Key takeaways

- Europe’s economy is set to benefit from rising investments, particularly in defence and infrastructure

- European small and mid-cap stocks are trading at a rare discount to large caps, with higher earnings growth projected due to their exposure to cyclical sectors and domestic markets

- The European Central Bank’s easing trajectory could benefit small and mid-cap stocks, which have historically outperformed large-caps under similar monetary conditions

- Amundi’s local expertise in European small and mid-cap (SMIDs), supported by €1.7 billion in assets under management, allows us to identify high-growth opportunities and navigate market dynamics effectively

A growing number of investors are reallocating part of their equity exposure away from the US. This trend is expected to benefit Europe, evolving from a tactical adjustment into a more structural realignment, supported by rising investments in defence and infrastructure. Europe’s economy, with its significant weighting towards cyclical sectors like industrials and consumer discretionary, stands to benefit from this change. In light of the current downward trend in interest rates, at Amundi we believe small-cap stocks deserve careful consideration due to their potential for domestic revenue generation.

What makes small-caps a strategic opportunity today?

In our view, small and mid-cap (SMIDs) stocks in Europe represent an compelling investment opportunity today, for several reasons.

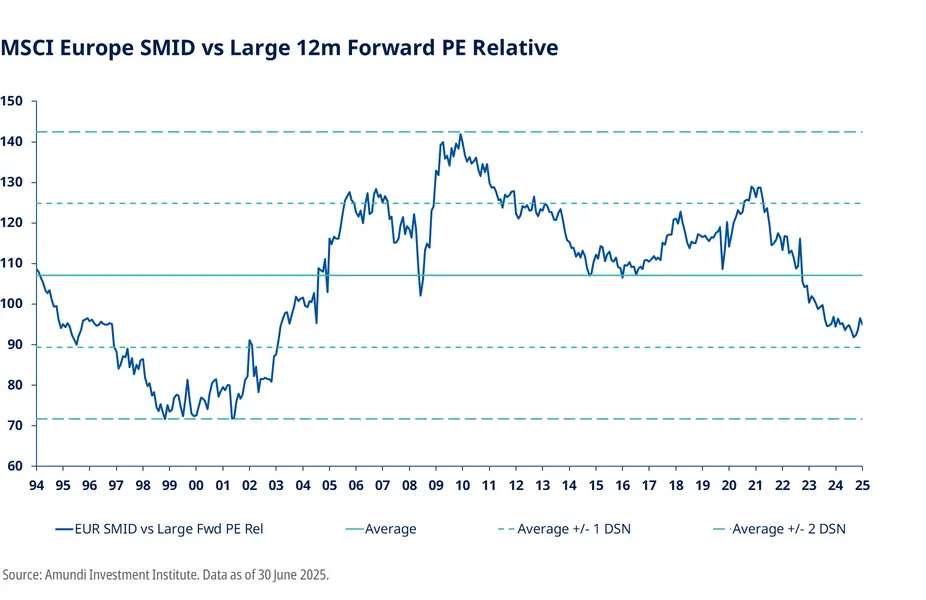

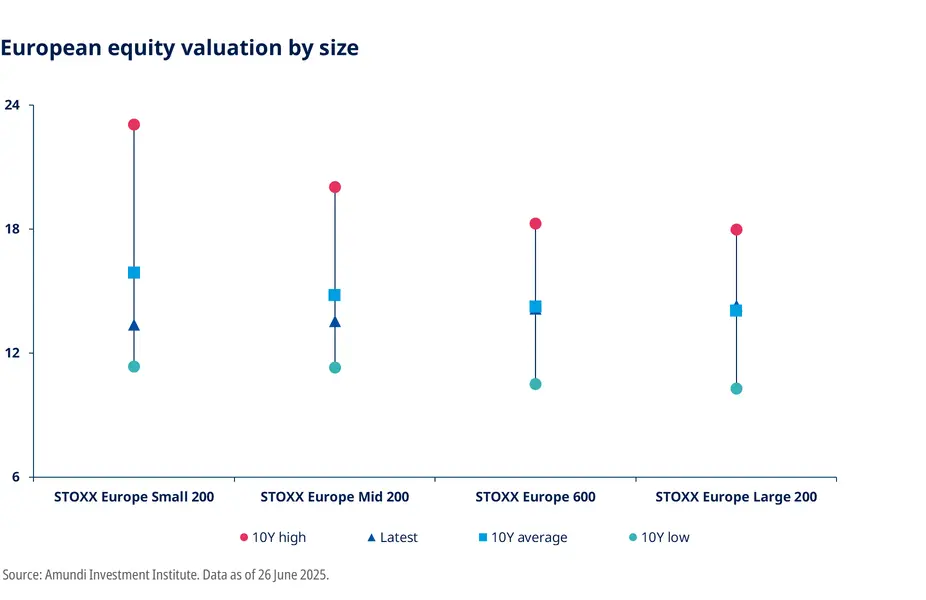

First, the valuation gap between small and large-caps is at its lowest point in 20 years. The MSCI Europe SMID Cap Index1 is currently trading at nearly a 10% discount on a 12-month forward price-to-earnings (P/E) basis compared to the MSCI Europe Large Cap Index2, which is a notable shift from its historical trend of trading at a 10% premium.

