In a landscape marked by geopolitical uncertainty, evolving interest rate trends, and renewed volatility, at Amundi we maintain a constructive outlook on the European credit market. We believe that 2025 could be a promising year for this asset class, driven by strong corporate fundamentals and still attractive spreads.

We see attractive opportunities in European credit due to its stability and risk-adjusted returns, especially in Spain and Germany

Compelling prospects for credit markets, despite volatility

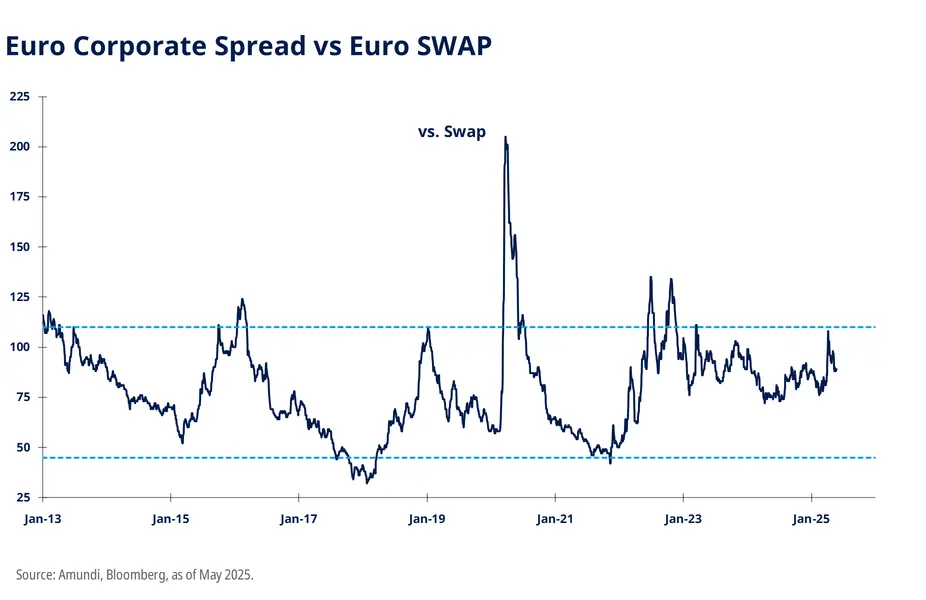

The current market environment is generally positive for credit, as several factors support our optimistic view. Many companies are adopting more conservative stances, such as fewer mergers and acquisitions, reduced cash expenditures, and less aggressive growth targets. These actions contribute to healthier financial conditions for issuers, benefitting credit investors. Additionally, market premiums remain attractive, providing reasonable compensation for the associated risks. Although uncertainty and volatility will remain—with new sources of tension emerging periodically—the current context suggests that risks are being adequately rewarded. Consequently, we maintain a constructive view on credit. Further spread compression might occur in the coming months, but the risk-return balance remains favorable, reinforcing an optimistic outlook for 2025.

Extensive opportunities in banking and financials

There is optimism regarding the banking and financial sectors. Recent performance in Europe indicates that all banks have increased profits. The sector demonstrates strong fundamentals and is relatively less exposed to tariffs in the event of an economic deterioration. Therefore, bank credit is currently viewed as a good investment option, with subordinated debt being particularly noteworthy.

We see value in AT11 and Tier 22 bonds, which provide exposure to investment-grade-rated issuers. These issuers are primarily European banks with solid fundamentals and still-attractive spreads. We also find opportunities in subordinated industrial corporate debt through hybrid bonds, which continue to offer high spreads. We favor high-quality industrial issuers with solid financial profiles, offering additional premiums due to the subordinated structure.

Overall, we believe the subordination premium remains attractive. In terms of both returns and issuer quality, this segment offers a balanced risk-return mix.

Growing traction in real estate and automotive

Traditionally highly correlated with interest rates, senior-focused real estate—often referred to as silver real estate—stands to benefit from the current scenario. The ECB’s easing policy has helped the real estate market recover from the lows experienced in 2022, and the sector has performed well recently. We continue to see potential in this space—especially since spreads remain wide and we believe there is still room for improvement from a fundamentals perspective. Additionally, if Germany follows through on its infrastructure investment plan, real estate could benefit indirectly from the associated industrial momentum.

The automotive sector is also regaining attention. Previously, a mix of factors suggested caution due to intense competition, high electrification costs with still-low electric vehicle (EV) sales, regulatory pressure in Europe, and tariff risks. The sector has shown signs of stress, but now some issuers have seen a sharp widening of spreads, making the risk more adequately compensated. As a result, we see opportunities in selected issuers that have been heavily affected and are now offering very attractive spreads. However, the recovery of the auto sector is expected to be slow, and a cautious approach is needed.

Why Amundi for European credit

Amundi stands out as a leader in the Euro Credit space since 1999, managing approximately €50 billion in assets3. Our seasoned investment team comprises 12 portfolio managers, with 8 focused on the Euro Investment Grade and 4 dedicated to the Euro High Yield segment3.

Our investment philosophy aims to deliver consistent returns, by adeptly navigating credit cycles and capitalizing on market inefficiencies. Our management style embodies a dynamic approach, integrating a balanced mix of top-down and bottom-up views.

Discover our European credit solutions

Amundi Funds Euro Subordinated Bond Responsible

Amundi S.F. - Diversified Short-term Bond Select

Amundi Funds Euro Corporate Bond Select

Discover other articles on this topic

Is it time to consider European Small and Midcaps?

What’s next for Europe and the world: Recent market developments

Time for Europe: The rising opportunities in bonds and equities

Tap into Europe’s future growth

1 AT1 (Additional Tier 1) bonds: type of subordinated debt issued by banks as part of their regulatory capital requirements. They are perpetual. Due to their higher risk profile, AT1 bonds typically offer higher yields compared to other types of bank debt.

2 Tier 2 bonds: form of subordinated debt issued by banks to bolster their regulatory capital. Unlike AT1 bonds, Tier 2 bonds have a fixed maturity date and rank senior to AT1 bonds but junior to senior debt.

3 Source: Amundi, as of 30 April 2025.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 4 June 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 4 June 2025

Doc ID: 4533341