Going forward, geopolitical realignment, supply-chain reconfigurations and the technology race represent a source of opportunity and risk for the region. Asia will be the primary growth driver, even if India and China moderate slightly.

Even though the global political environment was uncertain in 2025, EMs benefited from weakness in the USD and a more accommodative Fed, as well as front-loaded export demand. On the domestic front, strong labour markets and monetary policy easing further supported growth.

As the picture remains broadly similar, we expect EM growth to outpace developed markets, but trend sideways.

Going forward, geopolitical realignment, supply-chain reconfigurations and the technology race represent a source of opportunity and risk for the region. Asia will be the primary growth driver, even if India and China moderate slightly.

Under President Trump, US foreign policy has shown renewed assertions of influence in the Western Hemisphere reminiscent of the Monroe Doctrine - a stance underscored by high‑profile actions such as the military manoeuvre in Venezuela capture of Nicolás Maduro. The BRICS project is also expected to continue as an alternative and overlapping supply chain.

In the coming months, a wave of elections across Latin America could tilt several countries toward more business friendly, orthodox economic policies.

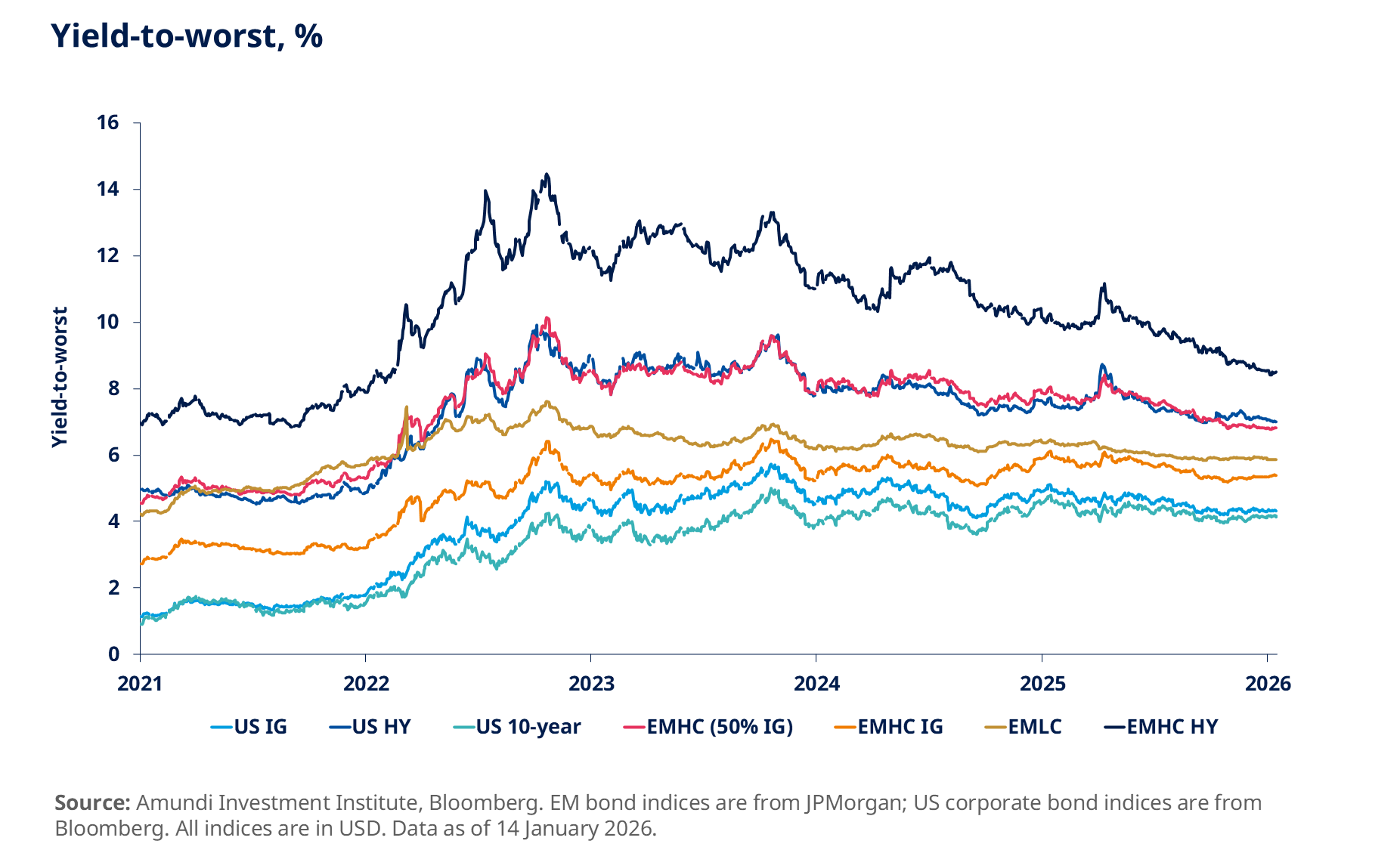

Liquidity in money market funds is at a record high, and as yields fall on the expectation of a rate cut from the Fed, demand for income will likely increase, which makes EM bonds, with higher yields, more attractive to global investors.

