Thinking global: equities beyond the tech race

Direct investment in AI and associated technologies has become a primary driver of capital expenditure and corporate earnings growth. The US has dominated in 2025, supported by robust policy framework and a strong innovation ecosystem. This is reflected in the disproportionate weighting of US equities in global benchmarks, with the US now representing nearly two-thirds of the MSCI ACWI market cap.

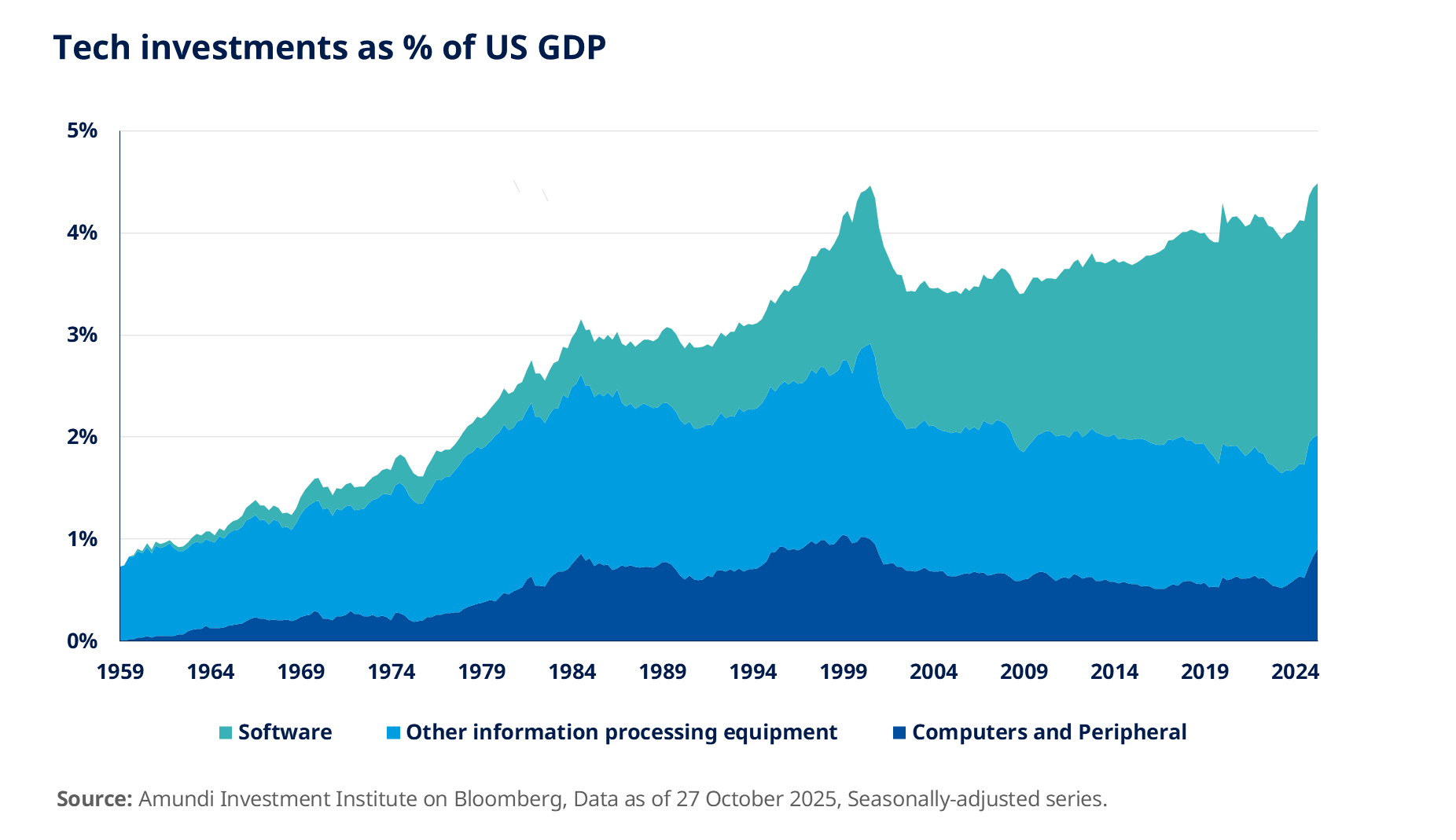

The strong relative performance has prompted comparisons with the dot-com bubble in the late 1990s and early 2000s. Nevertheless, unlike that period, returns in US equities are now underpinned by solid EPS growth, particularly in the Mega Tech names, distinguishing this period from the prior bubble. In addition, current margins are higher than those during the dot-com era and anticipated Fed rate cuts this year are expected to further support equity valuations.

However, concerns remain regarding the sustainability and potential profitability of current capex levels, particularly given the significant increase in debt issuance by the US tech sector in 2025. Therefore, it will be important to closely monitor risks, including weaker than expected profitability and upside inflation surprises.

Although direct AI investment remains modest, it is already triggering meaningful second round effects - higher demand for hardware and software, faster technological obsolescence, increased energy use, and greater infrastructure requirements.

Across Asia, China does not expect a tech super cycle in the way the US does. Still, Beijing is investing heavily in AI and adjacent technologies, and Taiwan continues to play a central role in global semiconductor manufacturing. Chinese tech offers more attractive valuations and stronger growth than US tech, making it a useful diversifier.

India is also emerging as a pivotal player in Asia’s broader technology ecosystem, leveraging strong product development capabilities and synergies from IT services. Similarly, Japan is also benefiting from demand for AI-related data centres and semiconductor stocks, while a weaker yen enhances the relative appeal of Japanese equities.

In Europe, the potential of AI is constrained by relatively modest fiscal support for technology investments. However, opportunities exist in sectors such as electrification, AI-related capital goods and small to mid-cap corporates benefiting from incremental improvements in productivity and innovation.

Additionally, European financials may benefit from elevated financing needs in a supportive rate environment.

AI capex growth is also expected to support several related sectors, many of which offer comparatively compelling valuations. Broadening exposure into the following sectors may present potential opportunities:

Conversely, concerns around oversupply continue to weigh on oil prices. Materials also face challenges due to tariff escalation risks and slowing global trade.

Diversification* remains the most effective defence in a world of concentrated equity markets and high valuations. Investor portfolios must rebalance across styles, sectors, sizes and regions to mitigate risks and capture opportunities, notably in Emerging Markets and European assets.

*Diversification does not guarantee a profit or protect against a loss.

Source: Amundi Investment Institute, Mid-Year Outlook - Ride the policy noise and shifts, June 2025.

Marketing material for professional investors only

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of January 2026. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 15 January 2026

Doc ID: 5133119