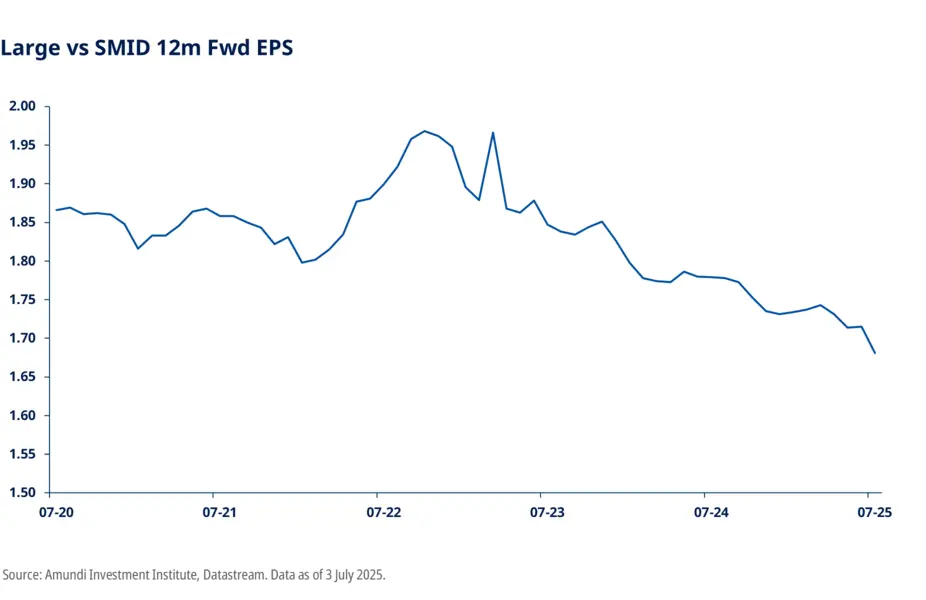

Secondly, the consensus forecast suggests that the portfolio-weighted forward 12-month earnings per share (EPS) growth for SMID stocks is expected to outpace that of large-cap stocks.

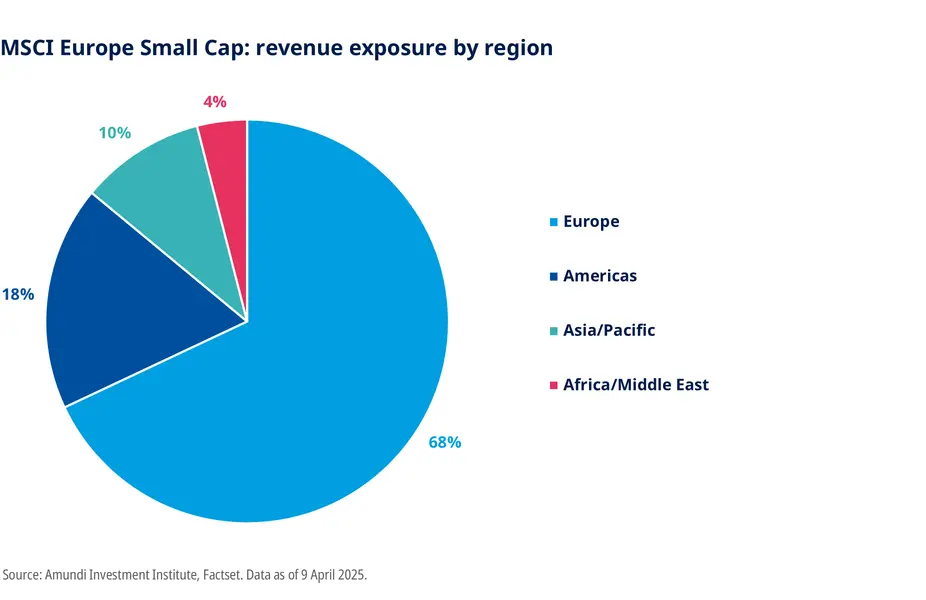

This higher expected EPS growth in the SMID segment reflects their greater exposure to cyclical sectors and domestic markets, which can help mitigate the impact of external factors, such as US policies and retaliatory measures from affected countries.

Additionally, cyclical sectors, such as industrials, consumer discretionary, and materials, typically experience stronger performance during periods of economic growth or recovery, as increased demand and business activity drive higher revenues and profitability.

