Investor Account Access

Investor access to Shareowner accounts and Closed End Funds accounts.

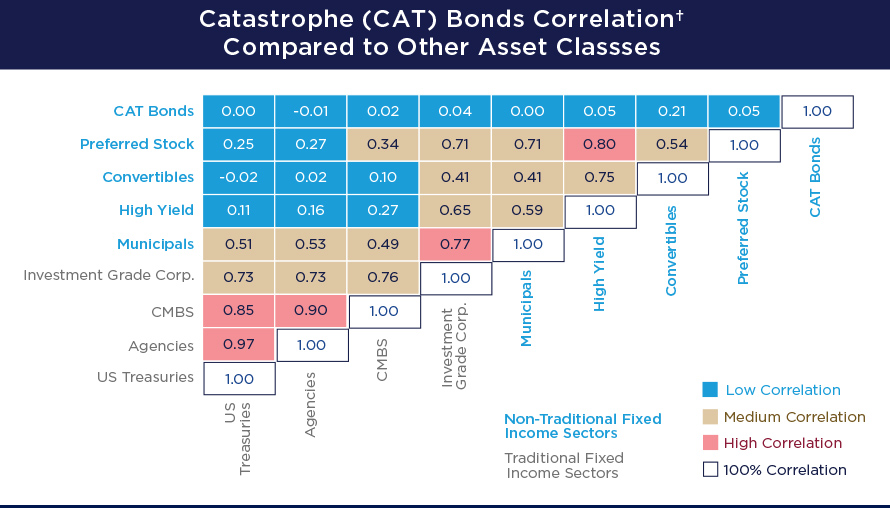

Source: Morningstar. Data as of 3/31/24. †Correlation - The degree to which assets or asset class prices have moved in relation to one another. Correlation ranges from -1 (always moving in opposite directions) through 0 (absolutely independent) to 1 (always moving together). Please see Terms and Indices below for more information. Data based on past performance, which is no guarantee of future results.

Outcome-oriented investments whose performance is linked to non-financial events

Catastrophe (CAT) bonds, a subcategory of insurance-linked securities (ILS), have exhibited low correlations to multiple other asset classes since these instruments were introduced to the market more than 20 years ago. This low correlation gives CAT bonds the potential to enhance diversification1, reduce volatility and strengthen the risk/return profile of an overall asset allocation portfolio.

CAT bonds are outcome-oriented investments whose performance is linked to non-financial events, such as earthquakes and hurricanes. Events such as hurricanes do not cause interest rates to rise, and stock market drops do not cause calamities such as earthquakes, giving CAT bonds a low correlation to overall market performance.

As long-term investors in insurance-linked securities such as CAT bonds, we believe this fundamentally uncorrelated asset class could have a role in a diversified portfolio. We also think diversifying strategies through asset classes like CAT Bonds and ILS can be especially important during times of market stress, when, historically, the correlations between many asset classes have increased.

In this environment, we believe an active approach to investing may be advantageous. Amundi US offers global investment opportunities to investors.

Terms and Indices

1Diversification does not assure a profit or protect against loss.

Asset classes represented by the following indices: US Treasuries – Bloomberg Barclays (Bloomberg) US Treasury Index. Agencies – Bloomberg US Agency Index. CMBS – Bloomberg CMBS Investment Grade Index. Investment Grade Corporates – Bloomberg US Corporate Investment Grade Index. Municipals – Bloomberg Municipal Index. High Yield – ICE BofA US High Yield Index. Convertibles – ICE BofA All Convertible Index. Preferred Stock – ICE BofA Preferred Stock Index. Event-linked “CAT” Bonds – SwissRe Global Cat Bond Index.

Indices are unmanaged and their returns assume reinvestment of dividends and do not reflect any fees or expenses. It is not possible to invest directly in an index.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management US (Amundi US) and is as of 3/31/2024.

A Word About Risk: Pioneer Cat Bond Fund

The Fund invests primarily in catastrophe bonds (CAT) and other forms of insurance-linked securities (ILS). The Fund could lose a portion or all of the principal it has invested in catastrophe bonds, and the right to additional interest and/or dividend payments with respect to the security, upon the occurrence of one or more pre-defined trigger events. Trigger events may include natural or other perils of a specific size or magnitude that occur in a designated geographic region during a specified time period, and/or that involve losses or other metrics that exceed a specific amount. The size of the ILS market may change over time, which may limit the availability of ILS for investment. The availability of ILS in the secondary market may also be limited. Investments in high yield or lower-rated securities are subject to greater-than-average price volatility, illiquidity, and possibility of default. The market price of securities may fluctuate when interest rates change. When interest rates rise, the prices of fixed income securities held by the Fund will generally fall. Conversely, when interest rates fall, the prices of fixed income securities held by the Fund will generally rise. Investments in the Fund are subject to possible loss due to the financial failure of issuers of underlying securities and their inability to meet their debt obligations. The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment. ILS in which the Fund invests may have limited liquidity or may be illiquid and, therefore, may be impossible or difficult to purchase, sell, or unwind. Investing in foreign and/or emerging market securities involves risks relating to interest rates, currency exchange rates, and economic and political conditions. The Fund may use derivatives, such as swaps, inverse floating-rate obligations and others, which can be illiquid, may disproportionately increase losses, and have a potentially large impact on the Fund’s performance. Derivatives may have a leveraging effect. To the extent the Fund invests a significant percentage of its assets in a single industry, such as the insurance segment, the Fund may be particularly susceptible to adverse economic, regulatory or other events affecting that industry. As a non-diversified Fund, the Fund can invest a higher percentage of its assets in the securities of any one or more issuers than a diversified fund. Being non-diversified may magnify the Fund’s losses from adverse events affecting a particular issuer. Please see a prospectus for a complete discussion of the Fund’s risks.

Individuals are encouraged to seek advice from their financial, legal, tax and other appropriate professionals before making any investment or financial decisions or purchasing any financial, securities or investment-related product or service, including any product or service described in these materials. Amundi US does not provide investment advice or investment recommendations.

Before investing, consider the product's investment objectives, risks, charges and expenses. Contact your financial professional or Amundi US for a prospectus or summary prospectus containing this information. Read it carefully. To obtain a free prospectus or summary prospectus and for information on any Pioneer fund, please download it from our literature section.

Securities offered through Amundi Distributor US, Inc.

60 State Street, Boston, MA 02109

Underwriter of Pioneer mutual funds, Member

SIPC.

Not FDIC insured | May lose value | No bank guarantee Amundi Asset Management US, Inc. Form CRS Amundi Distributor US, Inc. Form CRS

EXP-2025-04-16-ADID-3509757-1Y-T