ESG winners of tomorrow

ESG improvers

ESG winners of tomorrow

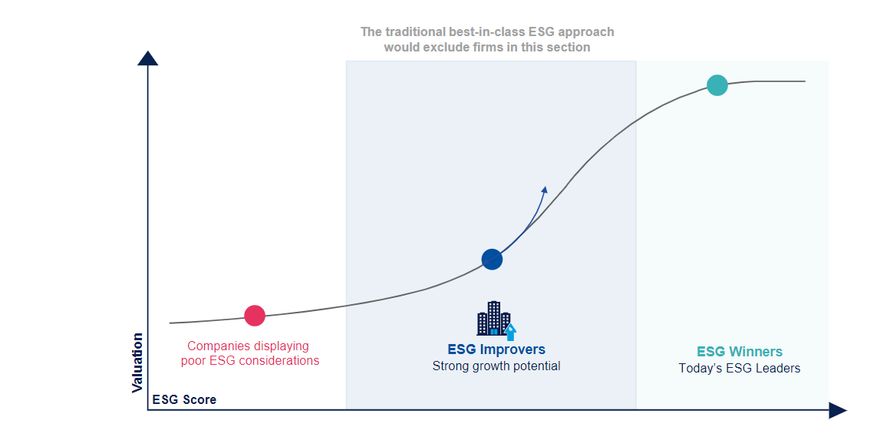

The inclusion of Environmental, social and governance (ESG) criteria is becoming more and more important to investors as they realise the power their investments can have. At Amundi, we want to do more than ‘just’ support businesses that already do well in ESG, we make the case for ESG improvers. But what are ESG Improvers? It’s where we aim to identify today the ESG winners of tomorrow. We believe investors may benefit from allocating money to businesses where the ESG premium is not priced in fully yet.

Thinking outside the box

As more and more investors are flocking to ESG companies that already do well on ESG by only considering the ESG Winners you are only focusing on a concentrated sub-set of companies. By including “improvers” you are casting a wider net in search of alpha opportunities which not only has potential benefits from an ESG perspective but also in terms of diversification.

We step away from the traditional best-in-class approach and focus on companies that sit in the middle of the ESG curve, so those businesses that are neither great nor terrible. Essentially we’re looking for companies today that could be potential ESG winners of tomorrow.

The link between ESG and valuation

Source: Amundi ( ESG in motion: a dynamic forward-looking approach to detect ESG ‘improvers’ | Amundi Research center ). As of December 2022.

In our view, ESG improvers may enable investors to tap into trends well before they materialise and could help increase the return potential of portfolios. That’s one of the reasons why at Amundi, in line with our philosophy of helping firms meet their sustainability goals, we set out to accompany businesses in their ESG journey. We are actively supporting companies seeking to improve on material ESG areas in which they are currently underperforming. Amundi’s search for ESG improvers follows a dynamic and forward-looking approach, which seeks to ensure that each company’s ESG potential is assessed on an individual basis.

Amundi’s five guiding principles for ESG Improvers1

1: Buy Low, Sell High: We extend this common investment philosophy to the realm of ESG and believe that this will increasingly get rewarded by the market.

2: Best In Class: Seeking ESG improvers through an all-inclusive approach across all sectors.

3: Fundamental Approach: Our analysis goes beyond static ESG ratings, we include forward looking qualitative assessments.

4: Materiality: ESG improvement must be tangible and relevant, therefore we focus on financially material factors.

5: Improvers & Leaders: The return potential of the improvers combined with the quality of the leaders may enhance the risk-adjusted return profile.

We expect that ESG investing will continue to gain traction over the medium and long term. Nevertheless, the headwinds experienced in 2022, led by a combination of external forces, made us believe that a greater focus on stock selection would be needed. When we ask investors what matters to them, ESG consistently comes up as one of their top priorities. That’s great news, but, the most interesting area is now moving from purely best-in-class (ESG Winners) towards focussing on ESG Improvers – those who can still improve materially. This requires investors to actively find those companies with capacity and intent to improve – investors need to move off the beaten track but with a better overall investment outcome.

Discover more about Amundi’s ESG approach

Amundi’s Responsible Investing Policy

Sources:

1. Amundi Asset Management, as at 30 May 2023

IMPORTANT INFORMATION

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 31 July 2023. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results. All investors should seek professional advice prior to any investment decision, in order to determine the risks associated with the investment and its suitability.

Date of first use: 31 July 2023

Doc ID: 2953878

You might be interested in

Infrastructure: What it is and why it's essential

What does the word infrastructure mean to you? Does it make you think of fields of wind turbines, solar parks, and other renewable energy projects? Perhaps you picture power pipelines or the giant vats that store and preserve our food.

Video: Climate Action

Nobody can turn back time. But everyone can shape the future. Question consumer decisions, reduce your own CO2 footprint or invest sustainably.