Discover how income could act as a possible source of resilience

January 2023 | 2 min read

Inflation remains above Central Bank targets

2022 unequivocally marked the return of inflation. Just as consumers face higher prices for key consumables and day-to-day expenses, investors and savers are rediscovering the impact inflation has on their wealth and financial markets at large.

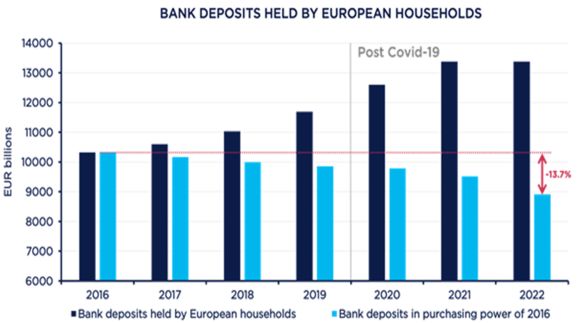

Inflation erodes savings

European households allocated an additional €3tn in cash deposits between 2016-21, which accounts for around 38% of their total financial wealth. While bank deposits increased significantly since 2016, the real purchasing power of this collective has actually gone down!

Figure 1 – Amundi Institute on EFAMA Market Insights data, ECB and European commission June 2022. 2022 estimate based on European Commission’s spring 2022 estimation of inflation in the European Union for this year (6.8%).

At the end of 2022, the cumulated loss in purchasing power since 2016 has been estimated at €1.4tn. It appears investing for income is becoming a top priority in the current economic and financial market backdrop. However, we believe that for investors looking to maintain their purchasing power or generate income from their savings, inflation presents a meaningful challenge.

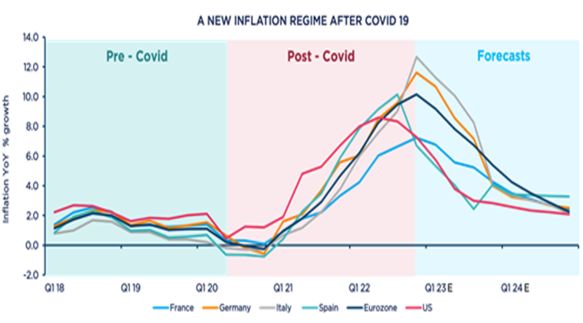

The drivers of inflation

The sharp increase in inflation we experienced over the past year and a half was driven by a combination of factors. Covid-19 played a significant role by triggering supply disruptions as the pandemic initially took hold, followed by a surge in demand as restrictions were ultimately lifted. The war-induced energy crisis only further exacerbated the inflationary conditions.2

While we believe that inflation may be on a decelerating path going forward3, we expect it to remain elevated compared to the pre-Covid-19 status quo. Click here for more insight into the drivers behind inflation .

Figure 2 - Source: Amundi Institute on IMF data and forecasts. Latest data and forecasts available as of 14 November 2022.

A historic market response presents a significant opportunity

Spiking inflation combined with high uncertainty across the economic, market and geopolitical environment may lead to a historic response in financial markets. In 2022, both the S&P500 index and the 10-year US Treasury bond market simultaneously posted double-digit negative returns for the first time in the last 100 years4.

While such downturns can be detrimental for many investment portfolios, they could present opportunities as well. In particular, yields have risen across the board - offering a potentially appealing entry point. This is especially true for bonds, but also for cross-asset allocations that may benefit from a range of opportunities across assets (e.g. government bonds, corporate bonds, emerging market bonds, equities). Notably, yields in these classes have risen considerably relative to the last decade.5

Figure 3 - Source: Amundi Institute, Bloomberg. Data is as of 16 December 2022. Govt bond average= average of 2 government bond indexes yields for US and EMU (from JPMorgan GIB US and EMU Indexes); Equity average = average of 3 Div. Yield from the S&P Aristocrats, MSCI Europe High Dividend and MSCI EM High Dividend Indexes, Cross-asset = average across yields from 10 indexes (the 3 equity indexes, the 2 govt bonds, 2 IG & 2 HY credit indexes for Europe and US (from Bloomberg Barclays) and 1 EM bond index (the J.P. Morgan EMBI Global Diversified Blended).