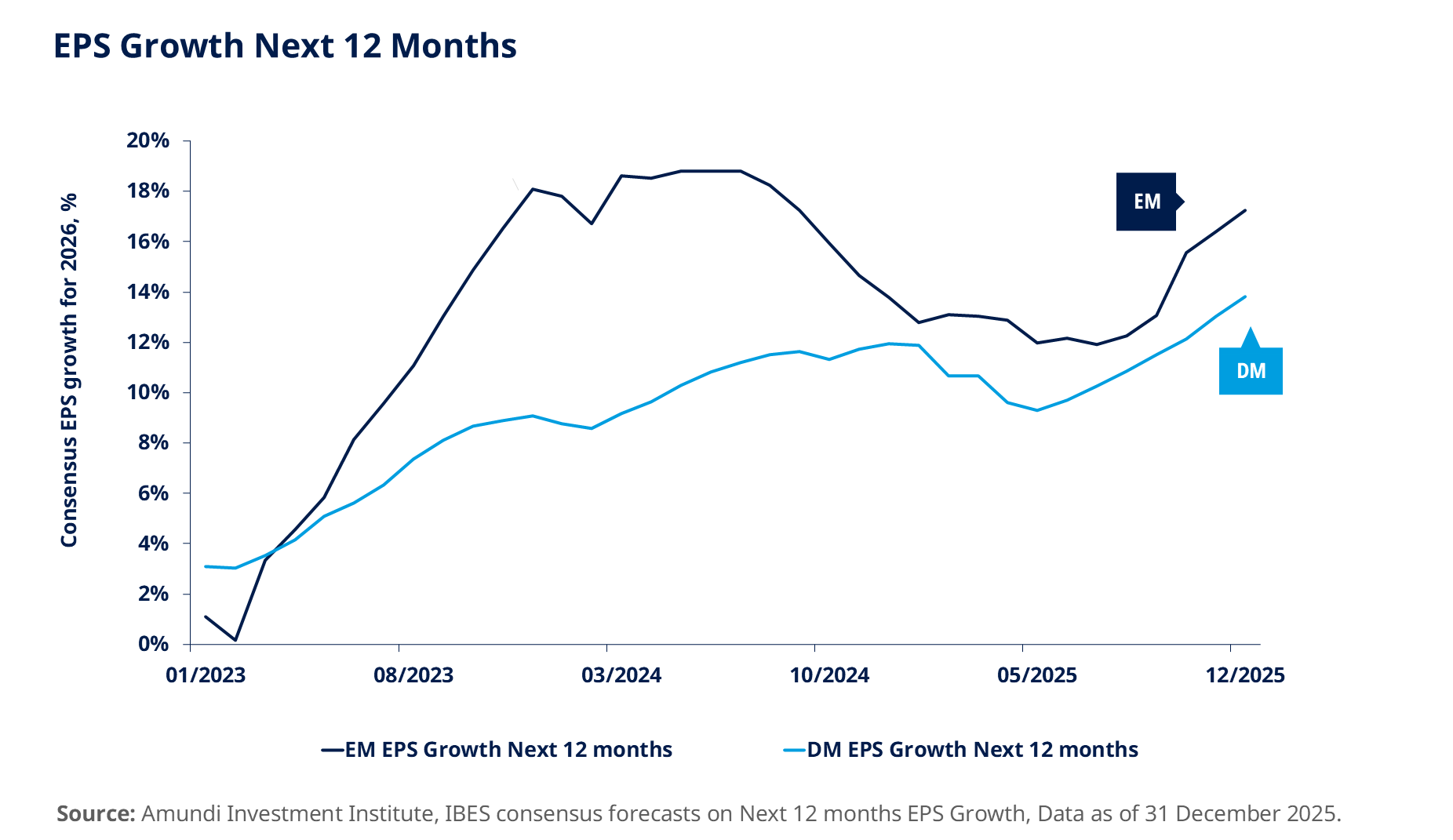

After 15 years of EM equity underperformance, their performance was boosted in 2025 by a weaker USD. This trend is expected to continue and is further supported by the EM growth premium compared to developed markets.

Improving consensus expectations for 2026 earnings in the region is also gaining traction and boosting EM equity appeal. Although we think this view may be somewhat overly optimistic, EPS growth is likely to remain supportive next year, particularly in Brazil, India and Taiwan.

A slight recovery in macro-momentum and single-digit earnings growth favour value and momentum styles. This benefits EMEA and selective LatAm equities. On the other hand, our view on Asia is mainly based on sectors and earnings growth linked to digital assets, China technology and AI areas.

Diversification does not guarantee a profit or protect against a loss.

Source: Amundi Investment Institute, 2026 Investment Outlook - Keep it turning, November 2025.

Marketing material for professional investors only

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of January 2026. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 15 January 2026

Doc ID: 5133119