Summary

Key takeaways

Today, private markets are recognized as an established and indispensable component of a comprehensive investment strategy, complementing public equities and publicly issued bonds to enhance long-term outcomes.

By fully integrating private equity, private debt, and infrastructure investments into their strategic asset allocation, investors can build more robust portfolios that are better equipped to navigate uncertainty and volatility in pursuit of long-term financial goals.

In the current macroeconomic environment, investors face heightened volatility driven by structural shifts, persistent geopolitical tensions, and evolving monetary policies.

Although traditional diversification methods have historically provided substantial benefits, market dynamics over time have highlighted the limitations of relying solely on conventional asset allocations to achieve an optimal level of portfolio diversification. As a result, investors who already maintain diversified portfolios are increasingly exploring additional avenues to enhance resilience and optimise long-term returns.

Private markets could represent an attractive solution, offering distinctive correlation characteristics and enhanced risk-adjusted performance. They complement the classic 60/40 equity-to-fixed income allocation, itself based on the negative correlation between equities and bonds. Over the past forty years, correlation between the two aforementioned asset classes has notably increased, challenging the notion that one serves as a hedge to the other.

Therefore, integrating private markets could represent a way to enhance diversification and build greater resilience, helping portfolios better navigate volatility amid ongoing geopolitical uncertainties, high environmental stakes, and concentrated market risks.

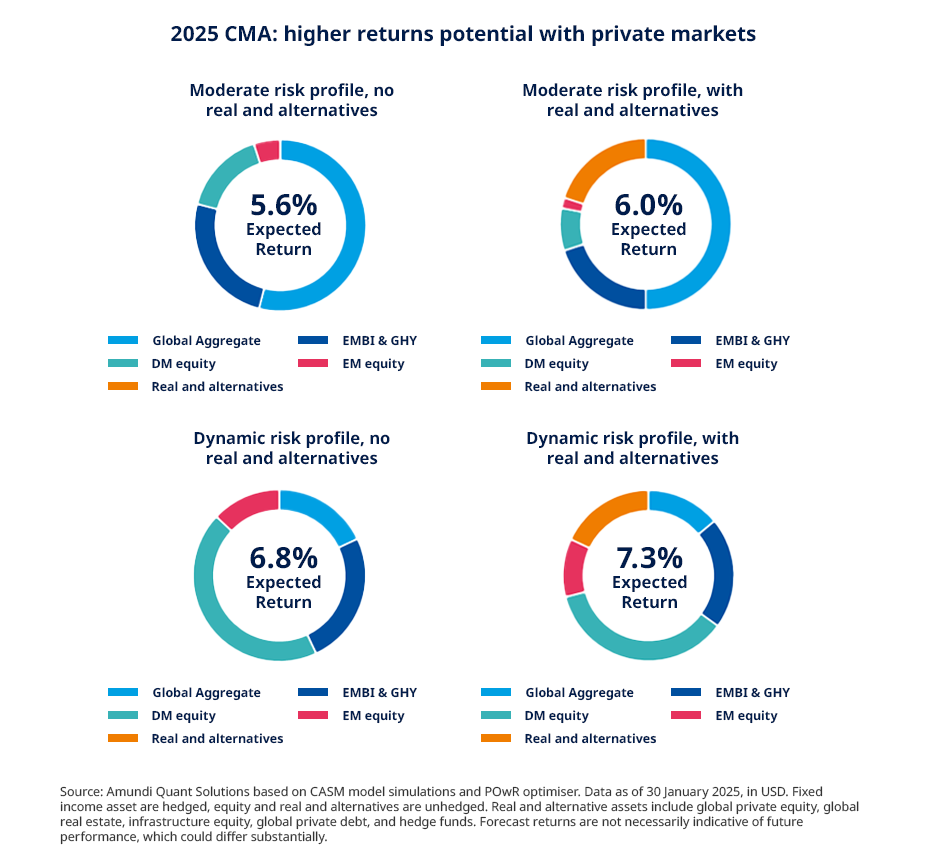

Supporting this theory is Amundi’s annual Capital Market Assumptions1 (CMA), which represents the long-term house view of the Amundi Investment Institute regarding over 40 asset classes. The latest CMA, published in March 2025, identifies opportunities in [taking] advantage of different correlation characteristics through a combination of traditional and non-traditional asset classes. In other words, investors should evolve their strategies, ensuring that they utilise multiple sources of portfolio diversification to manage risk and preserve returns.

A look-through into private markets

Private markets encompass a diverse range of asset classes, each with unique opportunities and characteristics that can cater to a variety of investment objectives. Key asset classes include real estate, natural resources, venture capital, private equity, infrastructure, and private debt. The latter three have a dominant position in the market and therefore play a central role in modern portfolio construction.

Preqin2 data forecasts that private equity AuM will reach $12 trillion by the end of 2029, while private debt and unlisted infrastructure AuM is expected to reach $2.6 trillion and $2.4 trillion, respectively.