MSCI Europe Small Cap: Sector Breakdown

Sector | Weight |

| Sector | Weight |

Real Estate | 6% |

| Industrials | 27% |

Health Care | 8% |

| Financials | 20% |

Communication Services | 6% |

| Consumer Discretionary | 10% |

Consumer Staples | 5% |

| Information Technology | 5% |

Utilities | 4% |

| Materials | 8% |

Defensive ≈ 30% | Energy | 3% | ||

|

|

| Cyclical ≈ 70% | |

Source: MSCI. Data as of 30 May 2025

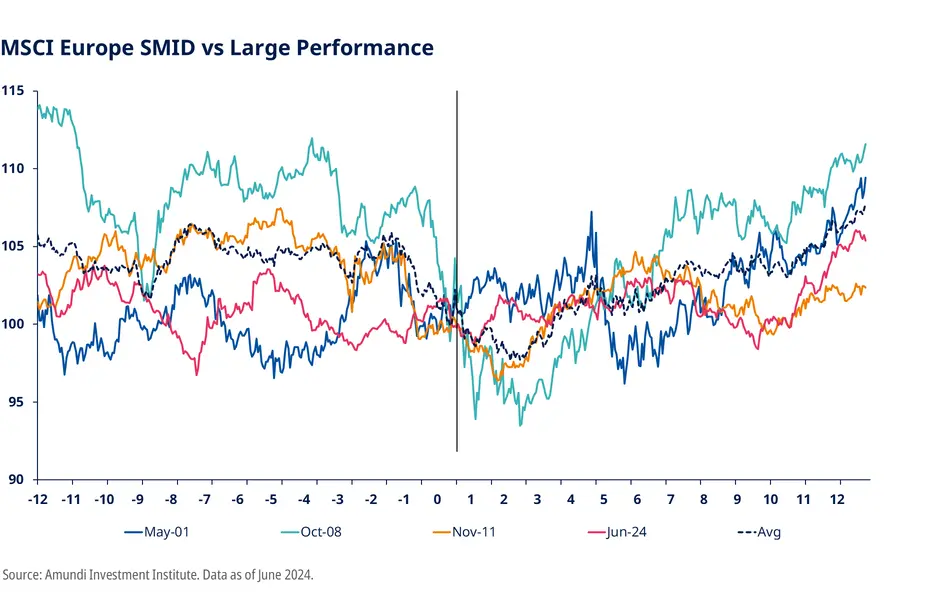

Finally, the European Central Bank (ECB)’s easing policy is expected to stimulate economic growth and improve market sentiment. Historically, small and mid-caps have outperformed large-caps in the 12 months following a rate cut, underscoring their cyclical nature and potential to rebound as economic activity in Europe accelerates.

An example of a success story:

One notable success story is an Italian luxury fashion brand specialising in menswear, womenswear, and accessories across Europe, North America, and East Asia. The company known for its no-logo policy and modern style, has consistently avoided fleeting fashion trends. We invested in the company when its market cap was around €2 billion, and have since witnessed its impressive growth to €7 billion. With no leverage and a conservative financial structure, the company stands as one of the most premium luxury names in the sector, justified by its good quality.

Our local presence provides us with deeper insights into the company and its operating environment, enabling direct access to management. This access is vital for our bottom-up investment approach, ensuring informed and strategic decision-making.

For illustrative purposes only. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services.

Why choose Amundi?

Small and mid-cap stocks offer valuable portfolio diversification by behaving differently from large-cap stocks across economic cycles. However, capitalizing on these opportunities requires rigorous stock selection, supported by an experienced team with strong research capabilities.

Amundi stands out as one of the largest asset managers in the European small and mid-cap sector, with €1.7 billion in assets3. Our investment professionals bring deep expertise across the entire spectrum of European small and mid-caps, bolstered by a local presence and specialisation in microcap4, small, and mid-cap companies. This local knowledge and experience help to:

- Access high-growth potential: microcap and small-cap companies often exhibit significant growth potential. By investing in early-stage firms, we position ourselves to benefit from their expansion and market capture, which can lead to substantial returns.

- Understand market dynamics: a thorough understanding of the challenges surrounding microcap and small to mid-cap companies allows us to make informed investment decisions. By assessing factors such as market trends, competitive landscapes, and operational hurdles, we ensure a comprehensive evaluation of potential investments.

Our country-specific management teams further enhance our capabilities. These teams provide precise insights into local companies, leveraging their proximity to the market to inform investment decisions. Our product range also includes funds exposed to single countries such as France, Germany, Austria, Spain, and Italy, ensuring tailored strategies for diverse markets.

Discover our fund

Amundi Funds European Equity Small Cap

1 The MSCI Europe SMID Cap Index captures mid and small cap representation across 15 Developed Markets countries in Europe.

2 The MSCI Europe Large Cap Index captures large cap representation across 15 Developed Markets (DM) countries in Europe.

3 Amundi, as of 30 April 2025.

4 Microcaps companies have a market capitalization of less than €150M at the time of investment.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 3 July 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 4 July 2025

Doc ID: 4629535