Powering sustainable growth

Trade tensions and security policies have increased the global emphasis on strategic autonomy - including onshoring, supply‑chain diversification*, and energy‑source diversification* - reshaping the opportunity set for responsible investors. This shift is further reinforced by advances in AI and accelerating digitalisation.

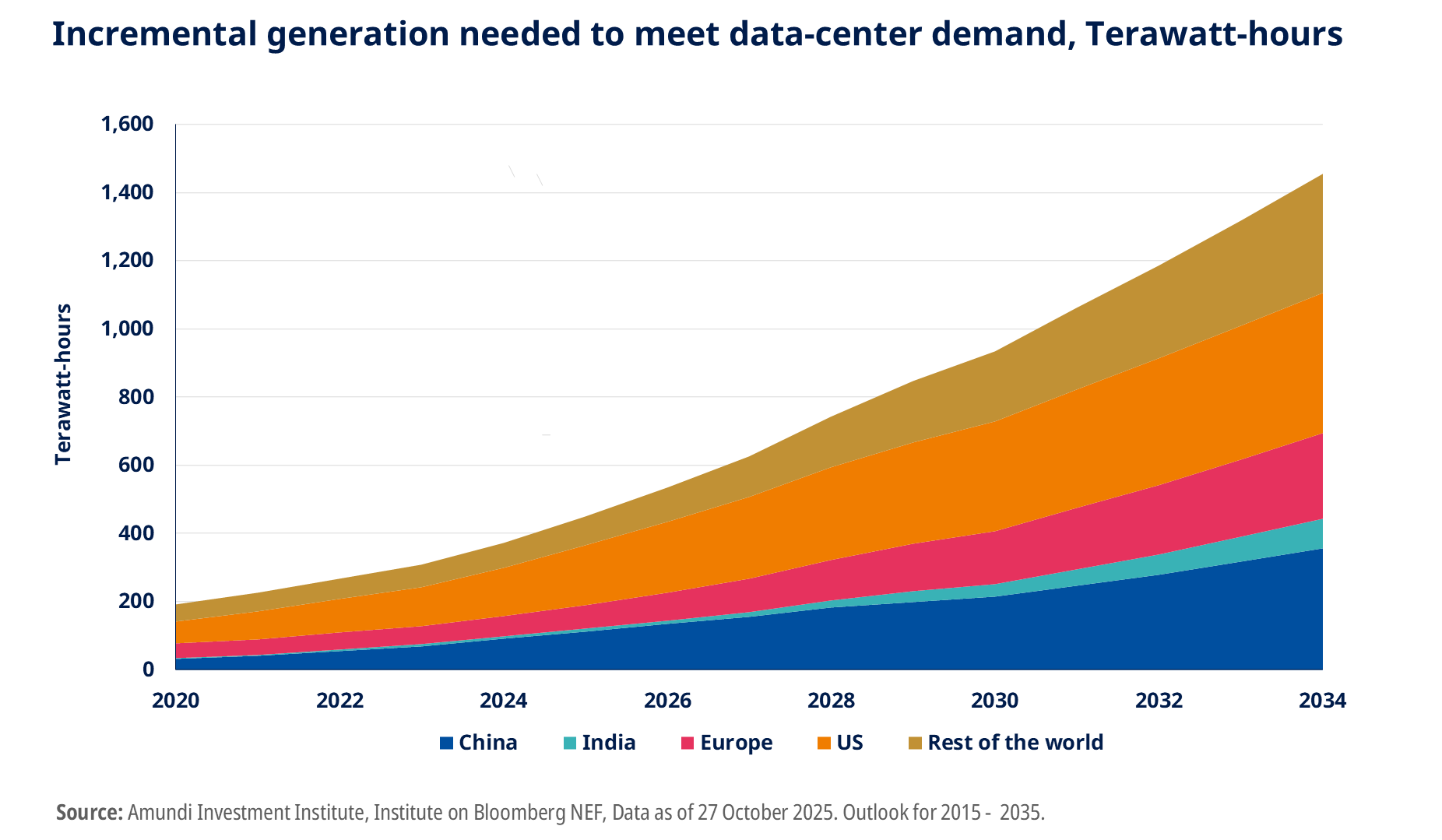

Accelerating electricity demand from data-centre expansion, industrial electrification and increased electric vehicle (EV) adoption. This requires expansion of the transmission network, increases in storage and grid upgrades. Our investment focus is on utilities that address climate challenges and pursue strategies that align with a pathway close to 1.5C and therefore include US operators as well as Korean transformer manufacturers supplying the US, Europe and the Middle East.

Industrials are improving efficiency, automating processes and expanding data centres due to structural demand growth from AI advances which are boosting demand for equipment and electricity. Beneficiaries may include companies providing electrical and building‑management equipment.

Water, which is primarily used for cooling at data centres, is a major part of their energy transition footprint. As it circulates through pipes, it absorbs heat from equipment, moves to cooling towers and is recirculated. Advanced water-based cooling cuts electricity use, enables waste heat reuse and lowers emissions.

AI workloads are a key demand driver for a nuclear revival which is supported by policy, regulatory frameworks and capacity targets. US tech companies are increasingly powering data centres with nuclear energy. Therefore, nuclear‑equipment manufacturers are well‑positioned given their established delivery records and strong market positions.

Copper is the preferred metal for electricity networks and is essential for solar panels, wind turbines and EV batteries. Cleantech demand for copper is projected to at least double by 2040, with strong EV sales - particularly in China - driving battery-related demand. However, changes to US tax policy or a subsidy rollback in China could slow growth to a more modest trajectory. Because copper supply is relatively inelastic - new mines have long lead times - prices are likely to remain elevated into 2026, which should benefit mining companies, including major producers in LATAM.

*Diversification does not guarantee a profit or protect against a loss.

Source: Amundi Investment Institute, 2026 Investment Outlook - Keep it turning, November 2025

Marketing material for professional investors only

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of January 2026. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 15 January 2026

Doc ID: 5133119