Investor Account Access

Investor access to Shareowner accounts and Closed End Funds accounts.

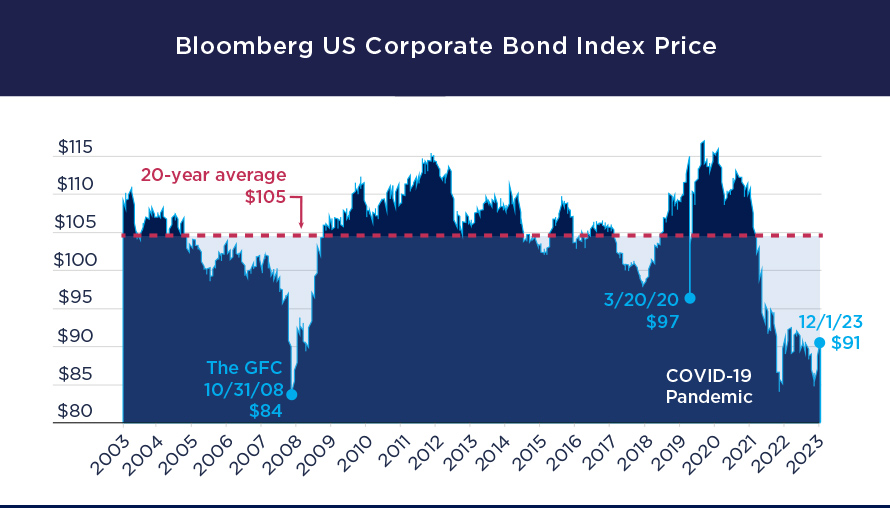

Source Bloomberg. Data as of December 1, 2023. The Bloomberg US Corporate Bond Index is a subset of the Bloomberg US Aggregate Bond Index and is composed of only investment grade bonds. Please see Terms and Indices below for more information. Data based on past performance, which is no guarantee of future results.

Prices are well below their 20-year average and pre-pandemic levels, creating opportunities for investors seeking total return

After 11 rate hikes by the US Federal Reserve to subdue inflation, the federal funds rate rose from near zero in March 2022 to 5.5% by July 2023, where it stands today. As a result, bond prices fell significantly as yields rose. While higher yields provide attractive income potential, lower prices can also offer attractive total return opportunities as bond prices recover and pull closer to par (100% of their face value) as they approach maturity.

Historically, during the past 20 years, the bond market has provided solid returns in multiple instances after such discounting of prices. Past performance is no guarantee of future results.

As shown in the table below, both prices and yields across US fixed income securities are at particularly attractive levels.

|

Average Price |

Yield-to-Worst† |

||

|---|---|---|---|---|

| Bloomberg US Aggregate Index | $89.15 |

4.91% |

||

| Bloomberg US Treasury Index | $89.01 |

4.41% |

||

| Bloomberg US Coporate Index | $90.70 |

5.47% |

||

| Bloomberg US MBS¹ Index | $87.18 |

5.10% |

||

| Bloomberg CMBS² Index | $89.43 |

5.70% |

||

| Bloomberg ABS³ Index | $97.43 |

5.36% |

||

Source Bloomberg as of December 1, 2023. †Yield to worst is a measure of the lowest possible yield that can be received on a bond that fully operates within the terms of its contract without defaulting. ¹US MBS: US Mortgage-Backed Securities ²CMBS: Commercial mortgage-backed securities ³ABS: Asset-backed securities. Past performance is no guarantee of future results.

US Treasury yields have fallen across the yield curve since November 14, 2023 after softer-than-expected inflation data was published as core prices rose at their slowest rate in more than two years4. A declining inflation trend, the potential for Fed rate cuts in 2024, solid economic fundamentals, and renewed demand for longer duration assets, combined with attractive relative valuations, offer the potential for robust total returns within fixed income in 2024.

4Source: US Bureau of Labor Statistics

Investors seeking fixed income solutions to help navigate more volatile fixed income markets and potentially capitalize upon valuation opportunities may want to consider broadly diversified funds with either a short- or intermediate-term duration focus.

5Diversification does not assure a profit or protect against loss.

Terms and Indices

Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years.

Par: When a bond is priced at 100% of its face value.

Relative valuation: Valuing an asset by comparing it to similar assets.

Total return: A performance measure that reflects the actual rate of return of an investment or a pool of investments over a given evaluation period.

Indices are unmanaged and their returns assume reinvestment of dividends and do not reflect any fees or expenses. It is not possible to invest directly in an index.

