Key takeaways

- Emerging markets debt (EMD) offers elevated yields and attractive fundamentals, making the asset class a valuable addition to a diversified portfolios.

- Emerging Market (EM) have grown significantly in global importance, now providing investment opportunities across a broad range of countries and asset types.

- With over 20 years of active management experience and more than 80 investment professionals, Amundi distinguishes itself through the stability and experience of its emerging market platform.

Emerging markets debt: a catalyst for portfolio growth

Emerging markets debt, despite its strong underlying fundamentals and historical performance, has often been overlooked and remains under-allocated in investor portfolios. In the current environment, where developed market (DM) central banks are on an easing trajectory1, the process of lowering interest rates is generally viewed as a positive catalyst for the emerging market asset class. This shift in monetary policy may encourage a reallocation of capital from cash funds into EM bond funds.

A key driver supporting EMD is the significant growth contribution of emerging markets over the past few decades. While EM accounted for only 25% of global GDP several years ago, its share has now risen to approximately 70%, underscoring its increasing importance in the global economy. The EMD market has also expanded2 and diversified significantly, with the number of investible countries growing from just eight in the mid-1990s to over 100 today.

In addition to its growth potential, the fundamentals of EM differ markedly from those of DM. EM countries generally exhibit lower debt-to-GDP ratios compared to DM, while maintaining strong fiscal and current account metrics. EMD also offers an attractive yield premium relative to DM bonds. Its lower correlation with global bonds, combined with higher exposure to growth factors, can provide meaningful diversification benefits for investors.

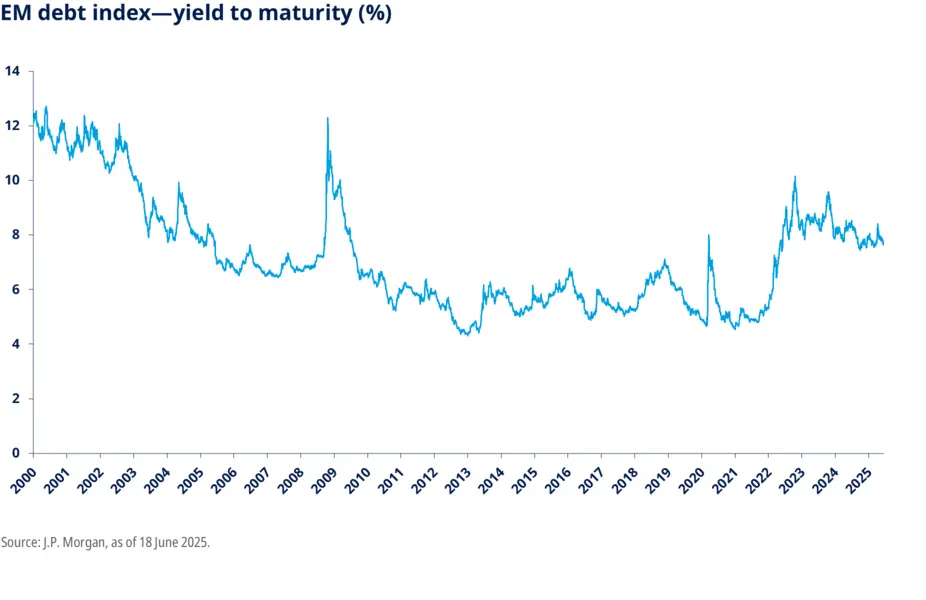

Another defining feature of EMD is its heterogeneity, offering a broad spectrum of investment opportunities across countries at varying stages of development. Several large EM countries have implemented reforms over many years and now hold investment grade ratings, while middle income3 and frontier markets4 continue to progress. Over time, the risk premia associated with EMD have transitioned from a more volatile phase in the 1990s to a lower volatility regime since the mid-2000s, reflecting the maturing and evolution of the asset class.