Private equity: value creation over the long term

Private equity is particularly attractive for investors seeking to enhance portfolio returns through strategic and operational value creation. Amundi’s CMA anticipates3 global private equity delivering a net-of-fees annualised return slightly above 10% over the next decade, approximately 400 basis points greater than forecasted public equity returns. Data from Preqin further indicates that over the past 20 years, private equity funds consistently outperform public market benchmarks by a margin of 1,000 basis points on average, and 400 basis points in high-return environments for public equities4.

Private debt: enhancing income stability and diversification

Private debt can provide investors with compelling income-generation opportunities alongside significant diversification benefits. Particularly attractive within mid-volatility credit strategies, private debt yields typically surpass comparable public debt market instruments: The Cliffwater Direct Lending Index posted rolling 5-year returns of nearly 9% on an annualised basis between 2013 and 2023, nearly double the return on public loans5.

The private debt market is expected to develop further as M&A activity in Europe rebounds, spurring an increase in demand for debt financing amidst the continued withdrawal of banks from the sub-investment grade lending business.

Infrastructure: driving stability and inflation hedging

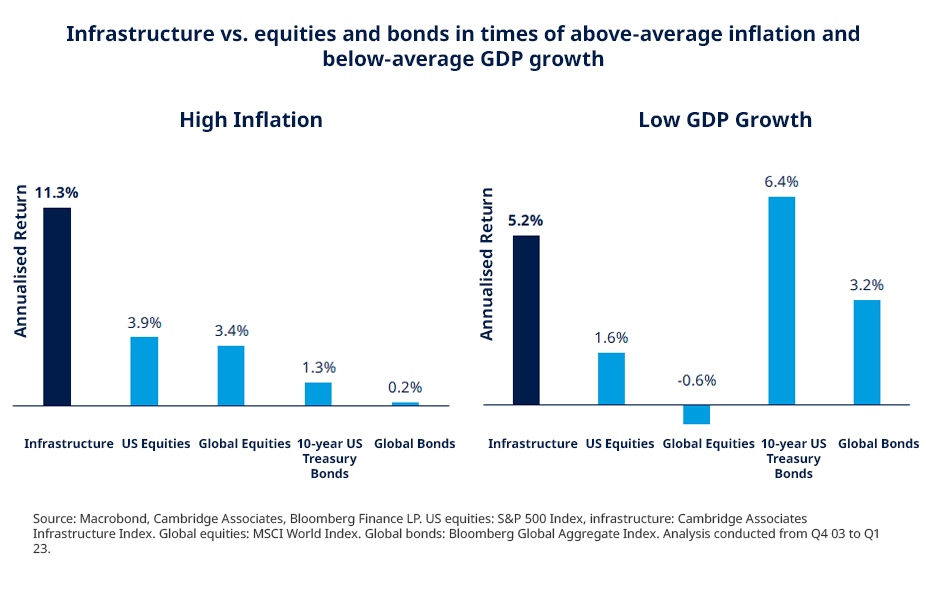

Infrastructure investments provide critical portfolio stability through predictable, contractual cashflows, typically secured by long-term agreements or regulatory frameworks. Amid an increasing need in global infrastructure spending, estimated at nearly $80 trillion by 20406, the asset class offers stable growth prospects alongside robust income generation. Infrastructure revenues are frequently linked directly to inflation indices, enhancing their attractiveness in scenarios characterised by inflationary pressures or monetary policy uncertainty. When the annualised return of unlisted infrastructure is compared to that of global equities and global bonds, it reveals consistently positive performance under multiple economic scenarios, regardless of whether interest rates are rising or falling, or whether GDP growth is accelerating or decelerating.7

An evolving landscape

While private markets have traditionally been associated with long lock-up periods and high entry thresholds, the landscape is evolving. Recent structural innovations and regulatory changes have significantly increased accessibility and liquidity options for non-institutional investors:

- Evergreen funds: These open-ended structures offer ongoing subscription and redemption windows under predetermined conditions. These vehicles provide greater flexibility for investors while maintaining exposure to long-term private market strategies and experiencing some of the benefits of the complexity premium8.

- Regulatory advancements (ELTIF 2.0): The introduction of ELTIF 2.09 aims to facilitate retail access to private markets. By lowering investment thresholds and enhancing liquidity options, ELTIF 2.0 enables a broader range of investors to participate in asset classes that were previously largely limited to institutions.

Multi-Manager (funds-of-funds) solutions: Funds that invest across multiple managers and strategies provide diversified access to private markets while offering more flexible structures than traditional single-strategy vehicles. In some cases, this model can facilitate improved liquidity terms, as pooled capital and staggered investment timelines create opportunities for more regular exit windows. Alongside broader diversification across geographies, sectors, and styles, this approach enables investors to access private markets with a more balanced risk and liquidity profile. Between 2017 and 2023, AuM of multi-manager funds (“funds-of-funds”) grew by 67%, indicating a growing spectrum of choice for investors10.

