At Amundi's European Private Debt platform we have proven privileged access to private markets, a dedicated and experienced team, and a robust and proven investment process. Finally, since 2014, ESG and extra-financial analysis have been at the core of our investment procedures.

Private Debt

The Private Debt’s success is supported by a strong value proposal with portfolio diversification, reliable income streams, attractive risk-adjusted returns, and low volatility.

Amundi’s European Private Debt platform focuses on senior corporate debt, commercial real estate debt and LBO debt across Europe. With 30 highly-experienced specialists located across three investment hubs, 250+ deals completed to date¹ and over €8.5bn of AuM¹, Amundi’s Private Debt team ranks today as number 10 Private Debt Fund Manager in Europe³

Private Debt: supporting profitable and sustainable growth and development of companies

The credit continuum of Europe's first Fixed Income platform

Our Investment Strategy

Amundi Private Debt is a leading player in senior corporate private debt financing in the Eurozone mid-market segment.

Our vision

Our funds give investors the opportunity to contribute to the senior financing of unlisted mid-sized companies and thus to get exposure to diversifying assets that offer more attractive yields than those of the traditional bond market. At the same time, our products enable unlisted mid-sized companies to expand their sources of financing beyond bank loans, over the long term (generally seven years), and with repayment at maturity.

Acces to unlisted mid-sized companies in the Eurozone:

Thanks to our many partnerships with leading European investment banks and our considerable fund-raising ability, we enjoy first-hand access to unlisted mid-sized companies in the Eurozone, and we are involved in virtually all private issuances which are eligible to our funds. Since its launch in 2012, Amundi Private Debt has accordingly raised and invested close to €9bn2 through three generations of funds and around 250+ transactions in the Eurozone. Over the past years, around 20 transactions per annum were carried out and in 2021 alone, 50% of the transactions that we made was in Europe outside France, including: Benelux, Germany and Spain.

The team behind the Funds:

The team, made up of highly experienced corporate finance professionals located across Europe including in Spain, Italy, Germany and France, follows a very selective investment process (7% hit ratio) based on an in-depth analysis of the company’s credit quality, the deal structure and the contractual documentation. This rigorous investment process also incorporates ESG criteria. We finance various business projects (investment, external growth, refinancing, etc.) and then support the issuer over the entire lending period, adjusting the documentation where necessary.

Obligations Relance Programme:

Amundi Private Debt, together with 10 asset management companies4 of Crédit Agricole Group, is proud to have been selected by the Fédération Française de l’Assurance (FFA) and the Caisse de Dépôts Group, to manage one of the seven sub-funds of the Obligations Relance (OR) Fund. The investment period of the Obligations Relance Fund should be extended to 31 December 2023.

The purpose of these 11 asset management firms is to offer additional financing to small and mid-sized French companies in the form of Obligations Relance, in order to help them bounce back in a market environment where recovery plans will be soon coming to an end.

Amundi Private Debt and the other 10 asset management firms - which have already been selected to manage Prêts Participatifs Relance (PPR) - have been untrusted with 222M€ for Obligations Relance. This initiative reinforces Amundi’s role in the financing of French companies, and more specifically in helping those companies grow and develop from a digital or environmental prospective, in today’s economic recovery.

Our current offer

Our offer is aimed at European professional investors seeking to diversify their sources of return through closed ended funds and dedicated accounts.

Over the last years, Amundi's range of private debt solutions has expanded from its core expertise of senior corporate debt to include new areas of private lending:

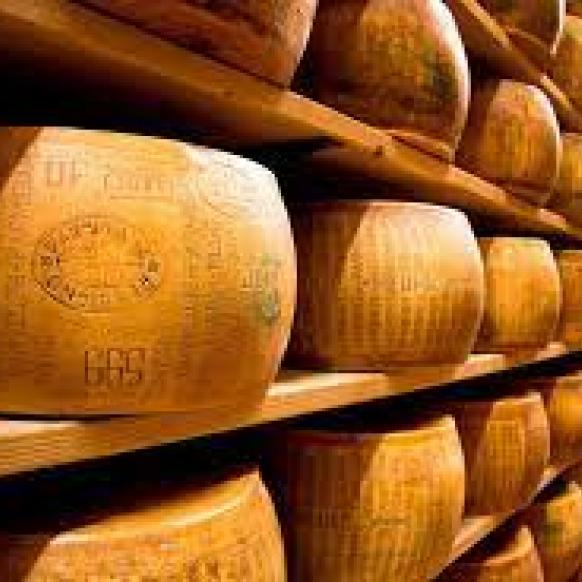

- Launch in 2017 of innovative private debt financings for real assets in the Italian agrifood sector, mainly backed by ham, wine and Parmesan assets.

- Launch in 2018 of a leveraged loans investment program focusing on broadly syndicated loans issued for large senior secured LBOs in Europe.

- Launch in 2018 of a commercial real estate loans investment program offering a diversified exposure to the Eurozone senior real estate debt market. The loans are mainly backed by core+ underlying real estate assets. This program benefits from a particularly favourable Solvency 2 treatment.

- Upon the success of the Senior Corporate Debt programme, launch in 2021 of a Senior Impact Debt strategy, dedicated to the financing of growing mid-cap companies in France and in the European Union. While ESG has been integrated into the investment process since 2014, the strategy aims at a stronger ESG ambition. The programme will define Sustainability Indicators and actively support issuers to reach them through either the promotion of sustainability-linked financing or through an innovative Contribution Impact.

How best to integrate ESG at the core of our investment processes?

ESG has been at the heart of Amundi's Private Debt platform and more specifically for its corporate private debt funds since 2014.

Integrating ESG into private debt is part of Amundi's strategy to be a leading asset manager in responsible investing.

But how are ESG criteria integrated within the investment and tracking processes? And how does this translate into practical terms?

Read the Private Debt's Responsible Investment charter and report to find out more on how responsible investing is playing an increasingly important role in our corporate private debt team’s investment processes today.

Discover our assets

|

The Private Debt platform of Amundi invests €1bn2 on average each year in the 3 expertise : Discover our assets

|