Investor Account Access

Investor access to Shareowner accounts and Closed End Funds accounts.

Source: Amundi US and Bloomberg as of 6/30/23. Please see Terms and Indices below for more information. Data based on past performance, which is no guarantee of future results.

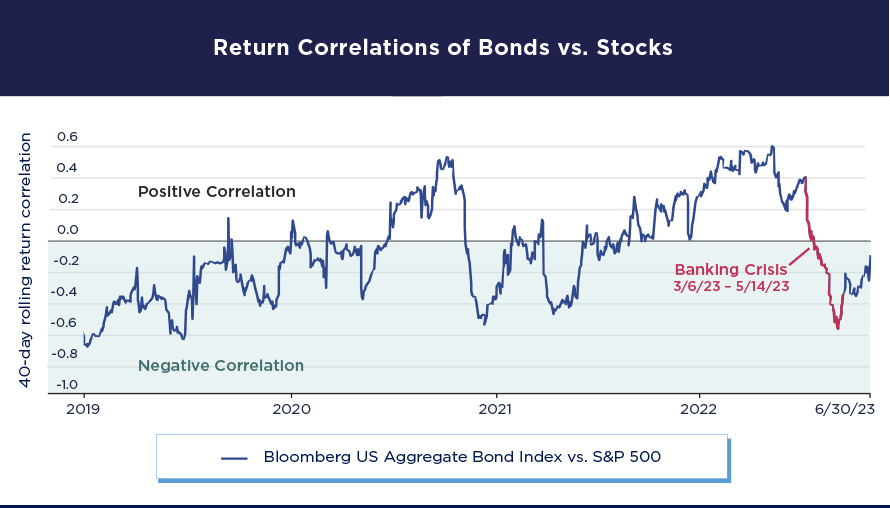

Correlations across certain asset types are often consistent over long-term investment horizons. That regularity may allow investors potentially to harvest diversification benefits and lower overall risk in their portfolios. For example, as the chart shows, the long-term correlation between equities and bonds is generally negative. That relationship functions to diversify and help reduce overall risk in portfolios, as bonds are generally less risky than stocks.

But correlations can change suddenly and become disruptive to portfolios for relatively short periods. This was most recently the case in 2022, when the US Federal Reserve raised interest rates to fight decades-high inflation at the most rapid pace since the 1980’s. That action led some investors to sell both equities and bonds, both of which are traditionally sensitive to changes in monetary policy. As a result, the historically negative correlation between equities and bonds became strongly positive for a period of time, contributing to increased portfolio risk.

The regional banking crisis in early March 2023, however, sent investors out of risky assets and into safer ones, like US Treasuries. This development, along with concerns about the economic outlook, has reverted the correlation between equity and bonds back to negative territory, in line with the historical relationship.

Overall, the diversification benefits resulting from incorporating asset classes and sectors with lower long-term correlations to each other can help reduce volatility and downside risk, and pursue attractive risk-adjusted returns over time. In addition, fixed income investors who remained fully invested in fixed income markets through credit cycles have generally been rewarded for their patience. In 9 out of the top 10 down market years for bonds since the 1970's, investors saw positive returns the following calendar year based on the Bloomberg US Aggregate Bond Index3. Of course, past performance is no indication of future results.

1Diversification does not assure a profit or protect against loss.

2Correlation - The degree to which assets or asset class prices have moved in relation to one another. Correlation ranges from -1 (always moving in opposite directions) through 0 (absolutely independent) to 1 (always moving together).

3Source: Bloomberg; Calculation is for each year end since 1975 through 2022.

Investors seeking fixed income solutions to help navigate more volatile fixed income markets may want to consider broadly diversified funds with either a short or intermediate term duration focus.

Terms and Indices

Bonds: Securities issued to raise money from investors willing to lend for a certain amount of time.

Stocks: A type of security that gives stockholders a share of ownership in a company.

S&P 500: The S&P 500 broad measure of large-cap US equities and serves as the foundation for a wide range of investment products.

Bloomberg US Aggregate Bond Index: A broad-based fixed-income index used by bond traders and fund managers as a benchmark to measure their relative performance.

Indices are unmanaged and their returns assume reinvestment of dividends and do not reflect any fees or expenses. It is not possible to invest directly in an index.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management US (Amundi US) and is as of 6/30/2023.

