rewiring of the global economy is forcing investors and policymakers to proceed with caution. Unpredictable policymaking is triggering big market swings. However, major economies have so far proved resilient.

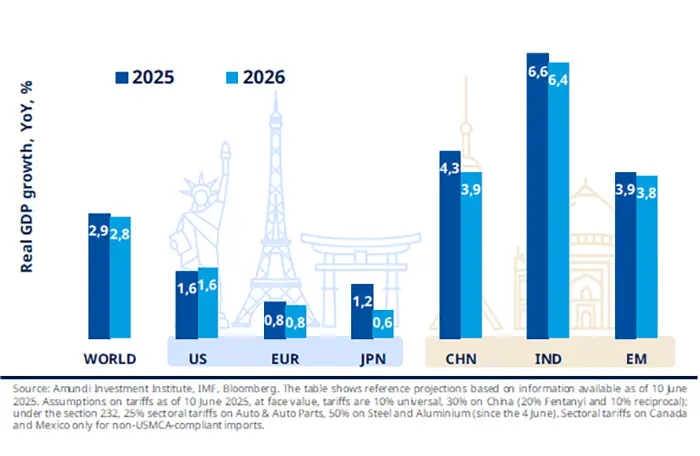

We expect US real GDP growth to slow from nearly 3% in 2023–24 to 1.6% in 2025, largely due to weakened private demand. Higher tariffs will raise prices, dampening consumer sentiment and spending, while uncertainty will weigh on investment. Although fiscal measures and deregulation may provide some relief, the impact is likely to be limited, with average tariffs around 15% (as per our base case) leading to economic losses and a temporary resurgence in inflation. Amid the growth slowdown, the Fed is expected to cut rates three times in H2.

We are now in a more contentious geopolitical environment, with the US administration contributing to rising tensions through tariffs and reduced commitments to European security. This could further unify Europe, with leaders recognising the benefits of collective negotiation as they seek to diversify trading partners through new trade agreements. The US–China relationship is set to deteriorate further, though both nations will seek to avoid escalation. In this environment, diversification away from US assets is set to continue, favouring European assets in particular.

Despite the sub-par growth outlook, we do not anticipate an earnings recession, as businesses show resilience. This, coupled with the Fed's anticipated rate cuts, supports a mildly constructive asset allocation with inflation protection. We favour global equities with a focus on valuations and pricing power, along with commodities, gold, and hedges against growth and inflation risks stemming from a world of geopolitical uncertainty. Infrastructure investments can offer stable cash flows. Currency diversification will be crucial amid shifting correlations between the USD, equities, and bonds.

Investors will demand a higher premium for US Treasuries, amid uncertainty on trade policies, rising public debt, and substantial bond supply. In developed markets, long-term yields will remain under pressure. Central Banks cutting rates will continue to support short-dated bonds, driving yield curve steepening. Investors will seek diversification across markets, favouring Europe and EM debt. Continue to play quality credit, with a preference for euro investment grade (financial and subordinated credit).

Equities may generate low single-digit returns in the second half, but rotations will continue. Europe’s appeal is likely to become a structural theme, favouring also small- and mid-caps, where valuations remain highly attractive. Globally, sector selection will be key. We favour domestic and service-orientated sectors to reduce the risk from tariffs, with a focus on themes such as US deregulation, European defence and infrastructure, and the ongoing Tokyo Stock Exchange reform, which is generating a more investor-friendly environment.

Emerging market equities will be favoured in H2 2025, driven by recovering macro momentum and stabilising inflation. As US exceptionalism fades, India and ASEAN are emerging as key beneficiaries of the global supply chain rerouting. India's ‘Make in India’ initiative is attracting multinational corporations, particularly in defence and IT. With a focus on domestically-orientated sectors, these markets are not just manufacturing hubs but dynamic growth engines, poised to capitalise on structural shifts and expanding consumer bases.

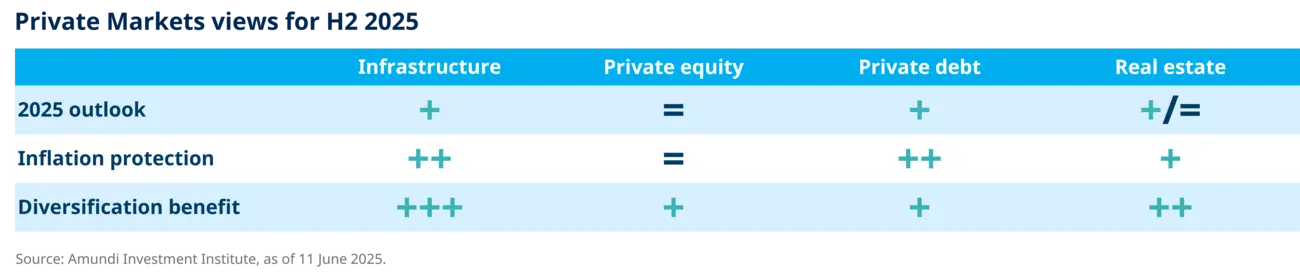

Extra selectivity is required given the surge of capital being invested in these segments. Overall, a challenging geo-economic backdrop will boost diversification through private assets, benefitting resilient domestic stories. Private debt and infrastructure are expected to remain the most attractive. Private debt may benefit from strong direct lending and fundraising, while infrastructure will attract investors seeking inflation protection.

Economic growth will depend on the trajectory of tariffs after the 90-day pause and the rollout of Trump’s policies. The persistence of policy uncertainty and the damage to domestic and investor confidence are risks to watch.

This information is exclusively intended for “Professional” investors within the meaning Directive 2014/65/EU of the European Parliament and the Council of 15 Many 2014 on Markets in Financial Instruments (as amended) (MIFID II). It is not intended for the general public or for non-professional individual investors within the meaning of all local regulations, or for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act. This non-contractual information does not under any circumstances constitute an offer to buy, a solicitation to sell, or advice to invest in financial instruments of Amundi or one of its affiliates (“Amundi”). Investing involves risks. The performance of the strategies is not guaranteed. Past performance does not predict future results. Investors may lose all or part of the capital originally invested. There is no guarantee that ESG considerations will enhance a strategy’s performance. The decision of investors to invest in the promoted strategies should take into account all characteristics of objectives of the strategies. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability. Amundi assumes no liability, either direct or indirect, resulting from the use of any of the information contained in this document, and shall not under any circumstances be held liable for any decisions taken on the basis of this information. This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of Amundi. This information is provided to you based on sources that Amundi considers to be reliable at the date of publication, and it may be modified at any time without prior notice.