Innovating to answer your needs

We have built a unique solution for an inclusive transition in line with the Paris Agreement.

This strategy supporting the transition to a low-carbon economy monitors a full range of climate-related risks…

- Physical and transition risks

- Carbon footprints

- Temperature alignment

…ensuring that the portfolio is aligned with a transition to a 2° objective, and working towards 1.5°C.

How to finance the recovery from the Covid -19 pandemic and foster long-term inclusive growth?

In line with our commitment to supporting new sustainable fixed income markets, we have developed our first Social Bond Strategy, which aims at directing investments towards projects addressing social issues or targeting positive social outcomes by investing in social bonds.

Through this strategy, we support the expansion of the nascent social bond market, which experienced a very strong uptick during the Covid-19 pandemic and has proven its financing capabilities for both the recovery and for continued inclusive growth.

Through emerging markets (EM) green bond strategies, we renew our commitment to support sustainable fixed income markets in low and middle income countries..

This strategy provides funding to potentially create positive impact towards the transition to a low-carbon environment in emerging markets.

The combined benefits of impact investing, attractive yield potential and limited duration risk offer unique investment opportunities to investors on EM green bond markets.

Discover our responsible investment offering

Learn more about our comprehensive responsible investment capabilities by downloading our brochures

Responsible offering and capabilities

Our responsible investing offering across the value chain

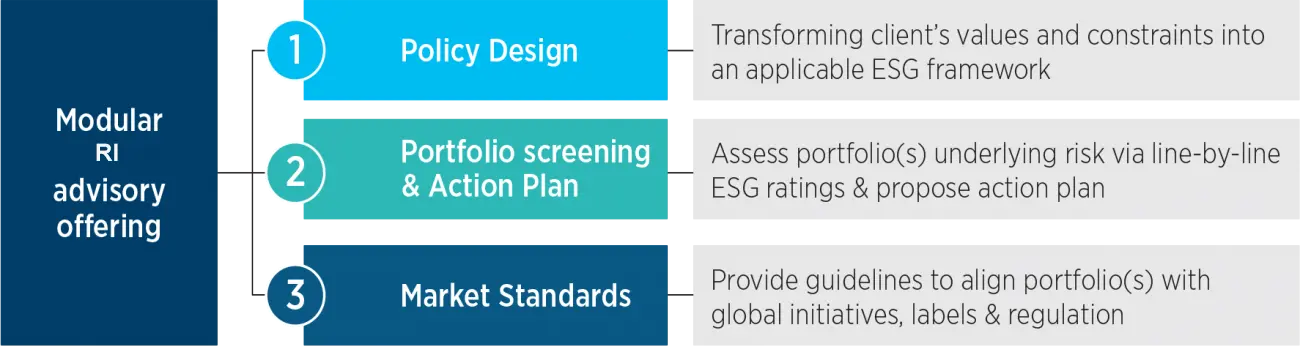

Advisory

Guiding investors in navigating responsible investment

Whether your goal is to generate a positive impact, to integrate ESG criteria in your portfolio, or to anticipate material ESG-related risks, our team of ESG experts is committed to supporting you in meeting your responsible investment objectives while respecting your specific constraints.

Responsible investment solutions

A wide range of responsible investment solutions

Our investment teams have developed specific expertise to assist our clients in achieving their particular specific investment objectives by offering a wide range of investment solutions across all asset classes and regions, from broad ESG integration to specific themes.

Long-standing player in ESG integration

As a pioneer in Responsible Investing, we have continuously strengthened our ambition to integrate ESG criteria through our investment strategies and to reinforce our engagement process to support issuers in making progress.

Since the announcement of our ambitious action plan in 2018, we have established an unprecedented level of ESG integration throughout our organisation. To this end, we have committed to integrating ESG criteria across the entire portfolio management value chain, notably through:

As part of our “ESG mainstreaming” approach, all our open-ended funds include:

- An environmental, social and governance assessment of the companies in which they invest

- The most highly rated companies are favoured, while the lowest-rated companies remain under-weighted, or even excluded

- With the objective to have a portfolio ESG rating above that of the benchmark or the investment universe

Selecting the issuers with the best ESG practices within each sector:

- Exclusion of issuers rated E, F, G*

- Average ESG rating of the portfolio ≥ ESG rating of the benchmark/investment universe

- Average ESG rating of the portfolio ≥ C

- Minimum 90% of issuers in the portfolio rated in terms of ESG

*Our ratings range from A to G, A being the highest rating and G the lowest.

Investment solutions :

- Implementing a complementary risk-based ESG approach

- Seeking to enhance value creation potential through the selection of appropriate criteria combinations

