- Credit markets performed in June despite macroeconomic uncertainties and more hawkish central banks. Lower quality segments outperformed.

- Inflation remains the ECB top priority. The central bank is increasingly concerned about the persistence of underlying inflation and continues to hold a hawkish tone, much like the Fed. The ECB justifies its aggressive monetary tightening by the persistence of the inflation risk and the resilience of economic activity. The ECB expects wages and employment to continue growing strongly. The ECB expects wages to grow by a further 14% between now and the end of 2025 and fully recover their pre-pandemic level in real terms.

- At the same time, the outlook on economic activity remains constructive. However, tighter financial and credit conditions will test the resilience of euro area firms, households and sovereign. Indeed, the decline in Firms’ net demand for loans in Q1 2023 was the strongest since the global financial crisis. In addition, “the correction in property markets could turn disorderly in the event of negative macro-financial surprises” according to the ECB financial stability review from May 2023.

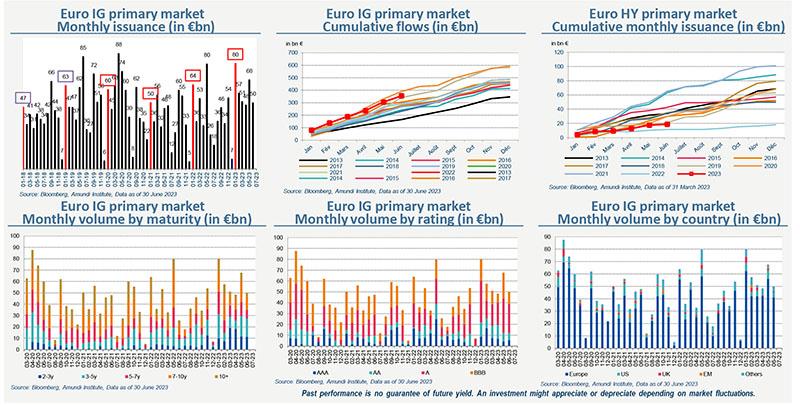

- Emissions eased in June, consistent with historical seasonality. We expect volumes to slow further in July and August and pick up again in September.

The essential

Primary market Investment Grade

Past performance is no quarantee of future yield. An investment might appreciate or depreciate depending on market fluctuations.

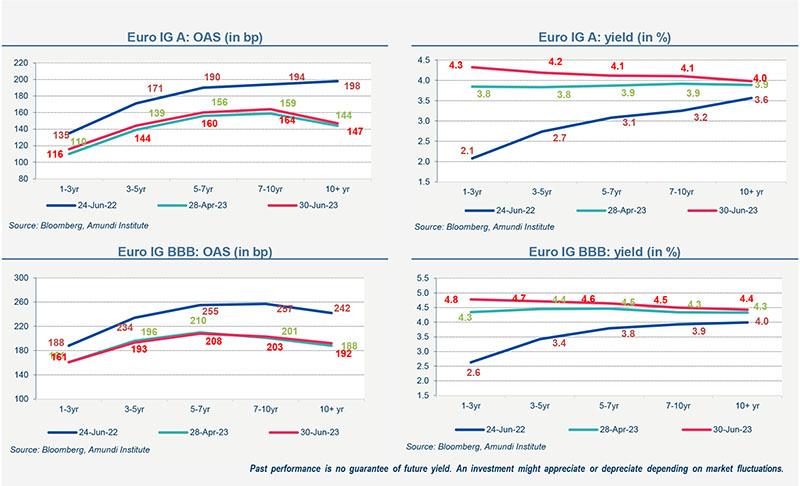

Market data

Past performance is no quarantee of future yield. An investment might appreciate or depreciate depending on market fluctuations.

Authors

Sandrine ROUGERON

Global Head of Corporate Clients and Corporate Pension Funds

Valentine AINOUZ, CFA

Head of Global Fixed Income Strategy

Amundi Institute