Key takeaways:

- Diversification1 remains essential, particularly as popular indices have become increasingly concentrated, exposing investors to greater risks from market corrections and missed opportunities in other regions or asset classes.

- Amundi’s Multi-Asset Income strategies are designed to provide a steady annual income through a carefully diversified portfolio that spans asset classes, geographies, industries, and risk premia.

- By combining the strengths of fundamental research with advanced quantitative models, Amundi’s integrated approach uncovers unique opportunities, delivering enhanced accuracy and consistent risk-adjusted returns across market cycles.

- Amundi's Multi-Asset investment team, based in Munich and Milan, brings an average of 22 years of experience and consists of dedicated portfolio managers specializing in all major asset classes.

The importance of diversification

Harry Markowitz, a Nobel laureate and the father of Modern Portfolio Theory, once remarked that diversification is a valuable principle in finance. While the idea of spreading investments across various assets is a fundamental concept taught in portfolio management courses, many investors still tend to maintain concentrated portfolios, often with significant exposure to a few US technology stocks.

Over the past three years, the remarkable growth of the Magnificent Seven2 has significantly boosted the US stock market. The market-weighted S&P500 Index has cumulatively outperformed its equally weighted version by 37.65%, highlighting the magnitude of Magnificent Seven’s spectacular rise versus the broader market3. The flipside of this performance is the fact that S&P500 is now a very top-heavy, highly concentrated index. According to LSEG Datastream, the Magnificent Seven now account for one-third of the total index weight4.

Chart 1: Over the last three years, the Market-weighted S&P 500 has materially outperformed its equally-weighted counterpart due to the spectacular rise of the Magnificent Seven.

