Diversifying in an era of controlled disorder

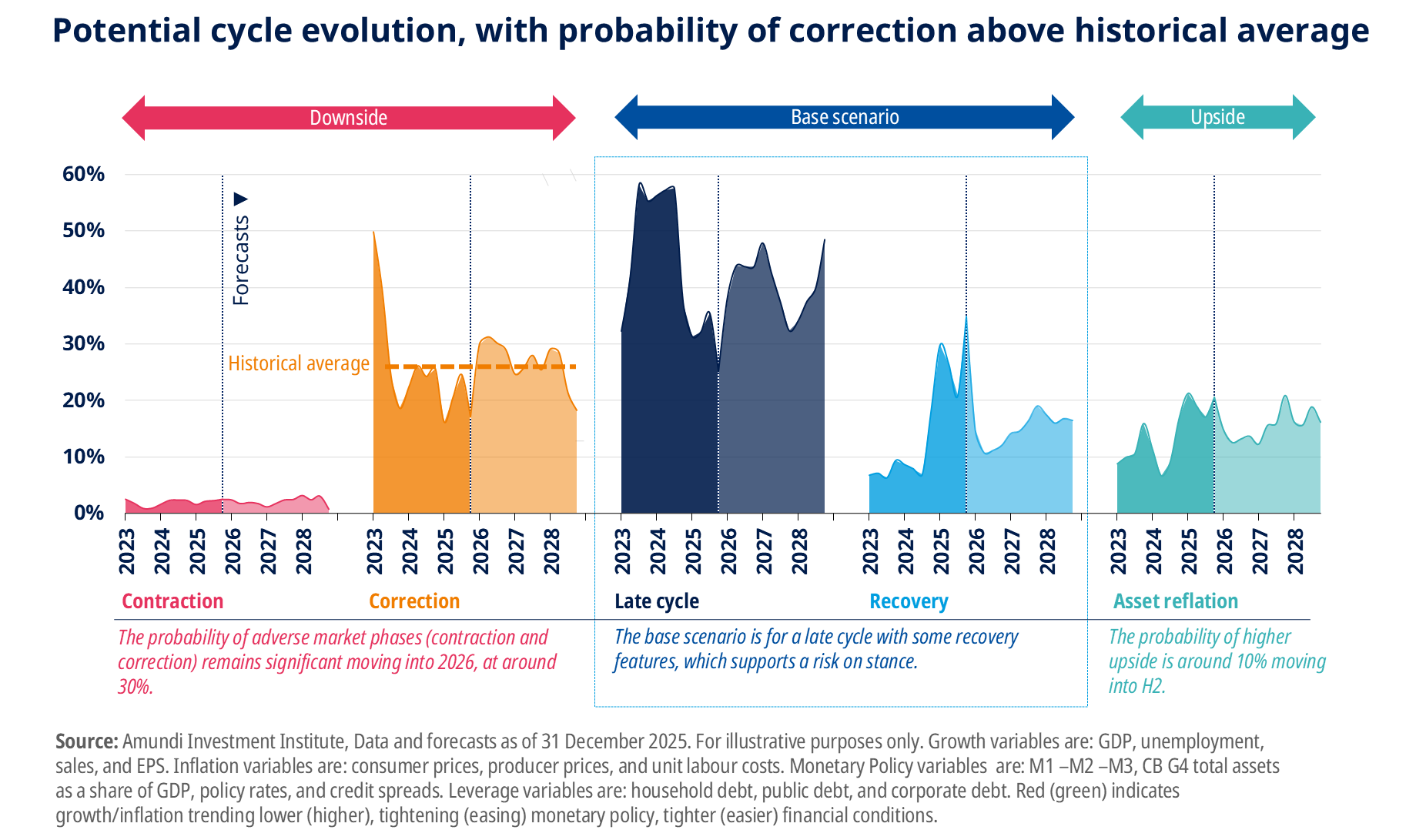

Despite stretched valuations and rising geopolitical and policy risks, overall positioning across asset classes remains moderately pro-risk but prudent, with greater emphasis on diversification*, hedging and selectivity.

In equities, profitability and leverage should be key differentiators, consistent with the AI-driven investment supercycle in which capital intensity and monetisation capacity determine leadership. Sector and style allocation will be primary performance drivers during the year; we see opportunities in financials, industrials, defence and the green transition, complemented by renewed activity among European small and mid-caps - notably in capital goods and defence-related areas.

Within fixed income, an agile duration stance is appropriate, alongside a selective approach: neutral on sovereigns but with a clear preference for investment-grade credit, where risk-adjusted returns remain attractive. Greater allocation to alternative income and inflation hedges - such as private credit, infrastructure and commodities - can enhance real-return resilience.

Private credit has benefited from increased corporate activity (lower rates, resilient growth, deregulation and mid-market consolidation), with more competitive valuations making private markets an attractive diversifier*. We see compelling opportunities in private debt and infrastructure - offering inflation protection and exposure to themes like energy security, reshoring and AI - and selective cases in private equity and real estate.

Secondary markets should gain appeal as institutionals and sophisticated buyers increase volume. Rising M&A activity supports direct lending, and continued spread compression in private debt, alongside falling rates, should help reduce defaults; disciplined selection, strong covenants and high-quality sponsors remain essential.

Private equity typically benefits from stronger public-market activity; we expect growth in mid-market operators across healthcare, AI and data infrastructure, renewables and cybersecurity.

Hedge funds face low near-term risks but medium-term challenges from rich valuations, higher leverage, possible dollar weakness, disruptive technologies and a multipolar geopolitical environment. Investors should favour micro-level analysis and avoid large directional bets. Event-driven strategies - particularly merger arbitrage and special situations - are experiencing a revival, with European mid-market deals offering attractive spreads due to lower stock valuations.

Commodities provide diversification* and inflation hedging. Oil remains driven by fundamentals despite tariffs and geopolitical tensions; base metals tied to AI, energy infrastructure, the green transition and defence are long-term structural winners. Gold remains a key hedge against US policy risk, potential dollar weakness and excess supply of US assets.

Currency diversification* can also be effective: selective exposure to JPY and EUR, alongside chosen emerging-market FX, can complement broader hedging and diversification strategies.

The economy is adapting to a new regime of “controlled disorder”. Tech-led transformation, fiscal stimulus and industrial policy are keeping activity alive and leading to the emergence of new winners. Inflation becomes a structural theme that investors must also factor into their allocations.

* Diversification does not guarantee a profit or protect against a loss.

Views as of November 2025.

Source: Amundi Investment Institute, 2026 Investment Outlook - Keep it turning, November 2025

Marketing material for professional investors only

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of January 2026. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 15 January 2026

Doc ID: 5133119