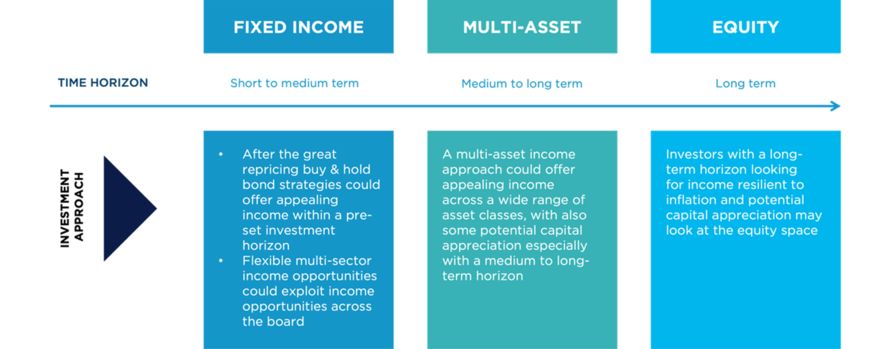

Restoring the balance with higher yields

As inflation rises and general market uncertainty abounds, many investors may be forced to reconsider their investment portfolios. Investors that rely on income from their investments can look to target higher income opportunities to meet their needs and provide resilience in the face of inflation.

Consider an investor with a portfolio value of €100,000 who aims to withdraw €3,000 on an annual basis (inflation-adjusted, and with no further capital appreciation).6

If inflation is at 2% and income yields stand at 3.5%, this investor can maintain their income goals for 18 years before dipping below the original €100.000 mark.

However, if inflation rises to 5% and the income remains unchanged… the portfolio value will fall below €100.000 in 8 years, and draw-down to €0 in 29 years!

In order for investors to sustainably maintain their income goals and general standard of living, a higher income yield is needed to counter-balance theeffects of inflation. Crucially - the longer the period of inflation persists, the more important this consideration becomes.6

The problem spawns the solution

The historically negative market response to inflation has, at the same time, generated the solution for income investors. At a time when protecting one’s income and savings with high yields are most relevant, the steep drops in bond and equity markets have arguably created one of the best income opportunity backdrops in the last decade5.

Amundi provides a wide array of relevant inflation-resilient income opportunities across a variety of investment horizons7 to capitalize on the current market environment.

Sources:

1. Amundi Institute on EFAMA Market Insights data, ECB and European commission June 2022. 2022 estimate based on European Commission’s spring 2022 estimation of inflation in the European Union for this year (6.8%)

2. Amundi Institute, Inflation is here to stay, as of 7 April 2022

3. Amundi Institute on IMF data and forecasts. Latest data and forecasts available as of 14 November 2022.

4. Amundi Institute, Global Financial data. Data is as of 31 October 2022. Past performance is no guarantee of future results.

5. Amundi Institute, Boomberg. Data is as of 31 October 2022.

Govt bond average= average of 2 govt bond indexes yields for US and EMU (from JPMorgan GIB US and EMU Indexes); Equity average = average of 3 Div. Yield from the S&P Aristocrats, MSCI Europe High Dividend and MSCI EM High Dividend Indexes, Cross-asset = average across yields from 10 indexes (the 2 govt bonds + 2 IG & 2 HY credit indexes for Europe and US (from Bloomberg Barclays) and 1 EM bond index (the J.P. Morgan EMBI Global Diversified Blended).

6. Amundi Institute for illustrative purposes. The simulation assumes that the annual withdrawal rises in line with inflation, no capital appreciation and that the portfolio capital increases at the income rate.

7. Amundi Institute, as of November 2022

Important Information

Unless otherwise stated, all information contained in this document is from Amundi Ireland Limited and is as of 18 January 2023. The views expressed in this page should not be relied upon as investment advice, a security or service recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results. Amundi Ireland Limited is authorized and regulated by the Central Bank of Ireland.

Date of first use: 18 January 2023

DOC ID:

Learn more about our Convictions

Powered by Amundi Institute