Investor Account Access

Investor access to Shareowner accounts and Closed End Funds accounts.

In an uncertain market environment, investors may want to recalibrate their allocations for growth while seeking to protect portfolios from downside. Beyond a traditional core portfolio, asset allocations may include low- or uncorrelated assets such as interval funds, catastrophe bonds, and other unique sources of return. A highly diversified, cross-asset strategy may provide enhanced exposure and effective risk management.

To strengthen their portfolios, investors may wish to seek exposures with little to no correlation with traditional markets. Jon Duensing, head of fixed income and portfolio manager at Amundi US, describes some of these opportunities and explains how investors can potentially benefit.

|

The annual repricing of reinsurance means ILS can remain poised to compensate investors for the risks involved, even with climate change risks on the horizon. Learn more about how these securities can help broaden investor portfolios. Read our full paper, Insurance-Linked Securities and Climate Change |

|

|

Including catastrophe bonds within a broader asset allocation can potentially have powerful diversification benefits while also offering total return potential. Read our full paper, Opportunities in Catastrophe Bonds. |

|

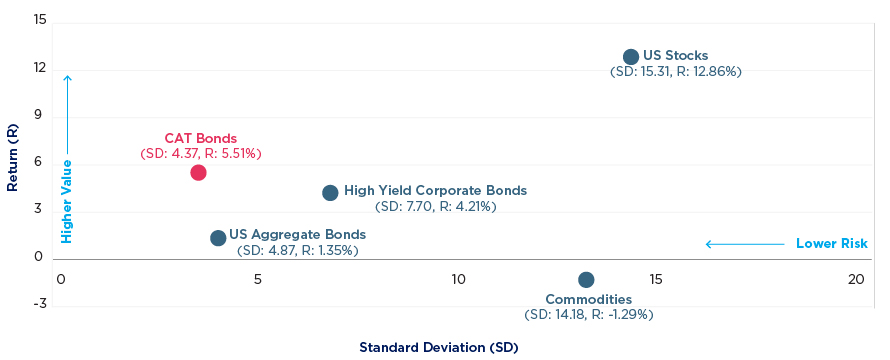

Over 10-year period ending 3/31/24, CAT Bonds offered higher return with lower realized risk than many other asset classes

Alternatives can reduce portfolio risk and deliver competitive returns when compared with traditional assets.

Source: Morningstar as of 6/30/2024. Data is based on past performance, which does not guarantee future results. Data is not meant to represent the performance of any Amundi US portfolio. Commodities represented by Bloomberg Commodity Total Return Index. CAT bonds represented by the Swiss Re Global CAT Bond Total Return Index, which tracks the aggregate performance of all USD, EUR and JPY denominated CAT bonds, capturing all ratings, perils and triggers. US Stocks represented by the S&P 500 Index, a commonly used measure of the US Stock Market. US Aggregate Bonds represented by the Bloomberg US Aggregate Bond Index. High Yield Corporate Bonds represented by the ICE BofA US High Yield Index. Indices are unmanaged and their returns assume reinvestment of dividends and do not reflect any fees or expenses. It is not possible to invest directly in an index.

Amundi US offer a unique suite of alternative assets which can further diversify‡ a traditional portfolio:

Please visit our Mutual Fund page to find our full list of mutual funds.

†Correlation - The degree to which assets or asset class prices have moved in relation to one another. Correlation ranges from -1 (always moving in opposite directions) through 0 (absolutely independent) to 1 (always moving together). ‡Diversification does not assure a profit or protect against loss.

Definitions: Catastrophe bond: Debt instruments designed to raise money for insurance companies in the event of a natural disaster by paying out only if specific conditions, such as earthquakes or tornados, occur. Interval fund: A closed-end mutual fund that doesn't trade on an exchange and only allows investors to redeem shares periodically in limited quantities.

Before investing, consider the product's investment objectives, risks, charges and expenses. Contact your financial professional or Amundi US for a prospectus or summary prospectus containing this information. Read it carefully. To obtain a free prospectus or summary prospectus and for information on any Pioneer fund, please download it from our literature section.

Securities offered through Amundi Distributor US, Inc.

60 State Street, Boston, MA 02109

Underwriter of Pioneer mutual funds, Member

SIPC.

Not FDIC insured | May lose value | No bank guarantee Amundi Asset Management US, Inc. Form CRS Amundi Distributor US, Inc. Form CRS

EXP-2025-04-08-ADID-3455470-1Y-T