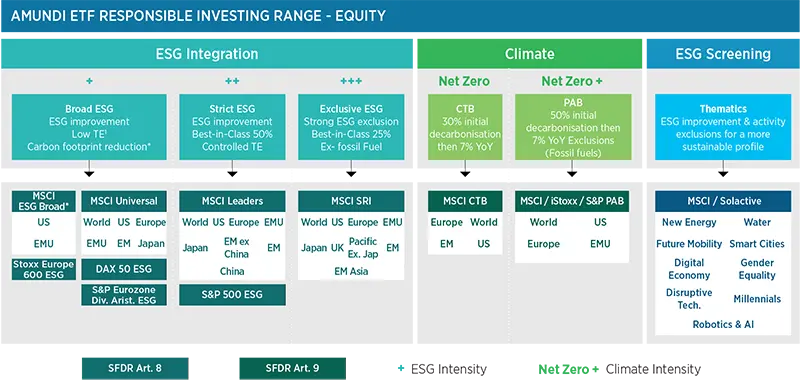

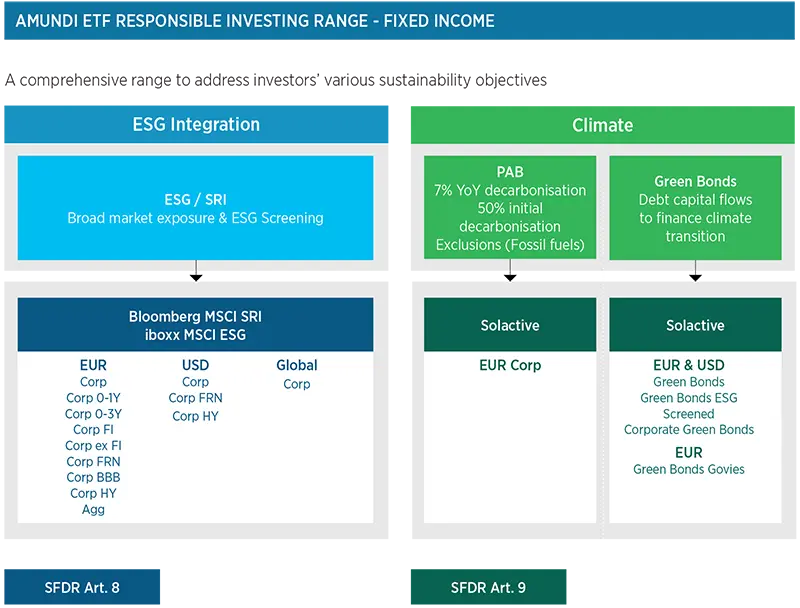

Responsible investing passive solutions, including:

- A large range of ETF & index funds

- Thematic by geography or asset class based on various index methodologies allowing investors to choose among various degrees of sustainability profiles.

Responsible investing passive solutions

There is no one-size-fits-all approach to responsible investing and as a solutions provider. As a solutions provider, we are committed to developing simple and ready to-use tools to help investors easily implement their responsible investment strategy according to their portfolio sustainability objectives and constraints.

In addition, the expertise of our index team and our proprietary index management tools allow us to develop fully bespoke solutions for our clients aimed at deploying their individual responsible policies.

An expanded range to address your various sustainability objectives:

Services

To complete our large range of advisory services and investment solutions, we provide you with responsible investment services that can reinforce your commitment to a more sustainable future.

Standard responsible investment services are included with responsible investing portfolio management when relevant.

We offer 3 types of services:

Engagement

&

Voting

We have defined an engagement and voting policy that we apply to our assets under management. We believe our role is to engage with issuers to allow for constant improvement and awareness of ESG-related topics through dialogue or voting at general assemblies.

Reporting tailored to your responsible investment objectives

As you need to monitor your financial and extra-financial performance guidelines and report the results of your investments, we offer different types of reporting according to your underlying strategy and responsible investment policy.

Responsible investment training & knowledge transfer

Responsible investing is evolving at a fast pace and we are committed to disseminating best practices, research and thought-leadership through content sharing, high level conferences and training programs.

We are recognised for our responsible investment expertise

We are recognised for our industry-leading responsible investment strategy: our PRI results for 2023* are 5 stars in 3 modules, 4 stars in 11 modules and 3 stars in 3 modules. One of the modules that obtained 5 stars is “Policy, Governance and Strategy".

The highest score (5 stars) is awarded to signatories that demonstrate industry-leading responsible investment practices (>90%)

_______________________________________________________________________________________________________

* Source: UN PRI, United Nations Principles for Responsible Investment. For more information on the 2023 PRI reporting and assessment:

2023 PRI Assessment Report

2023 PRI Public Transparency Report

Environmental Finance Bond Awards

Environmental Finance Sustainable Investment Awards

Global Capital European Securitization Awards

ETF Stream Awards

Discover our responsible investing offering & initiatives

This information is exclusively intended for “Professional” investors within the meaning Directive 2014/65/EU of the European Parliament and the Council of 15 Many 2014 on Markets in Financial Instruments (as amended) (MIFID II). It is not intended for the general public or for non-professional individual investors within the meaning of all local regulations, or for “US Persons”, as defined in the Securities and Exchange Commission’s “Regulation S” under the 1933 U.S. Securities Act. This non-contractual information does not under any circumstances constitute an offer to buy, a solicitation to sell, or advice to invest in financial instruments of Amundi or one of its affiliates (“Amundi”). Investing involves risks. The performance of the strategies is not guaranteed. Past performance does not predict future results. Investors may lose all or part of the capital originally invested. There is no guarantee that ESG considerations will enhance a strategy’s performance. The decision of investors to invest in the promoted strategies should take into account all characteristics of objectives of the strategies. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability. Amundi assumes no liability, either direct or indirect, resulting from the use of any of the information contained in this document, and shall not under any circumstances be held liable for any decisions taken on the basis of this information. This information may not be copied, reproduced, modified, translated or distributed, without the prior written approval of Amundi. This information is provided to you based on sources that Amundi considers to be reliable at the date of publication, and it may be modified at any time without prior notice.