Key takeaways

Emerging markets debt (EMD) continues to demonstrate resilience, supported by strong fiscal discipline and robust monetary policy frameworks.

With emerging markets (EM) yields at attractive historical levels, the asset class presents a compelling opportunity for investors to enhance their portfolios.

- Amundi’s expertise in emerging markets, combined with its broad range of strategies, positions it as a trusted partner for investors seeking to unlock the full potential of EMD.

Strong fundamentals and evolving opportunities

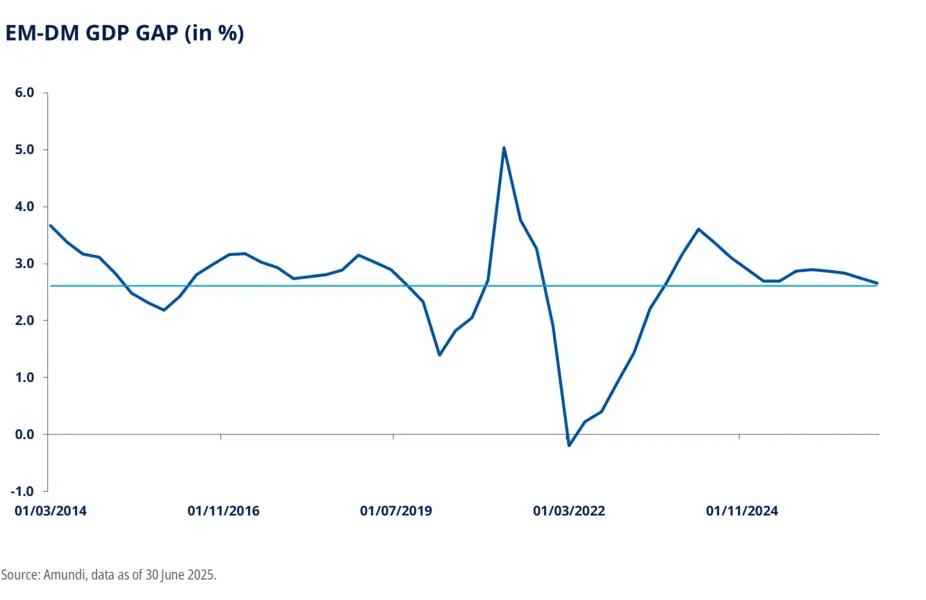

Despite remaining underinvested, emerging markets debt presents a range of compelling opportunities for clients, supported by strong fundamentals and a sustained growth premium compared to developed markets (DM). Although recent years have been marked by global economic challenges, many emerging markets responded effectively through monetary policy and fiscal discipline. While DM economies have continued to increase their debt issuance, EM countries have often addressed crises with policy reforms, further reinforcing their economic foundations.

This resilience is further reflected in the relatively low number of EM sovereign defaults through the commodity super cycle (2000s – early 2010s). However, in recent years, a combination of exceptional shocks, including the pandemic and the Russia-Ukraine war, have led to an increase in defaults among more vulnerable EM sovereigns.

That said, the International Monetary Fund (IMF) and other multilateral organizations significantly stepped up their support for EM economies during 2021-2022, providing critical assistance during a period of heightened financial stress. This support has been instrumental in helping EM countries navigate these challenges and maintain economic stability.

The year 2024 marked the completion of several landmark debt restructurings that have been underway for more than two years. Recovery rates in these recent round of defaults have remained attractive, although the restructuring process was occasionally prolonged, particularly during the COVID-19 pandemic.

It’s important to note that defaulted issuers remain part of the JP Morgan EMBI Global Diversified Index. Their yields (used to measure carry) are reflected in the headline index yield. However, within investors’ portfolios, these entities do not provide any carry until they complete restructuring. As many of these default situations approach resolution, the actual carry in portfolios is expected to improve significantly.

Number of sovereign ratings actions, including outlooks

| Down | Up | % Upgrades |

1/1/20-3/4/20 | 10 | 7 | 41% |

3/4/00-YE2020 | 194 | 15 | 7% |

2021 | 57 | 58 | 50% |

2022 | 103 | 65 | 39% |

2023 | 61 | 78 | 56% |

2024 | 45 | 100 | 69% |

2025 YTD | 22 | 19 | 44% |

Source: BofA Global Research, Bloomberg. Note: Suriname, Belize, Ecuador and Argentina were upgraded after restructurings of debt.