Unless otherwise stated, all information contained in this document is from Amundi Asset Management US (Amundi US) and is as of 11/30/2023.

A Word About Risk: Short Term Income Fund

The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment.The market price of securities may fluctuate when interest rates change. When interest rates rise, the prices of fixed income securities in the Fund will generally fall. Conversely, when interest rates fall, the prices of fixed income securities in the Fund will generally rise.Investments in the Fund are subject to possible loss due to the financial failure of issuers of underlying securities and their inability to meet their debt obligations.Prepayment risk is the chance that an issuer may exercise its right to prepay its security, if falling interest rates prompt the issuer to do so. Forced to reinvest the unanticipated proceeds at lower interest rates, the Fund would experience a decline in income and lose the opportunity for additional price appreciation.The securities issued by US Government-sponsored entities (e.g., FNMA, Freddie Mac) are neither guaranteed nor issued by the U.S. Government.The portfolio may invest in mortgage-backed securities, which during times of fluctuating interest rates may increase or decrease more than other fixed-income securities. Mortgage-backed securities are also subject to pre-payments.Investments in high-yield or lower rated securities are subject to greater-than-average price volatility, illiquidity and possibility of default.Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, and political conditions.

A Word About Risk: Pioneer Bond Fund

The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment. The market price of securities may fluctuate when interest rates change. When interest rates rise, the prices of fixed income securities in the Fund will generally fall. Conversely, when interest rates fall, the prices of fixed income securities in the Fund will generally rise. Investments in the Fund are subject to possible loss due to the financial failure of issuers of underlying securities and their inability to meet their debt obligations. Prepayment risk is the chance that an issuer may exercise its right to prepay its security, if falling interest rates prompt the issuer to do so. Forced to reinvest the unanticipated proceeds at lower interest rates, the Fund would experience a decline in income and lose the opportunity for additional price appreciation. Investments in high-yield or lower rated securities are subject to greater-than-average price volatility, illiquidity and possibility of default. The securities issued by US Government-sponsored entities (e.g., FNMA, Freddie Mac) are neither guaranteed nor issued by the US Government. The portfolio may invest in mortgage-backed securities, which during times of fluctuating interest rates may increase or decrease more than other fixed-income securities. Mortgage-backed securities are also subject to pre-payments.

A Word About Risk: Pioneer Strategic Income Fund

The market prices of securities may go up or down, sometimes rapidly or unpredictably, due to general market conditions, such as real or perceived adverse economic, political, or regulatory conditions, recessions, inflation, changes in interest or currency rates, lack of liquidity in the bond markets, the spread of infectious illness or other public health issues or adverse investor sentiment. Investments in high-yield or lower rated securities are subject to greater-than-average price volatility, illiquidity and possibility of default. The market price of securities may fluctuate when interest rates change. When interest rates rise, the prices of fixed income securities in the Fund will generally fall. Conversely, when interest rates fall, the prices of fixed income securities in the Fund will generally rise. Investments in the Fund are subject to possible loss due to the financial failure of issuers of underlying securities and their inability to meet their debt obligations. Prepayment risk is the chance that an issuer may exercise its right to prepay its security, if falling interest rates prompt the issuer to do so. Forced to reinvest the unanticipated proceeds at lower interest rates, the Fund would experience a decline in income and lose the opportunity for additional price appreciation. The securities issued by US Government-sponsored entities (e.g., FNMA, Freddie Mac) are neither guaranteed nor issued by the US Government. The portfolio may invest in mortgage-backed securities, which during times of fluctuating interest rates may increase or decrease more than other fixed-income securities. Mortgage-backed securities are also subject to pre-payments. Investing in foreign and/or emerging markets securities involves risks relating to interest rates, currency exchange rates, economic, and political conditions.

Individuals are encouraged to seek advice from their financial, legal, tax and other appropriate professionals before making any investment or financial decisions or purchasing any financial, securities or investment-related product or service, including any product or service described in these materials. Amundi US does not provide investment advice or investment recommendations.

Before investing, consider the product's investment objectives, risks, charges and expenses. Contact your financial professional or Amundi US for a prospectus or summary prospectus containing this information. Read it carefully. To obtain a free prospectus or summary prospectus and for information on any Pioneer fund, please download it from our literature section.

Securities offered through Amundi Distributor US, Inc.

60 State Street, Boston, MA 02109

Underwriter of Pioneer mutual funds, Member

SIPC.

Not FDIC insured | May lose value | No bank guarantee Amundi Asset Management US, Inc. Form CRS Amundi Distributor US, Inc. Form CRS

EXP-2024-12-11-ADID-3266698-1Y-T