Emerging markets debt offers diversification and unique conditions

| Hard currency sovereign | Hard currency corporate | Local currency sovereign |

Number of countries | 69 | 65 | 19 |

Market Cap. | $1.13 tn | $1.13 tn | $5.62 tn |

Average Rating | BBB- | BBB- | BBB+ |

Yield | 7.8% | 6.9% | 6.1% |

Duration | 6.4 years | 4.1 years | 5.3 years |

Source: J.P. Morgan, as of 31 May 2025.

Hard currency | Local currency | |

Driver of returns | US Treasury yields and additional credit spreads that reflect individual country risk characteristics. Spreads reflect an assessment of the creditworthiness of the borrower. | Local factors that driving each country’s domestic yield curve. Individual local currency movements relative to developed markets. |

Global financial conditions | Direction of US Treasury Market. | While not immune, they have a lower sensitivity to global financial conditions. |

Ownership | Held by global investors and is priced in terms of the spread to benchmark yield curve. | Predominantly held by local investors. |

Source: Amundi, as of 31 May 2025.

From a portfolio perspective, EMD has demonstrated its contribution in improving the Sharpe ratio of an efficient portfolio. Over the past two decades, EM hard currency sovereign credit, EM hard currency corporate credit, and FX-hedged EM local bonds have all exhibited high Sharpe ratios compared to other major asset classes5.

Income, often referred to as "carry," plays a central role in driving total returns within EM hard currency debt. This substantial income cushion provides protection against active risk factors such as spread and duration, while representing a stable source of future cash flows.