Looking at corporates, default rates across EM high-yield bonds remain comparable to those in DM. This, combined with attractive yield levels, underscores the enduring appeal of EM debt for investors seeking to enhance their portfolios.

| EM Corp HY | EM Corp HY | EM Sovereign HY | US HY | European HY |

2008 | 2.00% | 2.00% | 2.00% | 6.30% | 2.40% |

2009 | 10.50% | 10.50% | 1.90% | 12.10% | 12.00% |

2010 | 1.60% | 1.60% | 1.40% | 1.30% | 2.20% |

2011 | 0.60% | 0.60% | 0.90% | 1.80% | 1.30% |

2012 | 3.50% | 3.50% | 0.20% | 1.40% | 0.80% |

2013 | 4.30% | 4.30% | 1.00% | 0.70% | 1.60% |

2014 | 3.80% | 3.80% | 11.30% | 3.00% | 0.90% |

2015 | 3.80% | 3.80% | 4.80% | 2.60% | 1.20% |

2016 | 5.10% | 5.10% | 0.00% | 4.30% | 2.50% |

2017 | 2.20% | 2.20% | 0.40% | 1.50% | 1.10% |

2018 | 1.60% | 0.00% | |||

2019 | 1.70% | 0.00% | |||

2020 | 3.50% | 3.50% | 21.20% | 6.80% | 3.10% |

2021 | 7.10% | 7.10% | 0.30% | 0.40% | 0.80% |

2022 | 14.00% | 10.00% | 10.80% | 1.60% | 0.40% |

2023 | 9.00% | 6.00% | 2.00% | 2.80% | 2.50% |

2024 | 3.50% | 4.00% | 0.00% | 1.50% | 3.30% |

Average | 4.70% | 4.70% | 3.50% | 3.80% | 2.60% |

Source: Amundi.

