- Home

- Money market funds – back under the spotlight

Money market funds – back under the spotlight

August 2023 | 3 min read

Fixed income markets have experienced a major repricing in 2022. This phenomenon also had a relevant impact on money market funds (MMFs), which are now more appealing to investors.

As the performance of these funds is strictly correlated to central banks’ monetary policy stance, they haven’t been particularly in favour during the last decade.

Indeed, the expansionary policies carried out by the ECB and the Fed led to extremely low, if not negative, rates, drastically affecting the potential of this type of products.

However, the post-Covid recovery and Russia’s invasion of Ukraine contributed to push inflation to record highs, and central banks reacted with a dramatic change in their strategy, opting for a rapid increase in their interest rates. As a consequence, money market funds are now offering very attractive yields. This, combined with the low levels of volatility that typically characterises these products, has led to a surge in investors’ interest.

Traditionally, money markets have been predominantly considered by corporate and institutional clients. However, the current level of yields also represents a strong opportunity for less sophisticated investors, as a suitable alternative to government bonds or bank deposits.

Amundi, thanks to its expertise in cash management1, offers a full range of products that can address your liquidity needs.

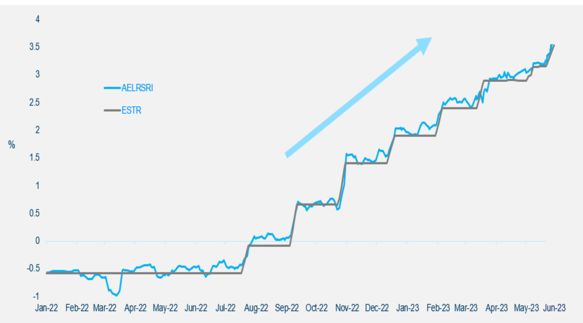

MMFs have strongly benefited from the end of the "lower-for-longer" yield environment

The euro short-term rate (ESTR) reflects the wholesale euro unsecured overnight borrowing costs of banks located in the euro area.

Source: Bloomberg and Amundi as of 30/06/2023. Amundi Euro Liquidity-Rate SRI I2 (AELRSRI) performance displayed for representative purposes only

Source:

1 No1 in Money Market Management in Europe in euros. FundFile - End June 2022 - Open-ended Funds domiciled in Europe and in euros only.

Important information

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 2 August 2023. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 2 August 2023

Doc ID: 3031619

Learn more about our Convictions

Powered by Amundi Institute