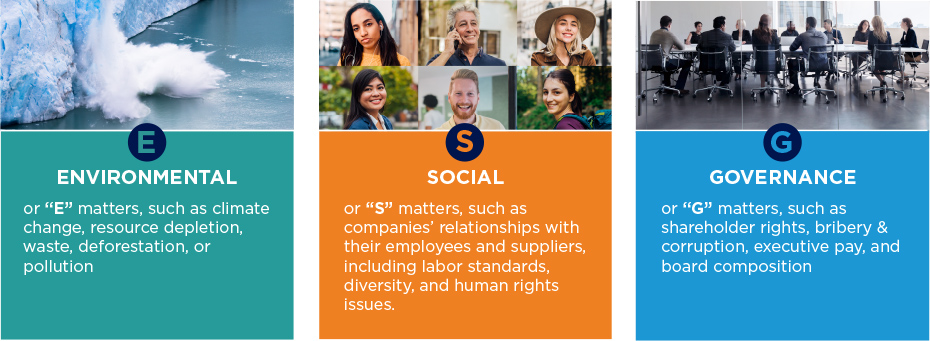

Sustainable investing has been part of our heritage for decades. Pioneer Fund, which first used this strategy and dates back to 1928, is recognized as one of the first mutual funds to deploy socially responsible investment criteria1, avoiding companies in the alcohol, tobacco and gaming industries for much of its history.2 Today, we continue to extend our range of dedicated funds that are focused on Environmental, Social and Governance (ESG) components.