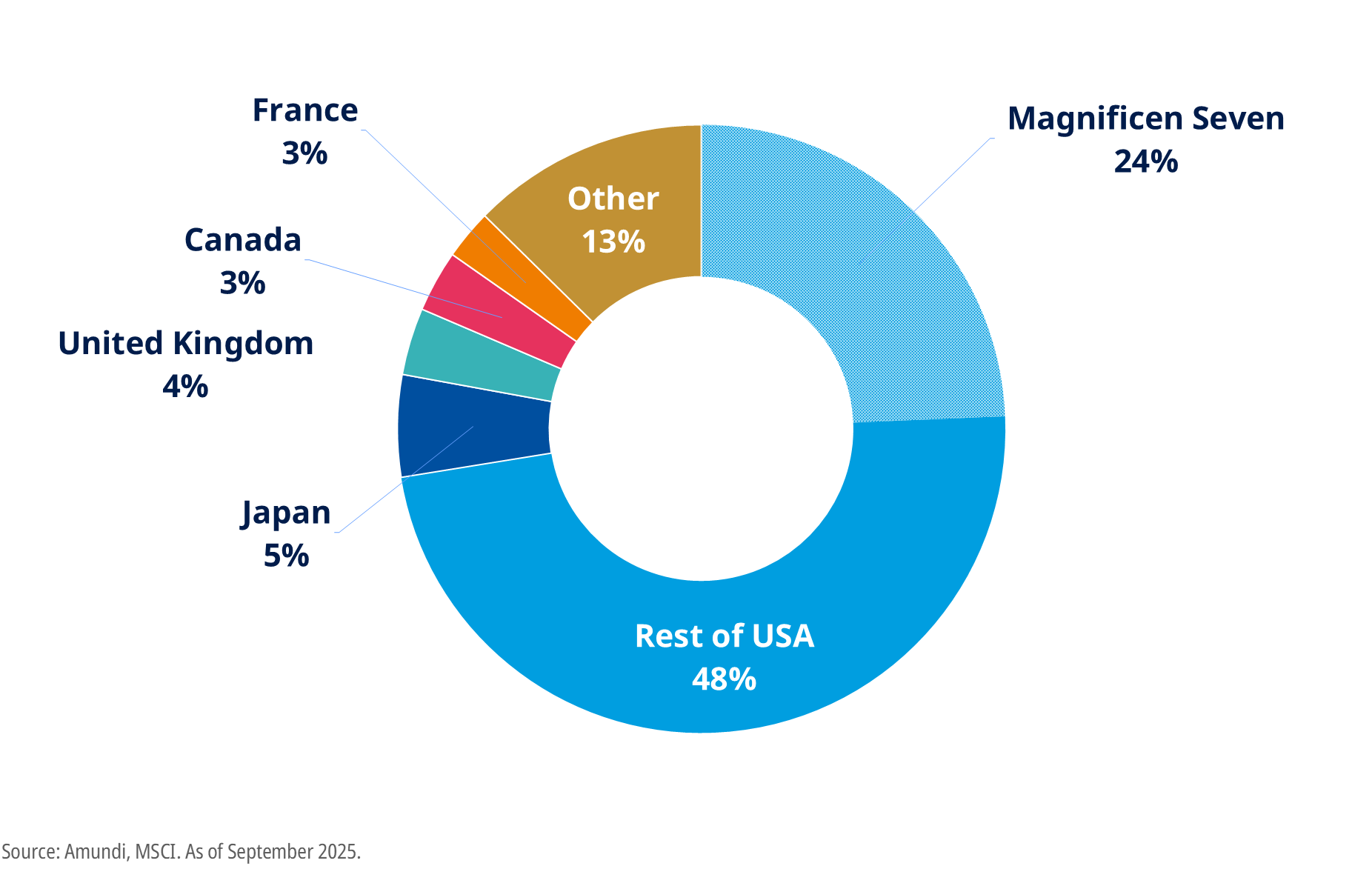

The MSCI World Index, that should offer improved diversification compared to US-centric indices such as the S&P 500, appears to also have limited effectiveness in achieving this objective. While on paper, the index is comprised of more than 1,300 issuers from 23 countries, in practice its exposure to US stocks is over 70% and the Magnificent Seven make up roughly one-fifth of the total index weight5.

Chart 2: MSCI World Index - USA comprises more than 70% of the index market weight. With a market weight of almost 23%, the Magnificent Seven represent more roughly one quarter of the index.

These developments wouldn’t be concerning if S&P500 and MSCI World weren’t as broadly used by the investment community as they actually are. According to data from S&P Dow Jones, at least $5.3 trillion of institutional assets are benchmarked to the S&P500 index6. Retail investors are equally exposed7.

