Summary

In a nutshell

-

Economic activity in the euro zone remains weak but showed signs of recovery last month in the services sector. Indeed, the purchasing power of households benefits the economy from the increase in real income reduction in inflation and increase in wages The strength of the labor market continues to support the economy.

-

The ECB is expected to start cutting rates in June. The ECB seems more confident about the continuation of the disinflation process However, Christine Lagarde reiterated the call for patience in matters of monetary policy The ECB remains cautious about the pace of disinflation, particularly in the services sector, and will continue to monitor developments in the labor market, which has shown great resilience Strong wage growth and low productivity have led to a sharp increase in unit labor costs.

-

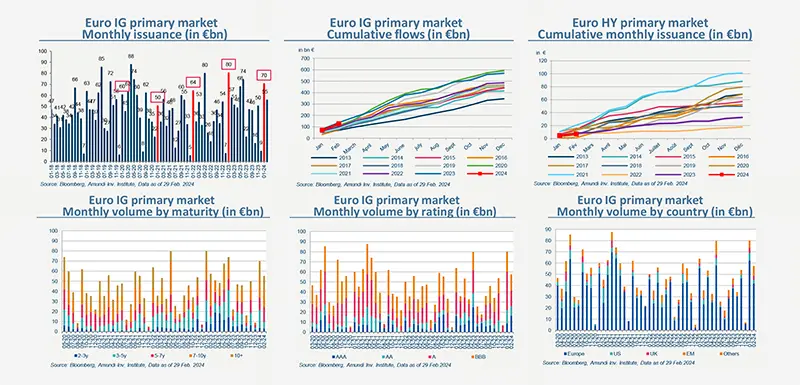

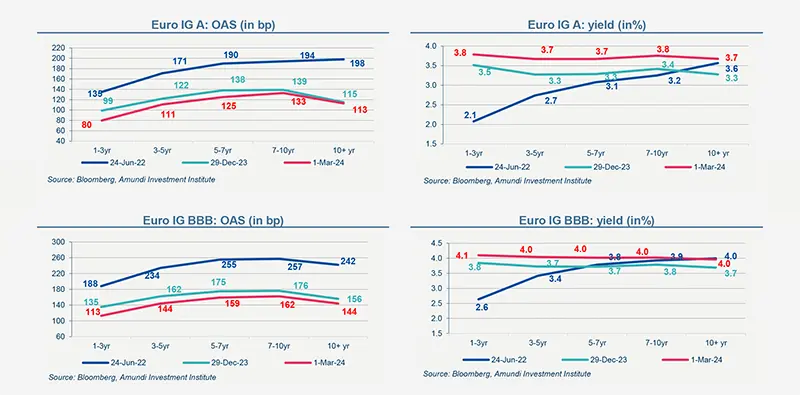

Corporate debt markets continue to perform in this context of resilient growth and anticipation of rate cuts Activity on the primary market remains strong and investor demand remains strong

Primary market Investment Grade

Market data

Find out about our treasury offer