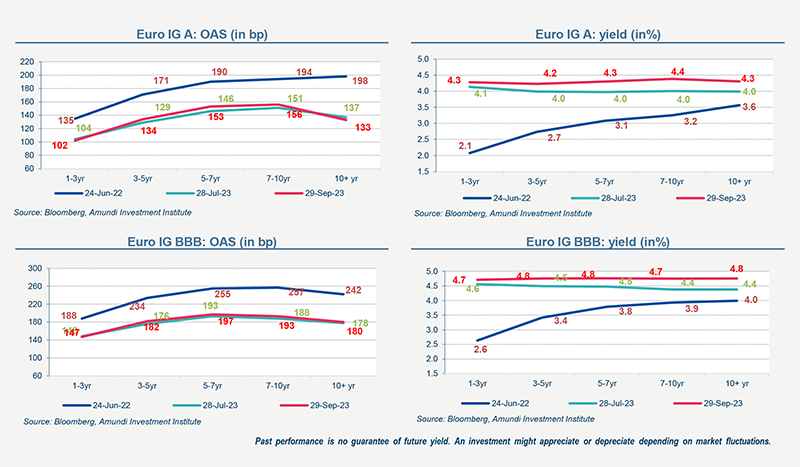

- Rates remain on an upward trend, particularly on long maturities. US 10 year yields were close to 4.8% and German 10 year yields were close to 2.9%. The returns offered by the “Investment Grade” euro and the “High Yield” euro reach 4.6% and 7.8% respectively. We have observed a slight widening of spreads in recent weeks.

- Markets expect central banks to maintain high rates for an extended period. Indeed, the American economy surprises with its resilience. Consumption, the driving force of the American economy, remains robust. The job market is cooling but remains tight Furthermore, the very expansionary fiscal policy of the Biden administration also supports investment spending. For its part, the ECB remains concerned about wage increases and inflation in services.

- More generally, investors are starting to demand higher yields to absorb the growing volumes of issuance used to finance state deficits. The transition to a low carbon economy and the strengthening of national sovereignty have a cost. We are moving from a world of abundance of savings to a world of shortage of savings.

The essential

Primary market Investment Grade

Past performance is no quarantee of future yield. An investment might appreciate or depreciate depending on market fluctuations.

Market data

Past performance is no quarantee of future yield. An investment might appreciate or depreciate depending on market fluctuations.

Authors

Sandrine ROUGERON

Global Head of Corporate Clients and Corporate Pension Funds

Valentine AINOUZ, CFA

Head of Global Fixed Income Strategy Amundi Investment Institute

Find out about Amundi’s treasury offer