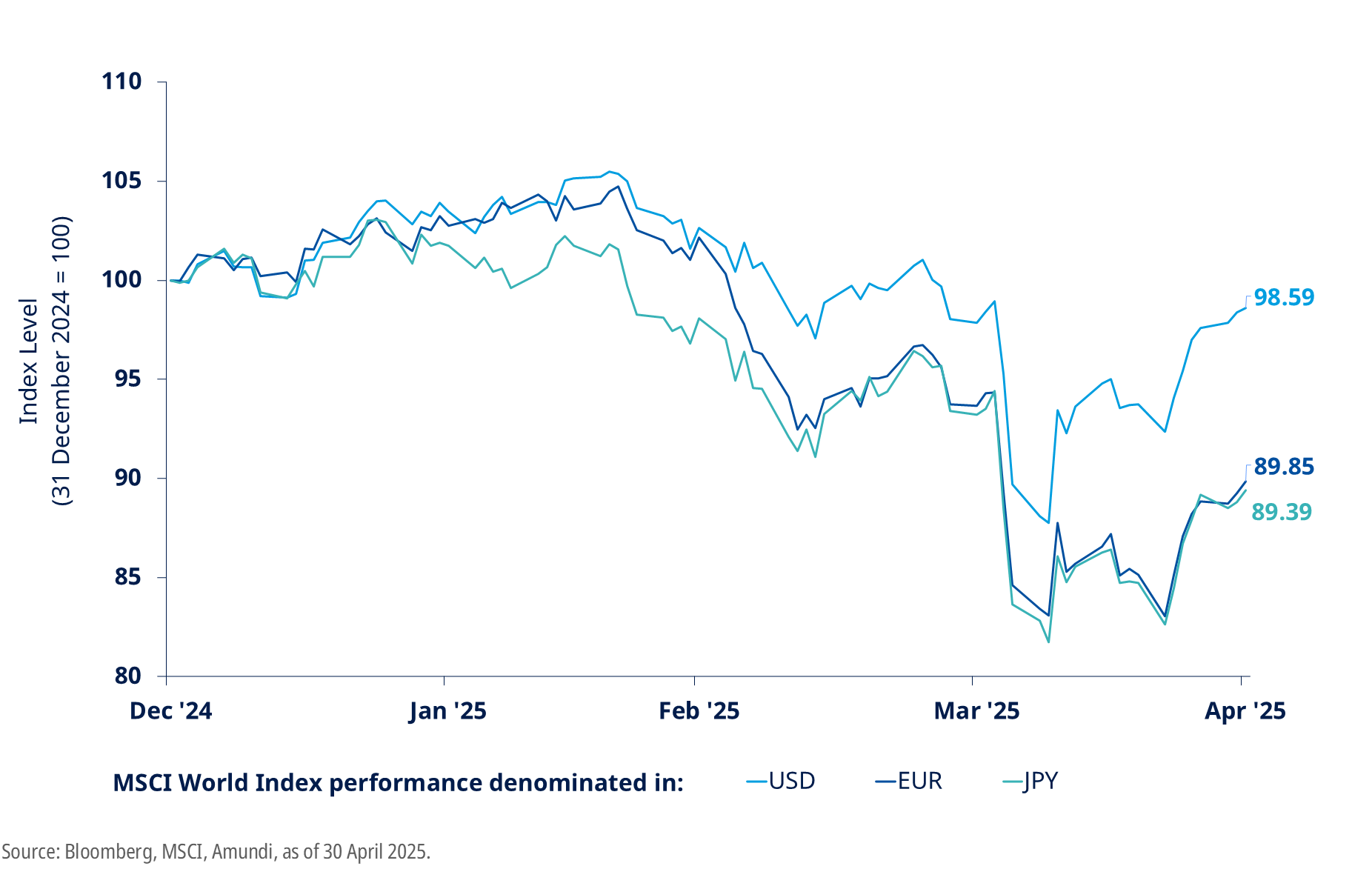

The challenges of this approach became evident in early 2025. Rising policy uncertainty in the US triggered a correction in the US equity market and a concurrent decline in the US Dollar. Consequently, between the end of December 2024 and end of April 2025, EUR-based MSCI World investors experienced a loss of nearly 10%, with Asia-based investors facing similar declines (e.g. MSCI World -10.61% in JPY terms). During this period, while US stocks and the US Dollar were decreasing in value, European equities rallied along with the Euro and select currencies such as the Japanese Yen, which appreciated against the US Dollar8.

Chart 3: Non-US investors holding currency unhedged positions in the MSCI World Index saw their losses magnified by the US Dollar, which depreciated against currencies like the Euro and Japanese Yen in early 20259

This episode, while short and challenging, underscored the importance of diversification in investment strategies. It also highlighted that many investors may benefit from considering a broader range of assets to enhance their portfolios.

Enter Amundi’s Multi-Asset Income strategies

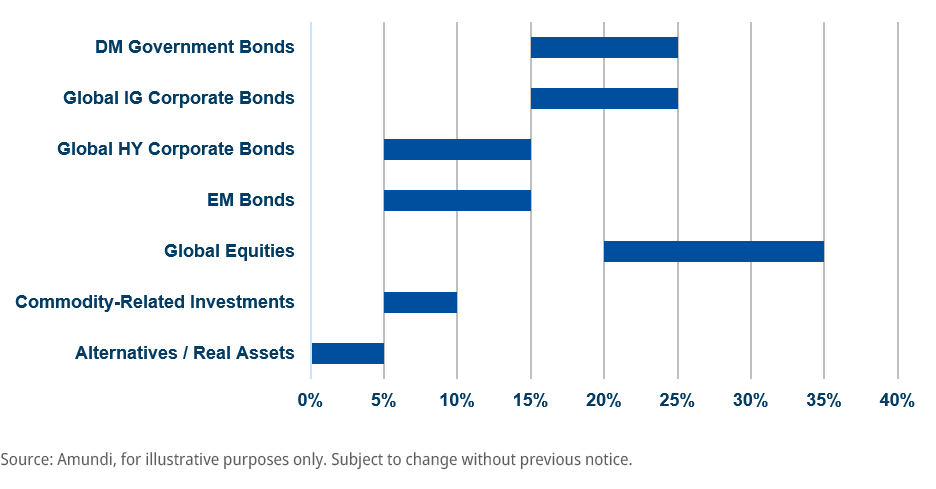

At Amundi, we strongly advocate for the advantages of diversification. Our strategies aim to deliver a competitive level of annual income to our investors, ranging from 4.0 to 6.5 percent in 2025, while also offering broad exposure to various asset classes, geographies, industries, and risk premia.

Our investment team, based in Munich and Milan, brings an average of 22 years of experience and consists of dedicated portfolio managers specializing in all major asset classes. Each member contributes uniquely to our disciplined investment process. As a result, our Multi-Asset portfolios provide a comprehensive level of diversification, exhibiting a mixture of traditional risk premia - such as interest rate, credit, currency, equity, and commodity risks – with non-traditional ones such as momentum, carry, value, and volatility.

Providing a high degree of diversification is a central feature of our investment approach, guiding every step of the process and shaping our strategic and tactical decisions across asset allocation, asset classes, markets, positions, and traded instruments.

Chart 4: Amundi’s Multi-Asset Income Strategies - typical allocation ranges across a wide variety of asset classes offering a high degree of diversification

Combining diversification with cutting-edge active management

Combining diversification with active portfolio management is key to unlocking the full potential of a Multi‑Asset portfolio.

