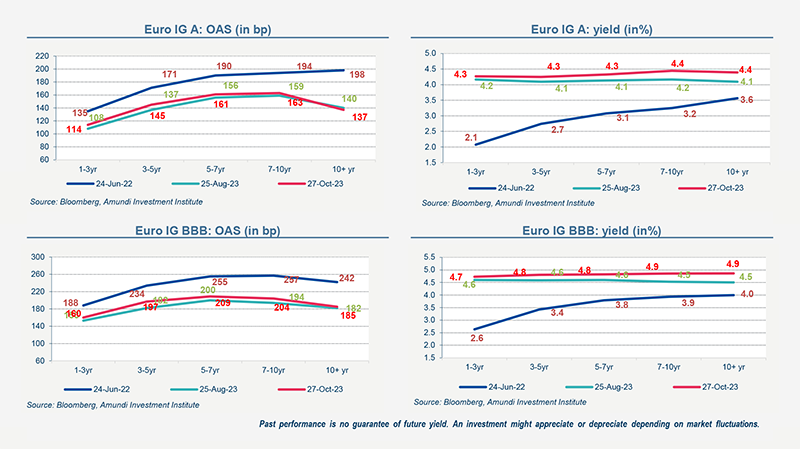

- Credit markets remain very volatile. During the first days of November, the sharp rise in rates and risky assets helped credit markets reverse much of the widening seen in October. Yields remain close to their highest since 2008: Euro Investment Grade (4.3%) and Euro High Yield (7.3%).

- The ECB adopted a cautious stance at its last meeting. Christine Lagarde recognized the recent deterioration of the macroeconomic environment (fewer new jobs are being created) and the further tightening of financing conditions. Monetary policy tightening is affecting the economy more than expected. More is to come. The important point of the meeting was the absence of discussion on the guidance regarding the reinvestment of PEEP securities. Christine Lagarde also highlighted that energy prices were becoming less and less predictable due to geopolitics.

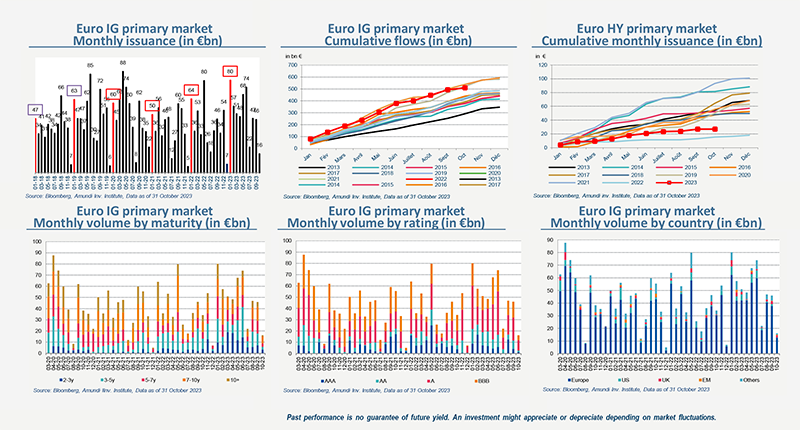

- Activity in the primary corporate debt market fell sharply in Octobers, impacted by high volatility in the interest rate and credit markets. Activity is historically strong in November.

In a nutshell

Primary market Investment Grade

Past performance is no quarantee of future yield. An investment might appreciate or depreciate depending on market fluctuations.

Market data

Past performance is no quarantee of future yield. An investment might appreciate or depreciate depending on market fluctuations.

Authors

Sandrine ROUGERON

Global Head of Corporate Clients and Corporate Pension Funds

Valentine AINOUZ, CFA

Head of Global Fixed Income Strategy Amundi Investment Institute

Find out about Amundi’s treasury offer