Summary

In a nutshell

-

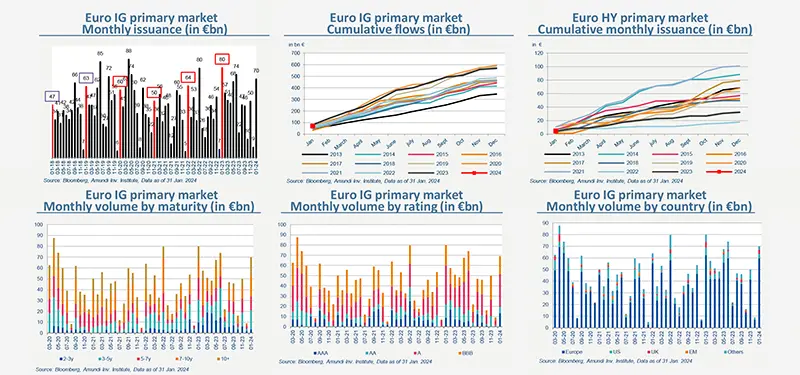

In January, the euro primary market is recording historically high activity, after a rather calm month of December Also note more volume on long maturities

-

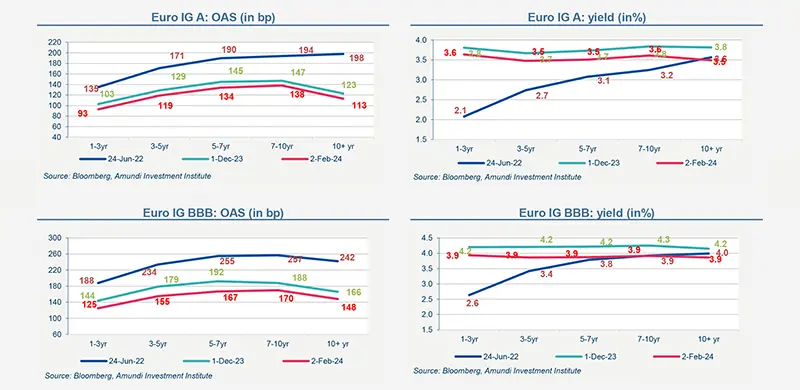

Investor appetite for rate products remains strong. Investors want to capture current yields before the expected drop in 2024 Indeed, the market anticipates that the ECB will lower its rates from April and by a total of 150 bp this year These expectations were reinforced during its last ECB monetary policy committee Christine Lagarde confirmed that “the disinflation process is at work” and expects “inflation to ease further in 2024”.

-

Credit spreads continue to tighten despite the recorded amounts of new issues. The market absorbs the flow of issues on the euro primary So far, the secondary market does not appear to be affected.

Primary market Investment Grade

Market data

Find out about our treasury offer