Investor Account Access

Investor access to Shareowner accounts and Closed End Funds accounts.

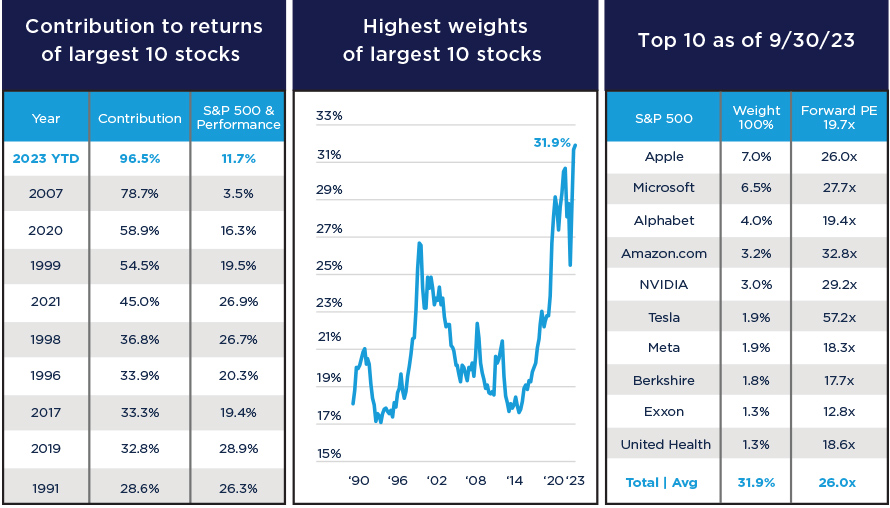

Data from 01/01/90 to 9/30/23. Source left table: Strategas. Middle chart and right table: Bloomberg and Amundi US. Securities listed are not meant to represent any current or future holding of an Amundi US portfolio, and should not be considered recommendations to buy or sell any security. Please see Terms and Indices below for more information. Data based on past performance, which is no guarantee of future results.

We believe extreme market concentration is unlikely to be sustained; active managers who select stocks based on fundamentals may benefit as concentration unwinds.

Over 90% of the year-to-date return of the S&P 500 Index through September has come from the 10 stocks with the highest weightings in the Index. There is no other calendar year of positive returns for the index going back to 1990 where concentration was as high.

The result is that the S&P 500 Index is now at one of its highest levels, with the top 10 stocks alone representing almost 32% of the Index1. Moreover, the 10 largest stocks trade approximately at an average 32% premium to the S&P 500 Index as measured by forward price-to-earnings estimates. While these are large, highly profitable companies, can they continue to lead the equity markets given their lofty valuations?

Looking back over past 30+ years, periods in which there have been sharp increases in market concentration have often been followed by sharp reversal in concentration of the Index, as seen in the chart above.

While some may argue that this time may be different given the dominance of the top 10 in their respective markets, we believe market concentration may decline at some point, and those invested in large cap index portfolios could underperform active managers who choose to balance their exposure to the top 10 stocks with stocks more compellingly valued.

1Source: Bloomberg, 9/30/2023.

In this environment, we believe an active approach to investing may be advantageous. Amundi US offers investment opportunities to investors.

Terms and Indices

Forward price-earnings ratio: The current price of a stock divided by the consensus analyst estimates of 1-year projections of its earnings per share.

S&P 500: The S&P 500 broad measure of large-cap US equities and serves as the foundation for a wide range of investment products.

Price/Earnings ratio (P/E): A valuation measure of expensiveness using a stock’s price divided by its per-share earnings

Indices are unmanaged and their returns assume reinvestment of dividends and do not reflect any fees or expenses. It is not possible to invest directly in an index.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management US (Amundi US) and is as of 9/30/2023.

A Word About Risk: Pioneer Fundamental Growth Fund

The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment. The Fund may invest in fewer than 40 securities and, as a result, its performance may be more volatile than the performance of other funds holding more securities. Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, and political conditions.

The views expressed regarding market and economic trends are those of Amundi Asset Management US, Inc. ("Amundi US"), and are subject to change at any time. These views should not be relied upon as investment advice, as securities recommendations, or as an indication of trading intent on behalf of any portfolio.

Investing in mutual funds involves significant risks. For complete information on the specific risks associated with each fund, please see the appropriate fund’s prospectus or fact sheet, available on our literature page.

Individuals are encouraged to seek advice from their financial, legal, tax and other appropriate professionals before making any investment or financial decisions or purchasing any financial, securities or investment-related product or service, including any product or service described in these materials. Amundi US does not provide investment advice or investment recommendations.

Before investing, consider the product's investment objectives, risks, charges and expenses. Contact your financial professional or Amundi US for a prospectus or summary prospectus containing this information. Read it carefully. To obtain a free prospectus or summary prospectus and for information on any Pioneer fund, please download it from our literature section.

Securities offered through Amundi Distributor US, Inc.

60 State Street, Boston, MA 02109

Underwriter of Pioneer mutual funds, Member

SIPC.

Not FDIC insured | May lose value | No bank guarantee Amundi Asset Management US, Inc. Form CRS Amundi Distributor US, Inc. Form CRS

EXP-2024-10-27-ADID-3186192-1Y-T