Beyond prioritizing the broadest level of diversification for our clients, we firmly believe that combining diversification with active portfolio management is key to unlocking the full potential of a Multi-Asset portfolio.

Our strong conviction is based on the fact that financial markets’ efficiency varies over time. Market shocks, such as the Covid-induced sell-off in March 2020, can lead to inefficiencies in the markets, creating opportunities for active management to seek alpha and achieve favourable risk-adjusted returns. Similarly, the wide range of markets we invest in are not all created equally. Some, like large-cap US equities, tend to be rather efficient. Others, like emerging market local currency debt, face structural complexities, which provides ripe opportunities for active portfolio management to outperform index-replication methods.

Amundi’s Multi-Asset Income team tackles these challenges and opportunities by leveraging the vast resources available at a leading global investment firm. Integrated within the broader Multi-Asset platform and as such benefiting from the insights and trade ideas of 60+ portfolio managers in 6 different investment hubs, 25+ macro and sovereign research analysts centralized in Amundi Investment Institute10, 60+ fundamental equity and credit research analysts, and a team of Quantitative Researchers analyzing risk exposures using state-of-the-art proprietary technology11.

But we don’t stop here. We combine Amundi’s global Multi-Asset investment process with local competence and unique investment capabilities. Over the last 3 years, our team has developed a security selection approach that integrates both traditional fundamental analysis and advanced quantitative techniques, applying it to asset classes such as emerging markets debt and volatility risk premium harvesting.

What is this integrated selection approach all about?

Over the last 3 years, our team has pioneered an integrated selection approach and applied it to asset classes such as Emerging Markets debt.

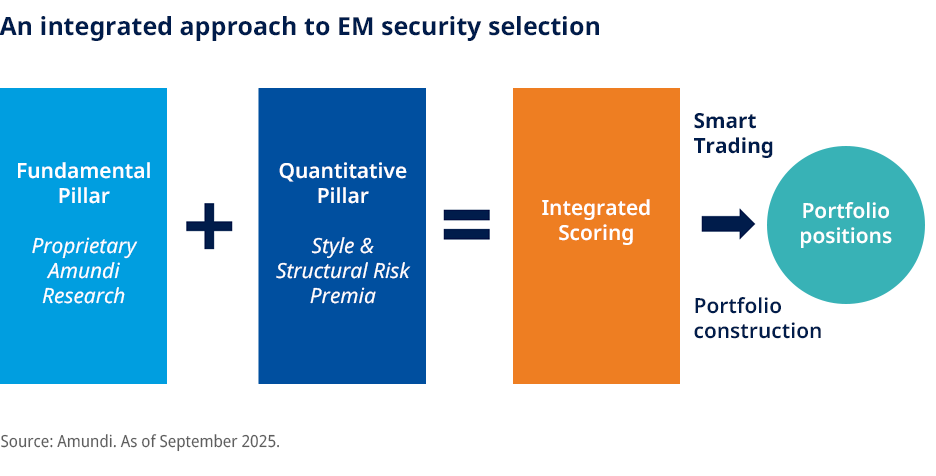

Our integrated selection approach merges insights from conventional fundamental research with signals derived from quantitative analytical models. We apply this approach to asset classes such as emerging markets debt and volatility risk premium harvesting, where the level of inefficiencies could provide rich opportunities to earn alpha. To illustrate our approach, we take Emerging Markets (EM) debt as an example below.

The first pillar of our EM debt security selection process relies on traditional fundamental analysis. Here, we leverage the strengths of Amundi’s global investment platform, including proprietary research from Amundi’s Investment Institute and the expertise of Amundi’s global credit research team, which covers Investment Grade and High Yield EM corporate issuers across Asia, CEEMEA12, and Latin America. This is complemented by the fundamental views and preferences of our dedicated EM debt portfolio manager, who holds ultimate responsibility for EM debt selection in our Multi-Asset Income portfolios.

Alongside this fundamental pillar, we run a second quantitative pillar which itself produces independent investment signals. The quantitative pillar is based on a number of proprietary models designed to capture well-known and researched alternative risk premia such as momentum, carry, and value. Currently, we apply these models cross-sectionally and use them as an information source to over- or underweight specific issuers across the EM universe.

In the final step, the fundamental and quantitative pillars are combined to generate a unified signal for each issuer in the EM debt investment universe. This integrated approach aims to enhance risk-adjusted exposure to specific EM debt issuers by leveraging the combined strength of both analytical perspectives.