Yield to Maturity (%) for EM hard currency fixed income over the last 25 years

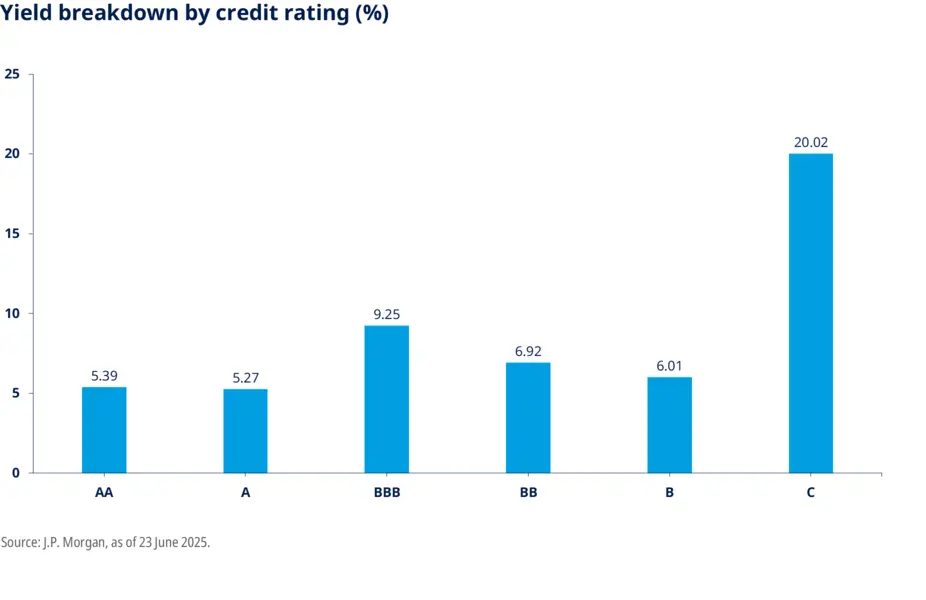

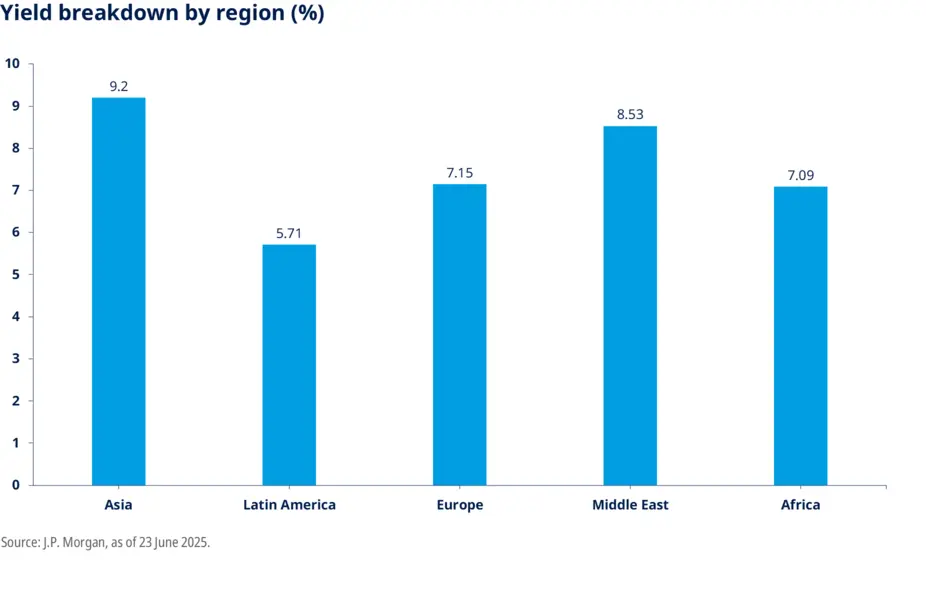

More than 75% of the EM hard currency investment universe, spanning over 70 countries, currently offers yields exceeding 6%. While these levels are attractive, selectivity remains essential. At Amundi, we prefer countries that are less affected by tariffs and/or benefit from improving fundamentals. Currently, we favour regions such as Latin America and EM Europe due to their resilience to external pressures and improving fundamentals. We also target Sub-Saharan African countries with stronger macro fundamentals and attractive valuations. Conversely, we see fewer opportunities in Asia due to tighter spreads.

From a rating perspective, we find more value in select high-yield countries compared to their investment-grade counterparts, with potential for spread compression in specific high-yield markets.

Why Amundi for EMD?

Amundi’s approach to EMD is built on a foundation of expertise, and comprehensive resources. With over 20 years of active management experience, the team has ensured continuity and a deep understanding of the asset class. The EM platform comprises more than 80 investment professionals, supported by a strong local market presence. This local footprint enables portfolio managers to access specialized insights and in-depth analysis.

Furthermore, Amundi’s collaborative structure fosters close interaction between EM debt and equity teams, encouraging the exchange of ideas on macroeconomic and idiosyncratic factors. Proprietary credit models and in-house tools enhance the investment process, allowing for effective risk monitoring and allocation. Amundi’s expertise in distressed EM debt adds another dimension, enabling the firm to identify and optimize risk-adjusted returns from issuers in distress or default.

Discover our solutions

Amundi Funds Emerging Markets Bond

Amundi Funds Asia Bond Income Responsible

Read the PDF version of this article

Continue reading on this topic

Resilience and opportunities in emerging markets

1 Amundi expect both the ECB and the Fed to cut policy rates over 2025 and 2026.

2 Source: JP Morgan EPFR, as of 30 October 2024. Current estimated size has reached ~$28.5 trillion. For fixed income, this includes ~$12.9 trillion in EM Local Currency Government bonds, ~$2.5 trillion in EM Hard Currency Corporate bonds, and ~$1.5 trillion in EM Hard Currency Government bonds.

3 Middle income markets refer to countries with per capita income levels between low-income and high-income thresholds, as defined by the World Bank.

4 Frontier markets are smaller, less developed economies than traditional emerging markets, often characterized by higher growth potential but also higher risks.

5 Source: J.P. Morgan, as of 22 October 2024. The other major asset classes considered are: US High Yield Bonds, US Investment Grade Bonds, US Government Bonds, Global Bonds, Global Aggregate Bonds, Emerging Markets Local Currency Bonds, US Equities, and Emerging Markets Equities.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 16 July 2025. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 16 July 2025

Doc ID: 4608945