Summary

Highlights

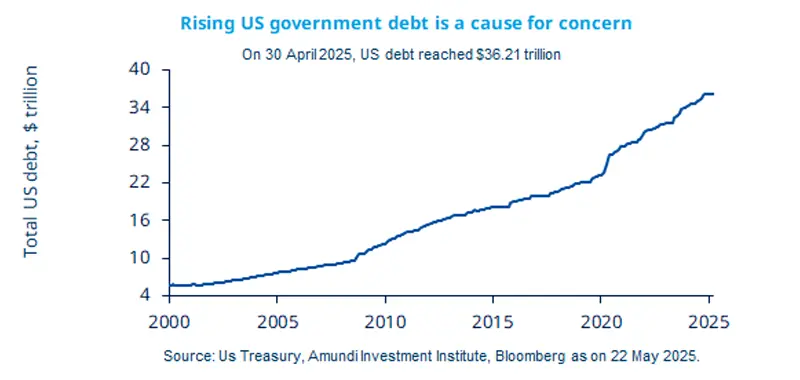

The US government lost their top-notch AAA rating on their long-term issuer debt recently, from Moody’s Ratings.

The debt trajectory is in focus after the House approved the tax and spending bill, which is now moving to the Senate.

- While US government bonds remain key, financial and policy issues are leading to higher volatility.

In this edition

Moody’s Ratings recently downgraded the US government’s credit rating by one notch from AAA (the highest possible score from the company) to Aa1. Rising government debt and interest costs, a high fiscal deficit (excess of expenditure over revenues), and government inaction to address these issues are the main reasons behind this move. The recent approval of President Trump’s tax and spending bill in the House could negatively affect government finances. It is still pending Senate approval, but it has caused alarm in financial markets, with yields on the 30-year Treasuries recently crossing the 5.0% level. Increased volatility in the US market may enhance the appeal of other markets, such as the European bond market, to global investors.Moody’s Ratings recently downgraded the US government’s credit rating by one notch from AAA (the highest possible score from the company) to Aa1. Rising government debt and interest costs, a high fiscal deficit (excess of expenditure over revenues), and government inaction to address these issues are the main reasons behind this move. The recent approval of President Trump’s tax and spending bill in the House could negatively affect government finances. It is still pending Senate approval, but it has caused alarm in financial markets, with yields on the 30-year Treasuries recently crossing the 5.0% level. Increased volatility in the US market may enhance the appeal of other markets, such as the European bond market, to global investors.

Key dates

28 May FOMC minutes, ECB inflation expectations | 29 May Bank of Korea policy, US GDP |

US personal consumption expenditure, German CPI, Brazil and India GDP |

*Diversification does not guarantee a profit or protect against a loss.

Read more