Bonds in the new policy order

Despite the ongoing increases in the US deficit, an unprecedented debt burden and above target inflation, foreign holdings of US Treasuries, at almost $9 trillion, are close to all-time highs. We believe this reflects international investors’ overly optimistic views about the continued dominance and unique position of the US in global affairs.

Current US debt policy tends to focus on short-term issuance rather than longer dated bonds, which reduces near-term costs but could result in increased pressure on the Fed to make deeper rate cuts.

Treasury yields have fallen in anticipation of loosening policy. While a weakening labour market may lead to rate cuts, reducing rates too far could reignite inflationary pressures. Therefore, a disciplined, tactical approach to duration is advised as yields are likely to remain range bound in 2026.

Investment grade credit, which benefits from limited supply and exposure to disciplined balance sheet management, provides an opportunity to diversify* away from Treasuries and is likely to benefit from additional spread tightening relative to government bonds. In Europe, we see attractive opportunities in the financial sector.

Caution is recommended on high yield bonds, as they may suffer from concerns around regional banks, private credit, as well as the potential cashflow impact from tariffs.

Germany is set to significantly increase its expenditure on defence, which will be accompanied by a rise in debt issuance in 2026. The resulting surge in government bond supply should create attractive buying opportunities for investors.

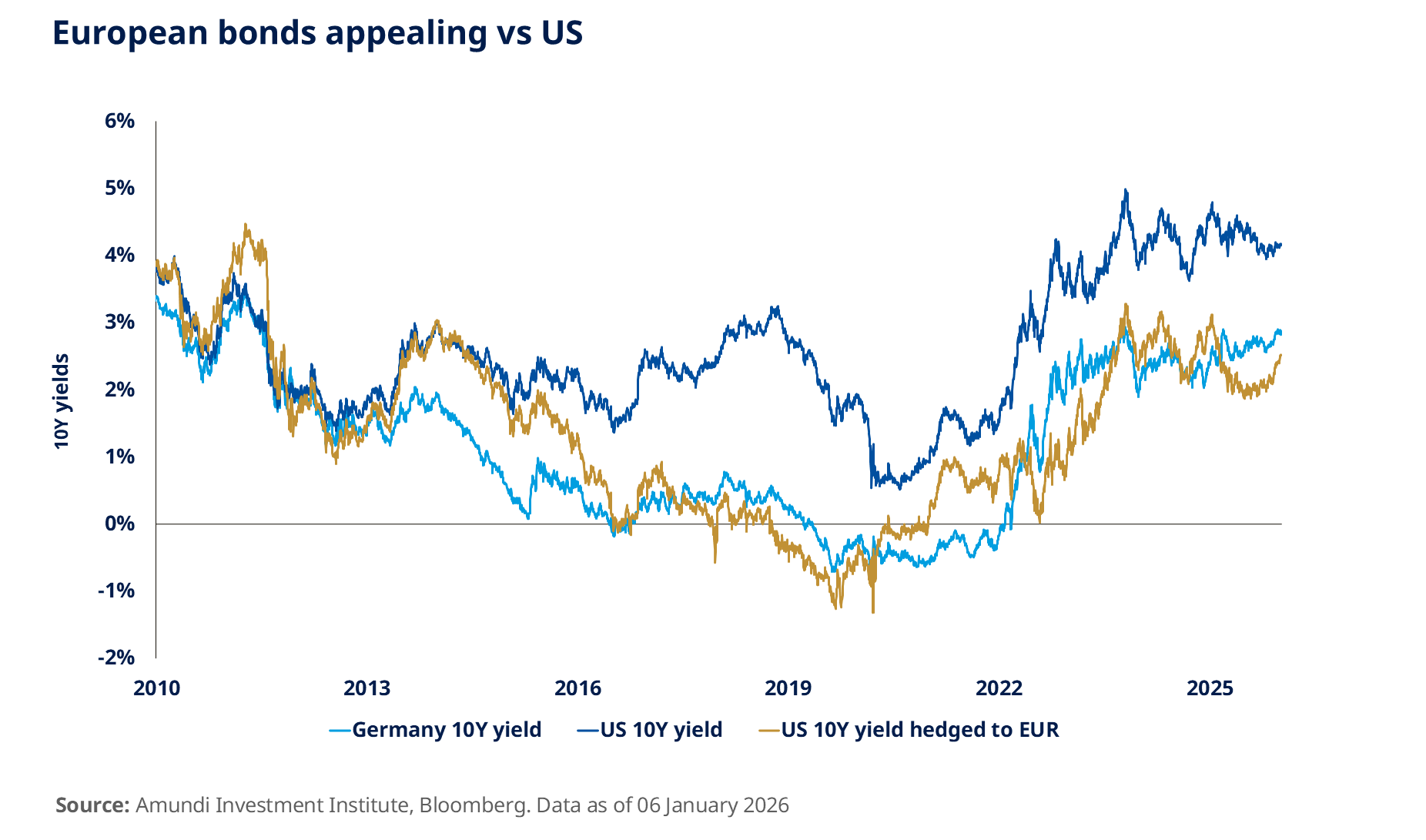

The ECB is expected to cut rates to 1.5% by mid-2026 which will enhance the appeal of European bonds compared to Treasuries, particularly at the shorter end of the yield curve. Lower rates in the Eurozone should encourage increased demand from European and international investors seeking alternatives to US government bonds. Peripheral European bonds, particularly Italy and Spain, appear compelling. UK Gilts are also attractive, trading at their widest discount to US Treasuries in roughly a decade.

Currencies

In 2025, expectations that the USD would be buoyed by pro-business deregulation and an assertive US tariff stance failed to materialise; instead, the dollar weakened as macro fundamentals deteriorated. Although macro fundamentals are no longer a clear drag on the USD, we believe they remain insufficient to reverse longer-term structural forces. We continue to position for a weak - though non-linear - USD in 2026.

The Eurozone’s economic outlook depends on prospective reforms. Given the private sector’s low debt service burden, there is little case for further rate cuts. This environment supports a stronger EUR/USD and EUR/CHF, but - after the outsized EUR rally in 2025 - a weaker euro versus cyclical currencies (the Skandies, Australian Dollar) and the JPY is more likely. Upcoming UK fiscal tightening is likely to limit growth and increase pressure on the Bank of England to cut rates. Sterling’s reliance on foreign inflows suggests GBP crosses will struggle to outperform unless GDP exceeds expectations or fiscal confidence improves.

In Japan, the currency remains weak as the BoJ is reluctant to lift real rates in, despite normalised yields and cheap valuations. In our view, dislocations should gradually dissipate, but sustained JPY appreciation will require either a harder landing or a credible signal that policy normalisation will continue.

*Diversification does not guarantee a profit or protect against a loss.

All opinions and estimates are subject to change without notice.

Source: Amundi Investment Institute, 2026 Investment Outlook - Keep it turning, November 2025.

Marketing material for professional investors only

Unless otherwise stated, all information contained in this document is from Amundi Asset Management S.A.S. and is as of 15 January 2026. Diversification does not guarantee a profit or protect against a loss. The views expressed regarding market and economic trends are those of the author and not necessarily Amundi Asset Management S.A.S. and are subject to change at any time based on market and other conditions, and there can be no assurance that countries, markets or sectors will perform as expected. These views should not be relied upon as investment advice, a security recommendation, or as an indication of trading for any Amundi product. This material does not constitute an offer or solicitation to buy or sell any security, fund units or services. Investment involves risks, including market, political, liquidity and currency risks. Past performance is not a guarantee or indicative of future results.

Date of first use: 15 January 2026

Doc ID: 5133119