Optimised portfolio allocation with alternatives

The strategic value of incorporating real and alternative assets into an already diversified portfolio to fully capitalise on market opportunities is clearly highlighted in Amundi’s CMA. For a USD-denominated investor with a moderate risk profile, expected annual returns over the next decade stand at 5.6%11 when exposed solely to traditional assets. This figure rises to 6.0%11 when incorporating real and alternative assets.

This analysis also shows that the inclusion of real and alternative assets can help to improve the portfolio’s Sharpe Ratio by reducing downside risk and increasing resilience against tail events.

That said, investors should recognise that while exposure to alternatives offers risk-return diversification benefits, it also entails heightened risks related to illiquidity and complexity, which require specific technical expertise. These factors must be carefully considered when designing and managing portfolios.

Why partner with Amundi Alternative & Real Assets (ARA)?

With the growing need to diversify into private markets, investors must select an asset manager who can ensure and oversee the timely and profitable deployment of capital.

Amundi ARA, a trusted European partner with over 40 years of experience, showcases its expertise in structuring and managing long-term investments.

Amundi ARA is a leading player in private markets asset management, with €69 billion AuM in real and alternative assets and 340 professionals across 8 investment hubs (Paris, London, Milan, Luxembourg, Barcelona, Madrid, Dublin and Zurich)12.

Amundi ARA combines a rigorous risk management process with proven expertise to build robust and diversified portfolios across all segments of private markets, including private equity, infrastructure, private debt, real estate and multi-selection of General Partners (GPs) within these asset classes. The strategies deployed may incorporate pure asset class strategies or a combination of them. Amundi ARA has also the capacity to create tailored vehicles, such as ELTIFs 2.0 evergreen funds, through direct investments or funds-of-funds.

Amundi ARA’s management team is dedicated to generating strong value for all stakeholders. Firmly believing that companies and financial actors bear a responsibility to address the major challenges of our time, the firm strives to facilitate the evolution of society towards a more sustainable development model. All of Amundi ARA’s current funds integrate environmental, social, and governance (ESG) factors in their investment processes and asset selection throughout the entire holding period, accompanied by reporting that complies with the Sustainable Finance Disclosures Regulation (SFDR)13 for its Article 8 and 9 funds.

As an investor in the real economy, Amundi ARA leverages its expertise to develop optimal and innovative solutions for both retail and institutional investors.

PI SOLUTIONS - AMUNDI PRIVATE MARKETS ELTIF - A (C)

* Diversification does not guarantee a profit or protect against a loss.

1 https://research-center.amundi.com/article/capital-market-assumptions-2025

2 Preqin is a leading provider of data, analytics, and insights on the alternative assets industry, including private equity, hedge funds, real estate, and infrastructure.

3 Forecast returns are not necessarily indicative of future performance, which could differ substantially.

4 Navigating the future of private capital performance, Preqin, January 2025.

5 Cliffwater Direct Lending Index: 8.9% 10-year IRR. The Cliffwater Direct Lending Index (CDLI) is an asset-weighted index that measures the unlevered, gross of fees performance of U.S. middle market corporate loans. Public loans are represented by the Cambridge Associates Modified Public Market Equivalent (mPME), which replicates private investment performance under public market conditions. The public index’s shares are purchased and sold according to the private fund cashflow schedule, with distributions calculated in the same proportion as the private fund, and mPME NAV is a function of mPME cashflows and public index returns. Past performance is no guarantee of future results.

6 Global Infrastructure Hub, February 2025.

7 Analysis conducted between Q4 03 and Q2 24. Unlisted infrastructure is represented by Cambridge Associates Infrastructure Index; global equities by MSCI World Index; global bonds by Bloomberg Global Aggregate Index. Past performance is no guarantee of future results.

8 For further information, please refer to “Unlocking private markets: The rise of evergreen funds in a democratized investment landscape”. 12 February 2025. https://www.amundi.com/globaldistributor/article/unlocking-private-markets-rise-evergreen-funds-democratised-investment-landscape

9 European long-term investment fund (ELTIF). The objective of the ELTIF 2.0 regulation is to promote long-term European investment in the real economy, encouraging a sustainable and inclusive growth.

10 Pitchbook, “PitchBook Analyst Note: Private Capital’s Path to $20 Trillion”, 1 May 2024. https://pitchbook.com/news/reports/q2-2024-pitchbook-analyst-note-private-capitals-path-to-20-trillion

11 Amundi Quant Solutions based on CASM model simulations and POwR optimiser. Data as of 30 January 2025. Forecast returns are not necessarily indicative of future performance, which could differ substantially.

12 Source: Amundi ARA, as of end of March 2025.

13 Please refer to the Amundi Global Responsible Investment Policy and the Amundi Sustainable Finance Disclosure Statement available at https://www.amundi.com/globaldistributor/responsible-investment-policies-reports.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 2 July 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 2 July 2025

Doc ID: 4619858

Marketing Communication – For Professional Clients only