A Word About Risk: Pioneer Bond Fund

The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment. The market price of securities may fluctuate when interest rates change. When interest rates rise, the prices of fixed income securities in the Fund will generally fall. Conversely, when interest rates fall, the prices of fixed income securities in the Fund will generally rise. Investments in the Fund are subject to possible loss due to the financial failure of issuers of underlying securities and their inability to meet their debt obligations. Prepayment risk is the chance that an issuer may exercise its right to prepay its security, if falling interest rates prompt the issuer to do so. Forced to reinvest the unanticipated proceeds at lower interest rates, the Fund would experience a decline in income and lose the opportunity for additional price appreciation. Investments in high-yield or lower rated securities are subject to greater-than-average price volatility, illiquidity and possibility of default. The securities issued by US Government-sponsored entities (e.g., FNMA, Freddie Mac) are neither guaranteed nor issued by the US Government. The portfolio may invest in mortgage-backed securities, which during times of fluctuating interest rates may increase or decrease more than other fixed-income securities. Mortgage-backed securities are also subject to pre-payments.

A Word About Risk: Short Term Income Fund

The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment.The market price of securities may fluctuate when interest rates change. When interest rates rise, the prices of fixed income securities in the Fund will generally fall. Conversely, when interest rates fall, the prices of fixed income securities in the Fund will generally rise.Investments in the Fund are subject to possible loss due to the financial failure of issuers of underlying securities and their inability to meet their debt obligations.Prepayment risk is the chance that an issuer may exercise its right to prepay its security, if falling interest rates prompt the issuer to do so. Forced to reinvest the unanticipated proceeds at lower interest rates, the Fund would experience a decline in income and lose the opportunity for additional price appreciation.The securities issued by US Government-sponsored entities (e.g., FNMA, Freddie Mac) are neither guaranteed nor issued by the U.S. Government.The portfolio may invest in mortgage-backed securities, which during times of fluctuating interest rates may increase or decrease more than other fixed-income securities. Mortgage-backed securities are also subject to pre-payments.Investments in high-yield or lower rated securities are subject to greater-than-average price volatility, illiquidity and possibility of default.Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, and political conditions.

A Word About Risk: Pioneer Strategic Income Fund

The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment. Investments in high-yield or lower rated securities are subject to greater-than-average price volatility, illiquidity and possibility of default. The market price of securities may fluctuate when interest rates change. When interest rates rise, the prices of fixed income securities in the Fund will generally fall. Conversely, when interest rates fall, the prices of fixed income securities in the Fund will generally rise. Investments in the Fund are subject to possible loss due to the financial failure of issuers of underlying securities and their inability to meet their debt obligations. Prepayment risk is the chance that an issuer may exercise its right to prepay its security, if falling interest rates prompt the issuer to do so. Forced to reinvest the unanticipated proceeds at lower interest rates, the Fund would experience a decline in income and lose the opportunity for additional price appreciation. The securities issued by US Government-sponsored entities (e.g., FNMA, Freddie Mac) are neither guaranteed nor issued by the US Government. The portfolio may invest in mortgage-backed securities, which during times of fluctuating interest rates may increase or decrease more than other fixed-income securities. Mortgage-backed securities are also subject to pre-payments. Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, and political conditions.

The views expressed regarding market and economic trends are those of Amundi Asset Management US, Inc. ("Amundi US"), and are subject to change at any time. These views should not be relied upon as investment advice, as securities recommendations, or as an indication of trading intent on behalf of any portfolio.

Investing in mutual funds involves significant risks. For complete information on the specific risks associated with each fund, please see the appropriate fund’s prospectus or fact sheet, available on our literature page.

Individuals are encouraged to seek advice from their financial, legal, tax and other appropriate professionals before making any investment or financial decisions or purchasing any financial, securities or investment-related product or service, including any product or service described in these materials. Amundi US does not provide investment advice or investment recommendations.

Before investing, consider the product's investment objectives, risks, charges and expenses. Contact your financial professional or Amundi US for a prospectus or summary prospectus containing this information. Read it carefully. To obtain a free prospectus or summary prospectus and for information on any Pioneer fund, please download it from our literature section.

Securities offered through Amundi Distributor US, Inc.

60 State Street, Boston, MA 02109

Underwriter of Pioneer mutual funds, Member

SIPC.

Not FDIC insured | May lose value | No bank guarantee Amundi Asset Management US, Inc. Form CRS Amundi Distributor US, Inc. Form CRS

EXP-2024-07-17-ADID-2994462-1Y-T