Research has shown that combining fundamental and quantitative signals enhances forecasting accuracy. Studies have shown that applying an integrated approach to credit markets can increase the success rate of investment recommendations from ~58% (purely fundamentally-driven calls) to ~66% (quantamentally-driven calls) – a significant improvement when applied on a large enough scale13. Our experience with implementing this approach shows similarly strong results with an after-cost Information Ratio14 > 1.0 realized over a period of 3+ years and, more importantly, through phases of both bull and bear markets, including the most recent sell-off in April 202515.

The explanation for this phenomenon is quite intuitive – because the fundamental and quantitative signals are not perfectly correlated, mixing them together improves the predicting value of the combined signal. This act of diversifying investment signals highlights both the advantages of diversification and the Multi-Asset Income Team’s commitment to delivering these benefits to clients.

The time is right for Amundi’s Multi-Asset capital

The range of Multi‑Asset Income solutions is well‑positioned to help a broad spectrum of investors enhance their portfolios."

Passive index-replicating strategies have become a common choice for many investors, both institutional and retail16. We recognize the benefits of this type of strategies, as they offer low-cost beta exposure to efficient markets like US equities.

However, the concentration in global equity indices may expose many investors to risks associated with potential corrections in a few stocks. As a consequence, we believe that considering including active strategies, such as Amundi’s Multi-Asset solutions, into investment portfolios can provide an extra layer of diversification and the potential to generate additional alpha from market inefficiencies.

Amundi’s Multi-Asset Income team offers investment solutions which not only provide a high-level of income through regular dividend distributions, but does so by harnessing Amundi’s global investment platform and complementing it with cutting-edge innovations in integrating fundamental and quantitative investment techniques. With the expertise of the team and the strength of the investment process, the range of Multi-Asset Income solutions is well-positioned to help a broad spectrum of investors enhance their portfolios.

Discover Amundi's income solutions

Amundi Funds Euro Multi-Asset Target Income

Amundi Funds Global Multi-Asset Target Income

Amundi Funds Real Assets Target Income

1 Diversification does not guarantee a profit or protect against a loss.

2 The term “Magnificent Seven” refers to the following companies-Apple, Microsoft, Amazon, Meta, Nvidia, and Tesla.

3 Cumulative returns for the 3year period between 30 September 2022 and 30 September 2025. Source: Own calculation, Bloomberg, S&P. The S&P 500 and S&P 500 Equal Weighted indices are provided for illustrative purposes only. These indices are not the benchmarks of the Sub-Fund and do not represent the holdings of the Sub-Fund. It is not meant as a direct comparison in terms of fund performance and no reliance should be placed on it in this respect. Past performance is not indicative of future results.

5 Source: MSCI, as of 30 September 2025.

6 Source: S&P Dow Jones Indices Annual Survey of Assets. Institutional assets are considered to be non-exchange traded products including mutual funds, institutional funds, separately managed accounts and insurance products. Institutional assets invested in exchange-trades products such as ETFs are not considered in this estimate. As of 31 December 2023.

7 Source: Amundi, MSCI, Bloomberg, as of 30 April 2025. Our calculations show that European-listed MSCI World ETFs alone have a total AuM of ~$590 billion. We assume that the majority of these assets are held by retails investors.

8 US equities are proxied by the MSCI USA Gross Total Return Index (Bloomberg Ticker: M2US). European equities are proxied by the MSCI Europe Index (Bloomberg Ticker: MXEU). For the period 31 December 2024 – 30 April 2025, the MSCI USA Gross Total Return Index lost 3.01% (in USD terms) while the MSCI Europe Index gained 7.20% (Total Return, in EUR terms). For the same period, the U.S. Dollar lost 8.61% against the Euro and 8.99% against the Japanese yen. Source: Bloomberg. As of 30 April 2025.

9 Source: Bloomberg, Amundi, as of 30 April 2025.

10 The Amundi Investment Institute produces analysis on economic and market developments, including their implications for investors. It leverages on the expertise of nearly 60 dedicated professionals across 11 specialised teams in 3 broad business lines.

11 Number of portfolio managers and research analysts as of 30 June 2025.

12 Central and Eastern Europe, the Middle East, and Africa.

13 Source: Better Together: Fundamental and Systematic Views in Credit Investing, 9 July 2024, QPS & Credit Research, Barclays.

14 The Information Ratio quantifies the excess return of an investment portfolio over a benchmark, adjusted for the risk taken to achieve that return.

15 Source: Amundi, as 30 September 2025.

16 According to State Streets 2024 ETF Impact Survey, 45% of individual and 67% of institutional investors have ETFs in their investment portfolios or use ETFs in their investment strategies. Source: State Street Global Advisors.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 10 October 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 10 October 2025

Doc ID: 4703281