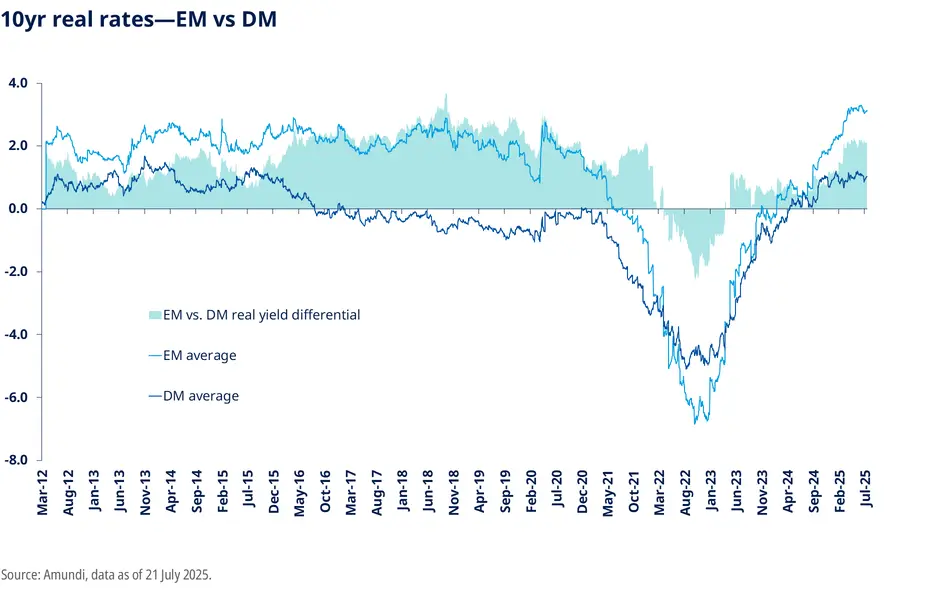

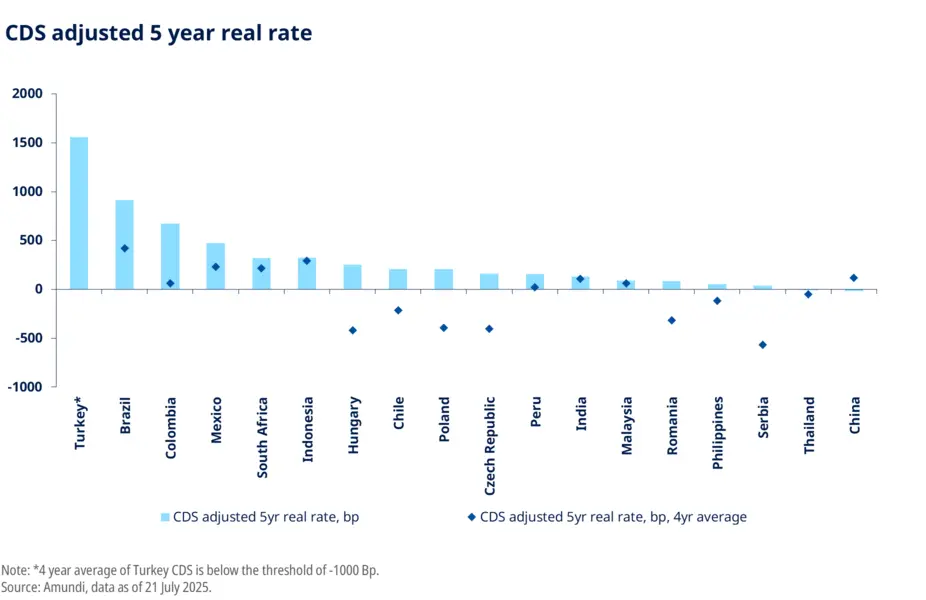

Real yields in EM local currency are at decade highs

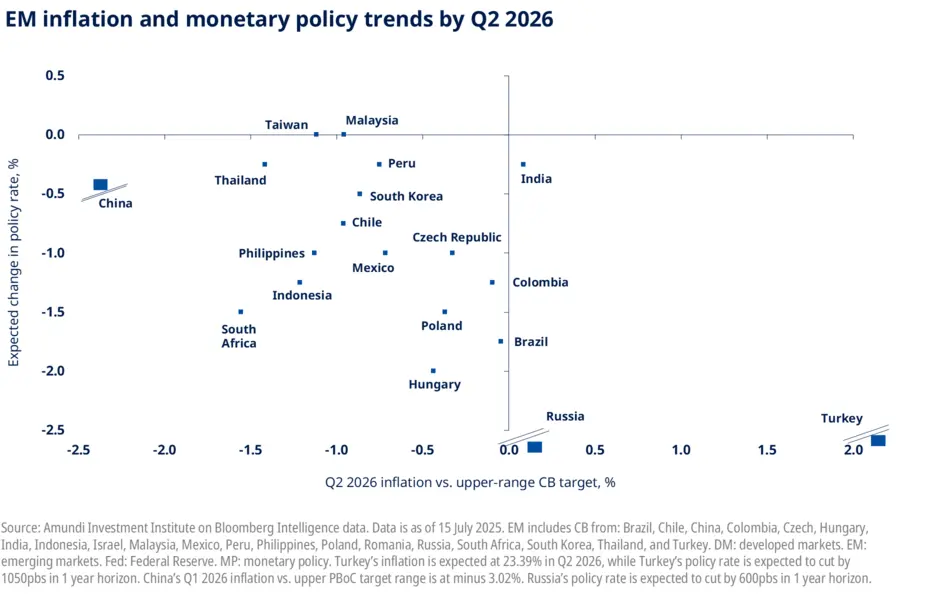

Real yields in EM local currency markets have reached decade high levels, creating a favorable environment for policymakers. The diminishing US growth exceptionalism, combined with the Federal Reserve’s monetary policy, has eased some of the constraints weighting on EM central banks.

For those EM central banks that acted early by raising interest rates, the significant inflation overshoot in recent years required a focus on stabilizing inflation, often at the expense of addressing growth challenges.

In contrast, for others, the relatively late start of the Fed’s easing cycle have brought some financial constraints, particularly on the foreign exchange front, limiting their policy flexibility. However, as these constraints ease, more central banks are expected to adopt a dovish stance and place greater emphasis on supporting growth.

The combination of elevated yields, robust fiscal metrics, and favorable macroeconomic conditions underscores the appeal of EMD, further enhanced by its growth edge over developed markets. Within this space, hard currency sovereigns offer compelling spreads, while EM credit provides access to some of the world’s fastest-growing companies.

Why Amundi for EMD?

Amundi’s approach to emerging markets debt is built on a foundation of strong expertise, and extensive resources, collectively providing a strong platform for navigating this dynamic asset class.

Over the past 20 years, Amundi has developed a deep expertise EM debt, supported by minimal turnover that ensures continuity and consistency in its investment strategies. This extensive experience is further bolstered by the presence of more than 80 investment professionals, whose strong presence in local markets provides access to specialized insights and granular analysis.

Beyond our experienced team, we maintain a collaborative structure that is central to our investment process. Close interaction between EM debt and equity teams encourages the exchange of ideas, enabling a comprehensive understanding of both macroeconomic trends and idiosyncratic factors. This integrated approach is enhanced by proprietary credit models and in-house tools, which facilitate precise risk monitoring and effective portfolio allocation.

Additionally, our expertise extends to distressed EM debt, where we leverage dedicated resources to identify and capitalize on opportunities among issuers facing financial challenges. By combining these capabilities with our research-driven philosophy, we are well-positioned to navigate the complexities of emerging markets.

Discover our solutions

Amundi Funds Emerging Markets Bond

Amundi Funds Asia Bond Income Responsible

Read the PDF version of this article

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 1 August 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 1 August 2025

Doc ID: 4708166